In accordance with the commitments made last July, Rio Tinto QIT Madagascar Minerals (QMM) and its partner, CrossBoundary Energy (CBE), have laid the foundation stone for the solar and wind power plant project that will supply the QMM ilmenite mine operations in Fort Dauphin, southern Madagascar.

The ceremony took place in the Ehoala Park area, in the presence of high dignitaries, including the Minister of Energy and Hydrocarbons, the Minister of Environment, the mayor of Fort-Dauphin and the Governor of the Anosy Region. The renewable energy project will go some way to helping operations in Madagascar reach carbon neutral status by 2023.

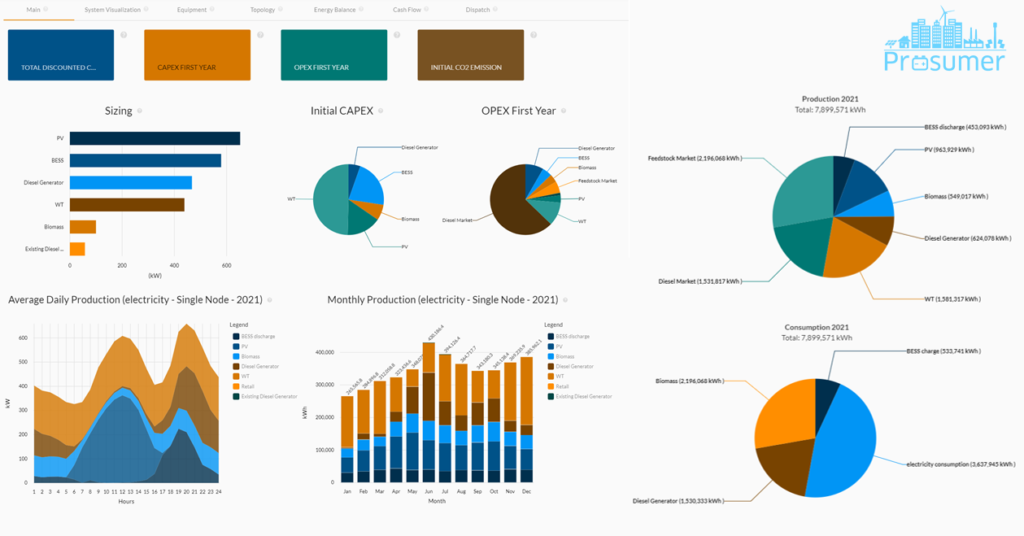

The renewable energy plant will be built and operated by CBE, an independent power producer with whom QMM has signed a 20-year power purchase agreement. The first unit, an 8 MW solar energy facility, will be operational in 2022. The 12 MW wind power facility will be completed in 2023. The project also includes an 8.25 MW lithium-ion battery energy storage system.

Around 18,000 solar panels and four wind turbines will enable QMM to meet all of its electricity needs during peak periods and up to 60% of its annual electricity consumption, as well as to reduce its annual carbon dioxide emissions by about 26,000 t, Rio said. In addition, the renewable power supply will reduce QMM’s heavy fuel oil purchases by up to 8,500 t/y. With this plant, QMM will also replace the majority of the electricity it currently supplies to the town of Fort-Dauphin and its 80,000 community members with clean energy.

Ny Fanja Rakotomalala, President of QMM, said: “This project is a key component of our ‘sustainable mine’ initiative, which aims to leave a lasting legacy for present and future generations, built independently of our mining operations. We want to leave this legacy through permanent dialogue, the full integration of activities within the development plan of the region, responsible social and environmental governance, the reduction of our environmental footprint and therefore of our carbon footprint, and through the creation of economic and social opportunities increasingly independent of QMM.

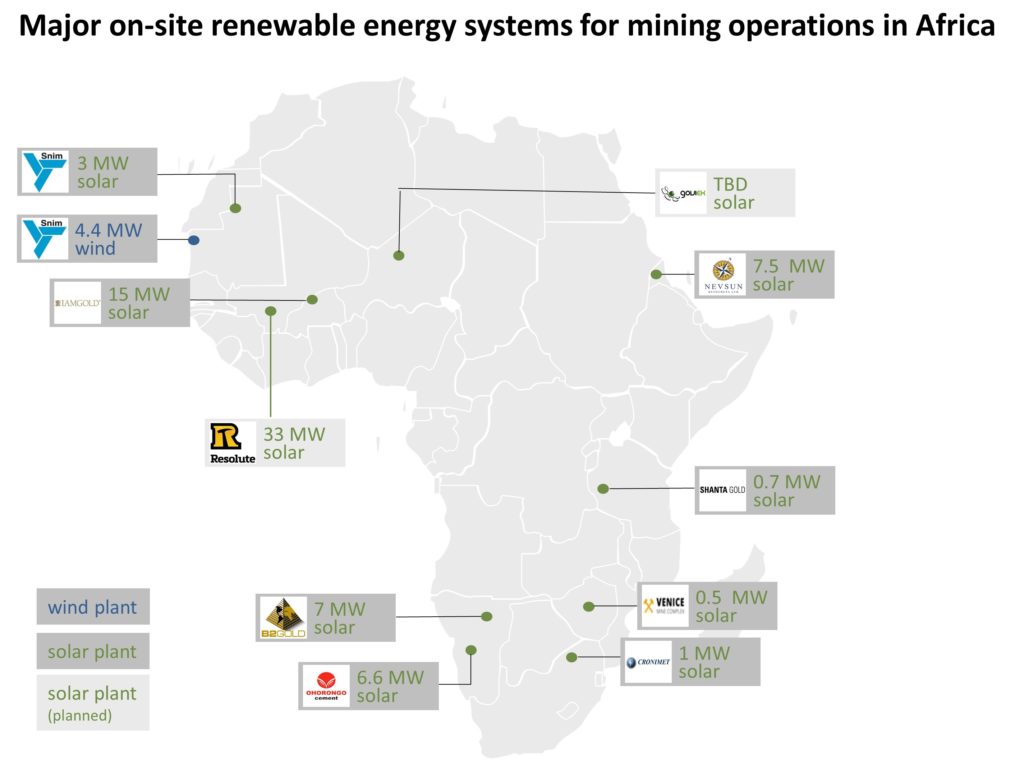

“This project is a strategic test, not only in Madagascar but also in the mining industry as a whole, as we have to innovate and rethink our operations in order to combat climate change and leave a sustainable legacy.”

Matt Tilleard, Managing Partner of CBE, said: “By establishing a commercial power plant that blends solar photovoltaic, battery energy storage and wind power, the QMM project greatly improves the island of Madagascar standing as a regional renewable energy leader. CBE is pleased to take up this technical challenge. We believe large-scale, complex commercial energy projects can be realised here in Madagascar thanks to ample supply of renewable resources, holistic government support and knowledgeable local implementing partners.”