Fenix Resources says it has signed definitive agreements with Newhaul Pty Ltd to acquire Newhaul’s 50% interest in Fenix-Newhaul Pty Ltd, resulting in the consolidation of 100% ownership of the haulage business into Fenix.

Factoring in the upfront consideration of A$7.5 million ($5.2 million) in cash and 30 million Fenix ordinary shares – with contingent consideration of a further 60 million Fenix shares subject to achievement of significant value-based performance milestones – the additional cash flows generated from the consolidation of the company’s haulage operations will result in higher earnings for Fenix and higher dividends available to Fenix shareholders, it said.

Fenix-Newhaul was incorporated in October 2020 as a 50:50 joint venture company to implement the strategic alliance between Fenix and Newhaul. It was established to provide haulage and logistics services to Fenix’s Iron Ridge Project, in the Mid-West region of Western Australia, 490 km from Geraldton Port.

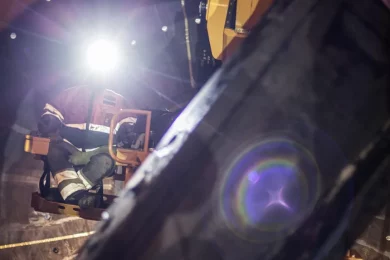

Fenix-Newhaul operates a fleet of 25 quad road trains which provide a daily haulage capacity to Fenix of up to 4,000 t/d. In the last 18 months, Fenix-Newhaul has hauled the equivalent of over 1.72 Mt of high-grade iron ore to Geraldton, completing over 15,000 round trips travelling almost 15 million km.

The Fenix-Newhaul business provides additional logistics support to Fenix’s operating iron ore loading facilities at Iron Ridge.

The business includes a driver change-over facility and a driver accommodation base at Cue, as well as a company-owned 110,000 sq.m depot in Geraldton with 24-hour workshop and administration support.

Fenix said the transaction will deliver lower operating costs for Fenix with additional value expected from operational flexibility advantages, as well as unlocking new growth opportunities that can now be explored for the benefit of Fenix. It quantified the former as cutting FOB costs by circa-A$10/t ($6.9 t), enabling Fenix to target total C1 FOB cash costs of circa-A$70/t (wet).

Rob Brierley, Managing Director of Fenix, said: “Consolidation of Fenix-Newhaul ownership is an important strategic initiative as it immediately reduces our haulage costs. It provides Fenix with a significant advantage over our peers given haulage costs are the largest cost input for Mid-West iron ore miners.”

John Welborn, Chairman of Fenix, said: “Fenix-Newhaul is a highly profitable state-of-the-art logistics business which is an essential component of Fenix’s business success. Consolidating 100% ownership is a smart move which will reduce our costs and provide operational flexibility. These advantages will make our business significantly more resilient and robust to commodity price volatility. The transaction is a key outcome from the board’s recent strategic review and provides Fenix with a vastly improved platform to evaluate and acquire further growth opportunities.”