Centerra Gold Inc and AuRico Metals Inc have entered into a definitive arrangement agreement whereby Centerra will acquire all of the issued and outstanding common shares of AuRico Metals for C$1.80 in cash consideration per share, representing an aggregate transaction value of C$310 million. This represents a 38% premium to the closing price of AuRico Metals’ common shares on the Toronto Stock Exchange (TSX) on November 6, 2017 and a premium of 37% to the 20-day volume weighted average price (VWAP) as of such date.

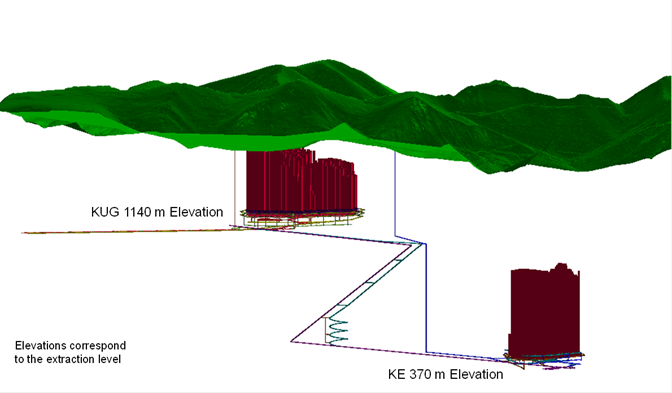

AuRico Metals is developing the Kemess property in British Columbia, Canada; a low-cost brownfield development asset that is host to the feasibility-stage Kemess Underground (KUG) and preliminary economic assessment level Kemess East (KE) projects. AuRico Metals also owns a high-quality, free-cash flow generating royalty portfolio which includes a 1.5% net smelter return (NSR) royalty on the Young-Davidson gold mine in Ontario and a 2.0% NSR royalty on the Fosterville mine in Australia. Together with Centerra’s low-cost, long-lived Kumtor mine in the Kyrgyz Republic and the Mount Milligan mine in British Columbia, Canada, Centerra is expected to be firmly established as a low-cost gold producer with a geographically diversified footprint and peer-leading development pipeline. Post-transaction, Centerra is expected to sustain and grow its production base with its strong balance sheet and liquidity profile, sector leading operating margins, and low capital requirements.

Highlights of the transaction:

- Enhances Centerra’s high-quality asset base in a world-class jurisdiction: The Kemess property adds a future cornerstone asset that will further bolster Centerra’s strong development pipeline including the fully-financed Öksüt project in Turkey, the Greenstone gold property in Ontario, Canada, and the Gatsuurt project in Mongolia. Kemess will also complement existing Centerra operations at the Mount Milligan mine in British Columbia and has the potential to unlock operating and tax synergies with its existing assets in British Columbia

- De-risked brownfield project: Over C$1 billion of surface infrastructure already in place, environmental approvals and an Impact Benefits Agreement with First Nations in hand, and permitting well advanced

- Numerous mine life upside opportunities at Kemess: The integration of KUG and KE has the potential to unlock a number of synergies and optimization opportunities

- Attractive acquisition return profile: Expected to be accretive to Centerra shareholders, on a per share basis, to net asset value, reserves and resources

- Optionality retained in royalty portfolio: Acquisition of a high quality, free-cash flow generating royalty portfolio provides immediate incremental cash flow and long-term upside from strong underlying assets

- Maintains strong balance sheet: Centerra currently holds in excess of $350 million in cash to fund the acquisition and has secured a new $125 million acquisition facility. Centerra plans to maintain its strong cash balance which positions the Company with the financial strength and flexibility to fund operating and capital expenditures required to build out its pipeline of development projects. Centerra plans to restructure its current debt facilities in connection with the closing of the Arrangement.

Stephen A. Lang, Chairman and Director of Centerra, said, “With the acquisition of the AuRico Metals assets, Centerra expands its existing development pipeline to include another low-cost de-risked brownfield development asset, the Kemess property, located in Canada-one of the lowest risk mining jurisdictions in the world. As well, the company adds a high-quality, free-cash flow generating royalty portfolio. In the future, as the company delivers on building out this development pipeline its production base will be sustained and continue to grow with sector-leading operating margins positioning the Company to generate robust free cash flows for many years to come.”

Chris Richter, President and CEO of AuRico Metals, stated, “Since AuRico Metals’ inception in the middle of 2015, our key objective has been to surface what we saw as significant value in the Kemess project. I am delighted to now see this value being recognized, with our shareholders receiving a strong cash offer from Centerra at a very attractive premium of 38% to the current spot price, and representing a return of over three times their initial investment in a period of less than two and a half years. I am proud of the success the AuRico Metals team has had in advancing Kemess while growing the value of our portfolio of high quality royalties. I also believe that Centerra is ideally positioned to realize the full potential of Kemess as a long life, significant gold and copper producer.”

Benefits to Centerra

- Acquiring a de-risked, brownfield development asset located in Canada that is complementary to Centerra’s Mount Milligan operation and has the potential to generate meaningful synergies

- Adds a strong polymetallic project in a tier-one jurisdiction that yields high-margin gold and copper production at a time when copper markets are expected to improve significantly

- Significant mine life improvement potential through the potential KUG and KE integration, resource to reserve conversion, and exploration potential

- Expected to improve Centerra’s operating cost profile and generate meaningful life-of-mine free cash flows

- High-quality, cash flow generating royalty portfolio.

Benefits to AuRico Metals

- Immediate and significant premium of approximately 38% based on the prior day closing price, and 37% based on the 20-day VWAP;

- All cash offer, not subject to financing condition;

- Strong deal certainty with support agreements from directors and senior officers of AuRico Metals as well as Alamos Gold Inc

- Secures future funding for Kemess to realize its future potential.