Derick de Wit, Associate Director, and Garth Marshall, Manager, Venmyn Deloitte note that “metal accounting is becoming an area of increasing focus due to the requirement for the resulting data to feed directly into financial reports. Metal accounting is vital to sound corporate governance and to assist in this area of scrutiny, Venmyn Deloitte designs a metal accounting process that identifies the flow from the Mineral Resource and Mineral Reserve through to saleable metal; detecting inconsistencies, accounting errors, bias, variabilities, and inefficiencies; and propose improvements to support accurate metal accounting.

“A further driving force for reliable metal accounting is the growing number of toll treatment companies and joint ventures. A toll treatment company could move from a situation where money is transferred internally, through input of product from the mine into their plant, and thus has no impact on its overall financial position; to a situation where money is paid for input from an external mine into the plant and money is then received from that plant’s output. In this instance, the toll treatment company needs to have accurate knowledge of the expected metal movements and recovery throughout the process. Similarly, partners in a joint venture need to understand the metal movements and recovery within their respective input and output.

“Mineral Resources and Mineral Reserves, mass, sampling and analysis results are the metal accounting inputs. Sound corporate governance requires that procedures are developed based on international best practices and furthermore, that the Mineral Resource and Mineral Reserve estimates and other data generated are completed accurately, consistently and transparently, so that accurate financial accounts can be produced.

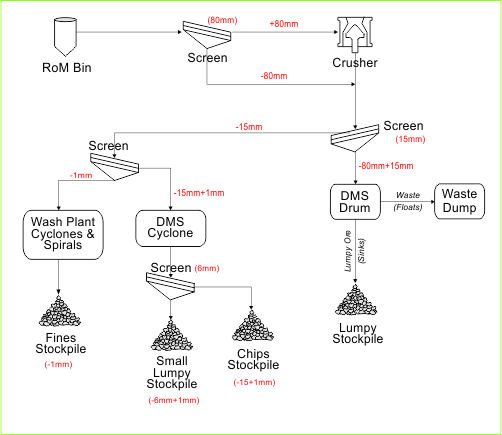

“The Venmyn Deloitte metal accounting methodology entails an all-inclusive view, which starts at the Mineral Resource, to where the metal is transferred from the mine to the concentrator, the smelter, the refinery, and finally to the financial accounts.

“Considering the aforesaid, a properly designed metal accounting process is vital for mining, metallurgical and toll treatment companies to monitor, check and improve the flow of material and therefore cash flows through improved metal recovery and identification and quantification of losses and emissions.

“Venmyn Deloitte uses the AMIRA P754 Code of Practice (the AMIRA Code) as a basis for all metallurgical accounting engagements. Venmyn Deloitte’s expertise examines the systems, procedures and methodologies already in place to determine the most cost-effective, multi-disciplinary approach towards improving metal accounting to be a reliable and accurate system from the Mineral Resource to the final saleable metal.

“Venmyn Deloitte follows the following ten principles as defined in the AMIRA Code when performing metal accounting assessments and making recommendations:-

- Metal accounting must be based on accurate measurements of mass and metal content

- System must be consistent and transparent and the source of all input data must be clear

- Accounting procedures must be well documented and user friendly for ease of application

- System must be subject to regular internal and external audits and reviews

- Management must respond timeously to rectify accounts or problems

- Where provisional data are used or where rogue data is detected, the procedures to be followed and levels of authorisation must be clearly defined

- System must generate sufficient data for various applications and should be bias free

- Target and actual accuracies must be stated throughout

- Validation of in-circuit inventories is required by annual (at minimum) physical stocktakes. Procedures and authority levels required for changes and unaccounted variances must be defined

- Every effort should be made to identify bias and reduce bias to an acceptable level.

“Venmyn Deloitte undertakes the required assurance procedures, and provides guidance, indicating measures to ensure compliance with continuously evolving international guidelines. Venmyn Deloitte’s team of experts, including experienced geologists, mining and process engineers, fully understand the principles of mass balance, process control, and data evaluation.

“Venmyn Deloitte designs an overall process starting at the Mineral Resource and Mineral Reserve through to final saleable metal to identify inconsistencies, incorrect accounting, bias and inefficiencies, and propose improvements to support accurate metal accounting.