South African platinum supply to fall to lowest level since 2001. A substantial reduction in supplies, as well as lower volumes of autocatalyst recycling, will move the platinum market from surplus to deficit in 2012, according to Johnson Matthey in Platinum 2012 Interim Review, released this week.Severe disruption to PGM mining is expected to reduce sales from South Africa and result in a 10% drop in worldwide platinum supplies to 5.84 Moz. Gross demand is predicted to remain firm, at 8.07 Moz, while a decline in recycling will help decidedly shift the market into a deficit of 400,000 oz.

South African platinum supply to fall to lowest level since 2001. A substantial reduction in supplies, as well as lower volumes of autocatalyst recycling, will move the platinum market from surplus to deficit in 2012, according to Johnson Matthey in Platinum 2012 Interim Review, released this week.Severe disruption to PGM mining is expected to reduce sales from South Africa and result in a 10% drop in worldwide platinum supplies to 5.84 Moz. Gross demand is predicted to remain firm, at 8.07 Moz, while a decline in recycling will help decidedly shift the market into a deficit of 400,000 oz.

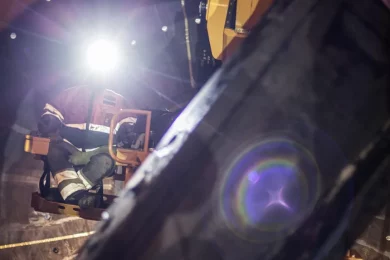

Platinum supplies from South Africa are forecast to fall by 12% year-on-year to 4.25 Moz, an 11-year low. South African platinum production losses due to strikes and safety stoppages in the first three quarters of 2012 are estimated to be at least 300,000 oz. The closure of marginal operations by some junior producers and below-plan performance at other mines will also account for some reduction in supply this year. Output and sales of platinum from other producing regions will remain broadly flat.

Gross platinum demand in autocatalysts is predicted to soften by 1% to 3.07 Moz. Falling vehicle production in Europe, together with a slight decline in the market share of diesel cars in the region, will be largely offset by higher purchasing of platinum by Japanese manufacturers as output improves following last year’s natural disasters. Greater demand is also expected from the light duty diesel sector in India, where sales have grown strongly in 2012, as well as more platinum used in heavy duty diesel emissions after-treatment worldwide.

Demand for platinum in the jewellery sector is expected to reach a three-year high of 2.73 Moz. Gross demand from the trade in China is forecast to reach 1.92 Moz driven by lower average platinum prices and an increase in the manufacturing of platinum jewellery to stock new retail stores being opened by Hong Kong brands in mainland China. Consumer demand for platinum jewellery in India has continued to grow, prompting an expansion of platinum jewellery manufacturing and retailing.

Industrial demand for platinum is forecast to subside by 13% to 1.79 Moz in 2012. In the glass manufacturing sector, new purchasing will be offset by the use of platinum scrapped from old facilities and the drawing down of inventory bought last year. Electrical demand is also expected to soften but purchasing of platinum for non-road emissions control applications will rise.

Physical investment demand for platinum is expected to remain positive at 490,000 oz. Investment in physically-backed exchange traded funds (ETFs) has largely followed the price during 2012, with net investment generally during periods of rising price. Net acquisitions by investors in the Japanese large bar market and in the coin sector will also supplement demand.

Platinum recycling is forecast to fall by 11% to 1.83 Moz in 2012. Platinum recovery from spent end-of-life vehicle catalysts is expected to soften as collectors have been holding on to spent converters in anticipation of improved prices. Platinum jewellery recycling will also weaken due to lower returns of old consumer pieces in Japan.

In 2013, gross platinum demand is expected to see modest growth, with steady autocatalyst demand and a recovery in industrial purchasing. However, as a result of ongoing disruption and possible restructuring of the industry, it is difficult to expect an increase in supplies from South Africa of any great magnitude from the 4.25 Moz forecast this year. Recycling could be a key factor in the platinum market balance in 2013, especially if prices see a material and sustained improvement, driving higher throughput of catalyst substrates to refineries.

The balance of the palladium market is forecast to swing by over 2 Moz this year from surplus to deficit, due to lower supplies, higher gross demand and less recycling. Supplies will contract mainly because of lower sales of Russian state stocks, while recycling will be constrained by subdued PGM prices. Gross palladium demand is predicted to rise to 9.73 Moz, driven by a return to positive net physical investment and higher autocatalyst purchasing, moving the palladium market into a deficit of 915,000 oz.

Supplies of palladium are predicted to decline to a nine-year low of 6.57 Moz. Palladium supplies from South Africa are forecast to fall by 6% this year, to 2.40 Moz, in line with lower underlying platinum output. Newly refined palladium supplies from Russia are expected to decrease due to a change in the ore mix and falling average grades. Sales of Russian state stocks are forecast to drop by over 500,000 oz compared with last year, to 250,000 oz.

Purchasing of palladium by the autocatalyst sector is expected to rise by 7% to a new high of 6.48 Moz. Demand for palladium is forecast to benefit from growth in global vehicle production, with the strongest performance in the principally gasoline markets of Japan and the USA, as well as continuing substitution of platinum in both light and heavy duty diesel after-treatment formulations.

Industrial demand for palladium is forecast to soften by 3% to 2.41 Moz. In electrical applications, a long-term trend towards using cheaper base metal alternatives to palladium in all but niche and high-end applications continues to drive demand lower. However, a wave of chemical plant construction in China will stimulate purchasing of palladium for new catalyst charges.

This year is set to mark the return to positive physical palladium investment demand, in contrast with the net liquidation seen in 2011. For the year as a whole, a change in investor sentiment towards palladium ETFs is expected to result in 385,000 oz of net new physical investment demand, a swing of 950,000 oz compared with last year.

Gross demand for palladium in jewellery is predicted to dampen by 11% to 450,000 oz. Purchasing of palladium by the Chinese jewellery sector is expected to decline once again as the metal continues to suffer from a lack of positioning and effective marketing, as well as competition from low-fineness gold alloys.

Supplies of palladium are expected to fall in 2013 as a result of lower output from Russia and the diminishing likelihood of a significant increase in output from South Africa. Another year of solid autocatalyst and industrial demand is forecast, together with higher returns of palladium from end-of-life vehicle recycling.