Tinka Resources notes that “zinc prices rocked in 2017 and started off great in 2018, but then declined sharply due to some new inventory that showed up on the LME in early 2018. The decline was subsequently made worse in mid-2018 when trade tensions escalated between the US and China.

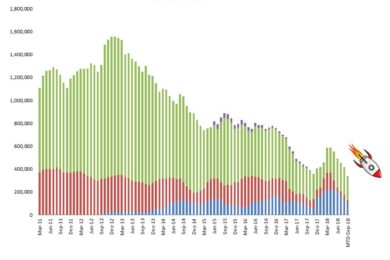

“What few investors may realise, is that total zinc inventories are now lower than they were in early 2018!” The chart, from Scotiabank, shows inventories.

Scotia’s mining sales team made the following comments in their morning note: “Data from China overnight showed that SHFE Zn inventories fell another 4,600 t W-o-W to 29,204 t; SHFE Zn stocks are now at their lowest levels in 11 years! They haven’t been this low since October 2007. On the SHFE, Zn stocks at 29,000 t are down ~60%% YTD after falling around 80,000 t or 51% in 2017.In addition, LME Zn stocks were down 3,100 t overnight as well. LME stocks at 203,475 t as of September 28 are down around 36,175 t or 15% so far this month, including a fall of around 3,175 t this week and 9,600 t last week. In the year to date, LME stocks are (still) up about ~2,825 t or 13% after falling 246,875 t or 58% in 2017.

“Zinc is tight,” Tinka notes. “So What about Zn premiums in China? According to Metal Bulletin, spot refined Zn premiums continue to push higher as a result, with the spot CIF premium in China soaring to $260-280/t in the week to September 25, a record high since MB began tracking the premium in Jan 2017. Supply cuts in China continue to create structural tightness in the short term; refined zinc production totalled 3.957 Mt in January-August 2018, down 6.6% year on year, according to the latest data from China’s National Bureau of Statistics.

“We are now starting to see a price response in zinc again, with zinc prices hitting $1.20/lb today, well off the $1.04/lb low hit two weeks ago.

Tinka’s share price has declined with zinc prices this year, despite a drill program of almost 20,000 m that has intercepted zinc in numerous step out and exploration holes. A resource update is now underway to incorporate this drilling data, with a new resource expected to be announced in Q4 2018.

Tinka’s Ayawilca property is located 200 km northeast of Lima in the Department of Pasco, Central Peru, at altitudes of between 3,800 and 4,300 m. The property is 40 km northwest of the worldclass Cerro de Pasco zinc-lead-silver mine, and 100 km south of the giant copper-zinc Antamina mine. Tinka owns 100% of the contiguous 150 km2 mining concessions at Ayawilca.

Tinka is focusing on growing the Ayawilca Mineral Resources. A new zinc discovery was made during 2017 at South Ayawilca that has significantly increased the resources at the Property. As announced on November 8, 2017, the company announced a 130% increase to the previous zinc resources.

Three NI 43-101 Mineral Resources exist on the Property, as announced on November 8, 2017. The Zinc Zone and Tin Zone resources are presumed to be mineable by underground methods for resource calculation purposes. The Colquipucro Silver Zone is presumed to be mineable by open pit methods.

The Ayawilca Zinc Zone has an Inferred Mineral Resource of 42.7 Mt at 7.3% zinc equivalent (6.0 % Zn, 79 g/t in, 17 g/t Ag, 0.2 % Pb). Resources were estimated at a cutoff grade of $55/t. Metal price assumptions used were $1.15/lb Zn, $300/kg In, $18/oz Ag, $1.10/lb Pb. Metal recovery assumptions were 90% Zn, 75% In, 60% Ag, and 75% Pb.

The Ayawilca Tin Zone has an Inferred Mineral Resource of 10.5 Mt at 0.70 % tin equivalent (0.63 % Sn, 0.23 % Cu, 12 g/t Ag). Resources were estimated at a cutoff grade of $55/t. Metal price assumptions used were $9.50/lb Sn, $3/lb Cu, and $18/oz Ag. Metal recovery assumptions were 86% Sn, 75% Cu, and 60% Ag.

The Colquipucro Silver Zone has a Mineral Resource (February 26 2015) of 7.4 Mt at 60 g/t Ag (Indicated) and 8.5 Mt at 48 g/t Ag (Inferred) in a preliminary open pit shell generated in Whittle software. Colquipucro is located 2 km north of Ayawilca, with mineralization occuring from surface to a depth of 80 m. Metal price assumption was $24/oz Ag. Silver mineralization is oxidized and leachable.