A recovery in metal prices, deep cost cutting and stricter financial discipline have positively affected the balance sheets and cash flows of high-yield miners in Europe, the Middle East and Africa (EMEA), in turn bolstering their liquidity levels in Q1 2017 versus last year, says Moody’s Investors Service in a report published today. Liquidity has remained solid for large investment grade miners.

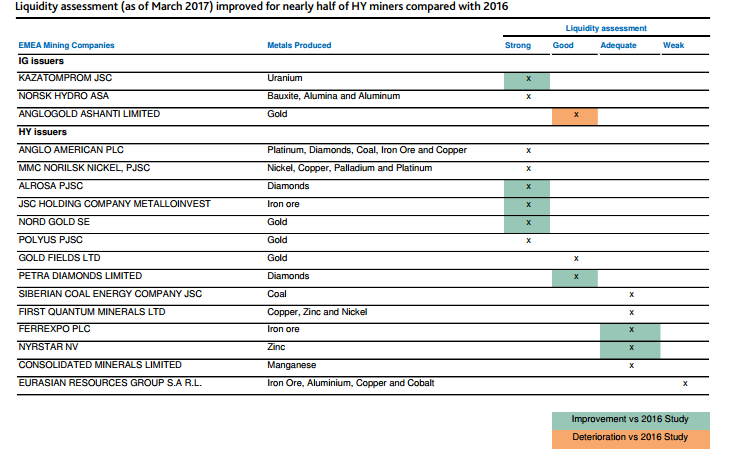

Moody’s report assesses the liquidity of 16 rated mining companies (three investment grade, 14 high yield) across the EMEA region.

“Almost all EMEA high-yield miners now have adequate to strong liquidity, which is very much in contrast with the past two years when 20% of all rated miners in the region were weak in liquidity terms,” says Gianmarco Migliavacca, Vice President — Senior Credit Officer at Moody’s.

Moody’s report, Mining Industry Liquidity Study 2017 — EMEA: High-Yield Miners’ Liquidity Has Strengthened, while Investment-Grade Remains Solid, is available on www.moodys.com. The rating agency’s report is an update to the markets and does not constitute a rating action.

High-yield miners have further mitigated refinancing risk by pushing a large amount of 2017-18 maturities to 2019 and beyond. As a result, near-term maturities are now much lower than a year ago, as most companies managed to repay or reschedule the bulk of these commitments. An improved debt maturity profile is one of the main considerations behind Moody’s decision to revise its liquidity assessment for Ferrexpo Plc (Caa2 stable), Nyrstar NV (B3 stable) and diamond companies ALROSA PJSC (Ba1 stable) and Petra Diamonds Limited (B1 positive) to adequate this year from weak in last year’s EMEA mining industry liquidity study.

“AngloGold Ashanti was the only miner whose liquidity assessment has been revised down, from strong to good, primarily due to higher than anticipated global capital expenditures and elevated operating costs in South Africa,” says Douglas Rowlings, Assistant Vice President — Analyst at Moody’s.

Eurasian Resources Group (Caa1 negative) remains the only company with a weak liquidity assessment as of March 2017, due to its very limited availability under committed bank facilities. However, Moody’s acknowledges that the company has improved its liquidity recently, by rescheduling the bulk of its bank maturities to 2025 from 2016-18.

Most other high-yield miners have reduced their reliance on banking facility drawdown in 2017 versus the previous year. Average use of committed revolving credit facilities fell to 28% in March 2017, a level close to 2013 pre-crisis levels, as performance improvements and stronger cash balances reduced the need for such facilities. Financial covenant compliance is no longer an issue this year for some high-yield miners as all miners are expected to remain in compliance.

Cash balances and available bank facilities remain the key liquidity sources for EMEA miners in 2017, but positive free cash flow is back as additional projected source of liquidity. Return to positive free cash flow and the doubling of average availability under revolving credit facilities among high-yield miners are two major liquidity improvements compared to last year.

Moody’s expects a rebound in capex in 2017 from the deep cuts made in 2016, and some resumption in dividends as excess cash is built-up. Most of the largest rated EMEA miners will maintain the disciplined financial policy already factored into their ratings. However, more aggressive dividend or capex plans would lead Moody’s to reconsider its financial policy assessments across its rated universe of miners.