MinerAndian reports that the Governments of Argentina and Chile agreed last month a protocol for Los Azules mining project, which “establishes the parameters to facilitate prospection and exploration works that the company operating the concession will have to face.”

The deposit located in San Juan is the largest known reserve of silver in the Trans-Andean region and currently considered a priority by the Argentinian Ministry of Mining.

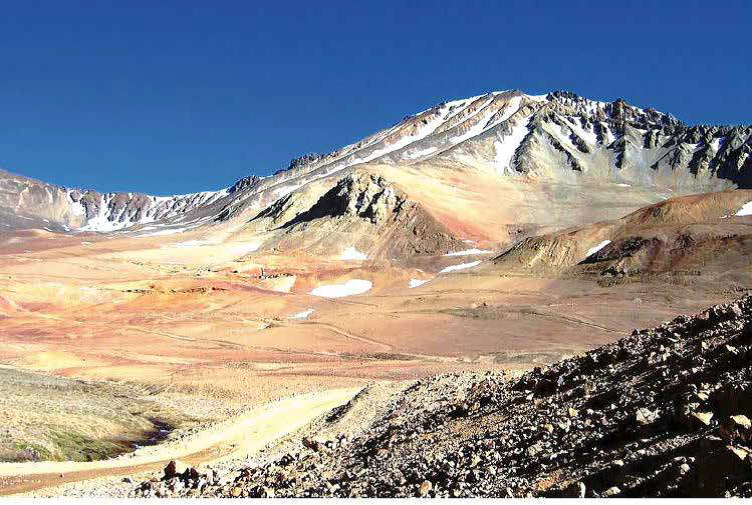

It is estimated that Los Azules can become one of the world’s largest porphyry deposits. The project, held by Canadian company McEwen Mining, is located north of Pachon, province of San Juan.

MinerAndia reports further that it is expected to produce 159,000 t/y of fine copper through conventional floatation.

“The area has the potential to become one of the world’s largest and lowest-cost copper porphyry deposits. It has a large exploration potential to extend its reserves”, said MacEwen.

The PEA effective September 1 used the assumptions of $3.00/lb copper, $1,300/oz gold, and $17/oz silver. The project generates a robust $2.2 billion After-Tax NPV (discounted at 8%) and 20.1% After-Tax IRR. The results of the 2017 PEA demonstrate that Los Azules is a robust, high margin, rapid pay-back, and long-life open pit mine at current copper, gold and silver prices.

The PEA also includes an updated resource estimate, which incorporates the results of the 2016-2017 drilling program. The copper resource contains 10,200 Mlb Indicated and 19,300 Mlb Inferred.

Generalised technical and economic parameters include a copper price of $2.75/lb, site operating costs of $1.70/t for mining, $5.00/t for processing and $1.00/t for general and administration, a pit slope of 34° and 90% metallurgical recovery.