Fortescue Metals Group is accelerating its carbon neutrality efforts, with the iron ore miner now expecting to achieve this ‘green’ milestone by 2030, 10 years earlier than its previous target.

Fortescue Future Industries (FFI), a wholly owned subsidiary of Fortescue, will be a key enabler of this target through the development of green electricity, green hydrogen and green ammonia projects in Australia, however, the company has also identified battery-electric technology as a potential diesel alternative game changer.

Dr Andrew Forrest, Chairman of Fortescue Metals Group, said: “We have joined the global battle to defeat climate change. We are trialling and demonstrating green hydrogen technologies in global-scale commercial environments, while also rapidly evolving into a green hydrogen and electricity producer of similar scale.”

In line with its 2030 aim, Fortescue, through FFI and its operations team, is undertaking to deliver several key projects by the stretch target of June 30, 2021. This, the company says, will underpin its pathway to decarbonisation.

These projects include:

- Developing a ship design powered by green ammonia and trialling that design in new ammonia engine technology, at scale;

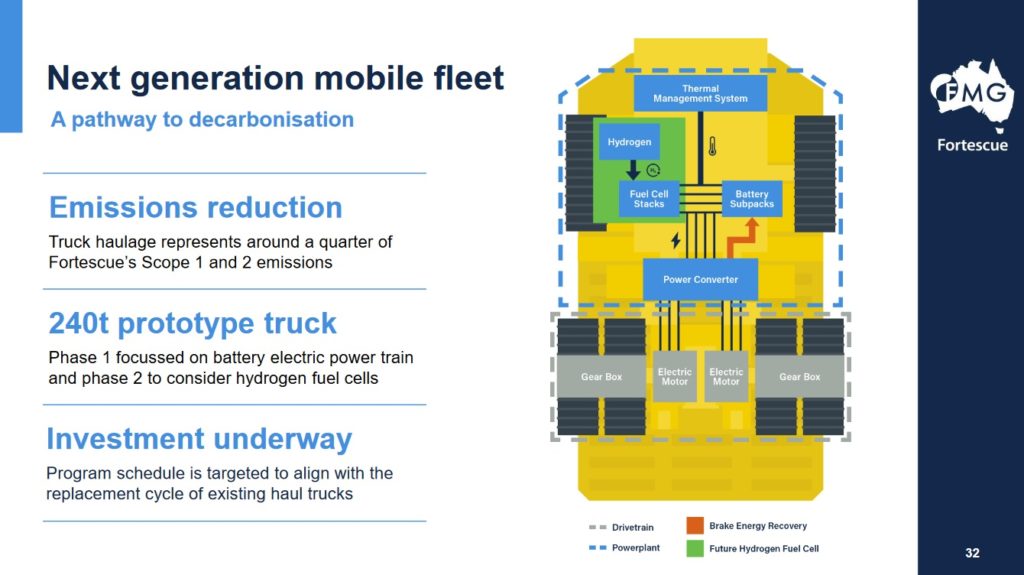

- Testing large battery technology in its haul trucks – a project the company is pursuing with the help of Williams Advanced Engineering;

- Trialling hydrogen fuel cell power for its drill rigs;

- Trialling technology on its locomotives to run on green ammonia; and

- Conducting trials to use renewable energy in the Pilbara of Western Australia to convert iron ore to “green iron” at low temperatures, without coal.

Fortescue Chief Executive Officer, Elizabeth Gaines, said: “Each of these projects will contribute to the world’s inexorable march to carbon neutrality. Fortescue will establish that the major steel, truck, train, ship and mobile plant industries can be operated with renewable, environmentally friendly energy. This will be possible as a result of these ground-breaking Fortescue trials. Each will be tested by Fortescue using commercial-scale equipment to prove that the demand for direct green electricity, green hydrogen and green ammonia could one day be as large as the fossil fuel industry.”

She added: “These projects are in addition to Fortescue’s significant investment with our partners into energy infrastructure, including the Chichester Solar Gas Hybrid Project and Pilbara Energy Connect program.”

Forrest said the company’s commitment to demonstrate green hydrogen’s economic value in world-scale operations, and become a major energy exporter, means Fortescue will emerge as an “executor” of major green hydrogen projects.

He said the company’s green energy and industry initiatives may one day out-scale its iron ore business due to the global demand for renewable energy, but Fortescue’s commitment to iron ore and resources globally “remains indefeasible”.

Fortescue says it is seeking to move from being a major consumer of fossil fuel with a current trajectory of more than 1 billion litres a year of diesel being used across the operations if no remedial action is taken – to a major clean and renewable energy exporter.

FFI is advancing projects across Australia, including Tasmania, to build large-scale renewable energy and green hydrogen production capacity. This will expedite the substitution of green hydrogen and green ammonia for carbon-based fuels, it says. These projects will, with the support of Australia’s governments, contribute to a significant reduction in national carbon emissions.