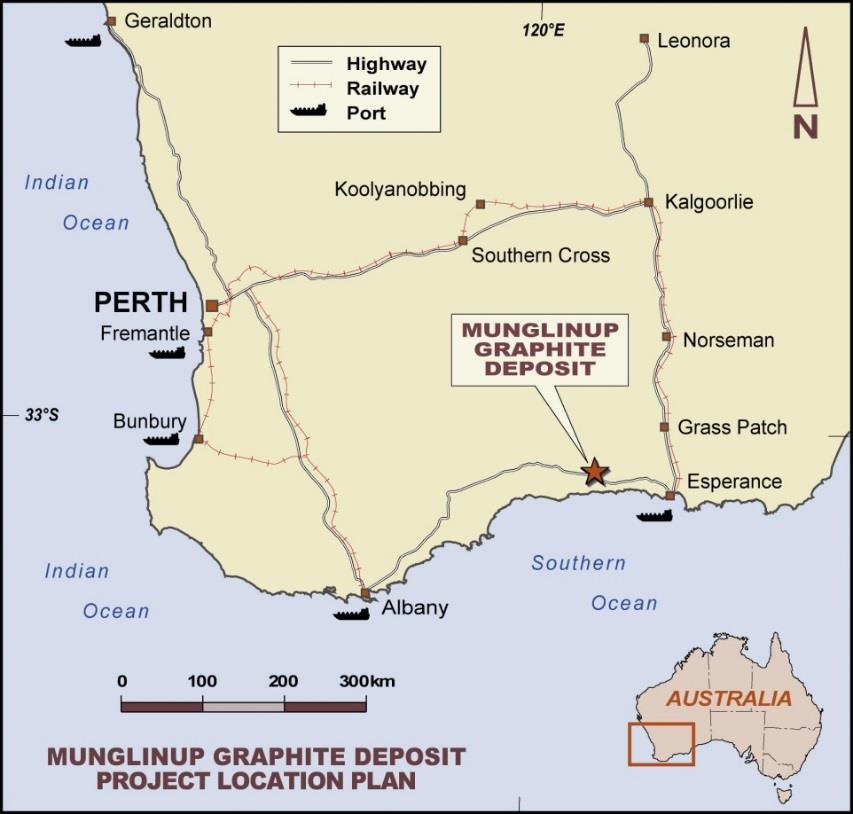

Western Australia could soon become a hub for battery manufacturing with the state expected to be the only jurisdiction in the country to produce all raw materials for lithium ion battery production. That is the view of Minerals Commodities Lltd Business Development Manager, Daniel Hastings, whose company is developing the Munglinup graphite project, about 100 km west of Esperance in Western Australia.

Speaking on day one of the inaugural Paydirt 2018 Battery Minerals Conference in Perth, Hastings said WA will soon be well positioned to entice battery manufacturers to invest in infrastructure.

“We believe that with WA expected to become the only jurisdiction in Australia and possibly the world producing all raw materials for lithium ion battery production – including nickel sulphate, lithium carbonate and hydroxide, and potentially battery anode material – the state will be well positioned to entice battery manufacturers to invest in infrastructure here,” he said.

“We take the view – like most other companies – that the current energy revolution has just begun and the outlook for battery raw materials is extremely positive. We identified graphite (its Munglinup graphite project ) as a target due to the belief that environmental issues in China, along with the average grade of these Chinese deposits, the projected increase in demand for anode material, the desire for battery producers to diversify geographical sources of graphite, and the likely sovereign risk and other locational issues with operating in Eastern Africa, would provide the basis for sustained increases in natural flake graphite prices over the longer term.

The Munglinup graphite deposit’s grade is in the top quartile for global flake resources, with a high grade Measured and Indicated JORC compliant Mineral Resource of 3.625 Mt at 15.3% graphite for 554,000 t of contained graphite, with the deposit open at strike and depth.

Munglinup has a fully granted mining lease valid until August 2031, with adjoining exploration licence. The tenements are located in a fully gazetted mining reserve, with no native title or private land ownership issues.

Studies have indicated that the project could be in the lowest cost operating quartile and in the highest-grade quartile, as compared against global flake graphite deposits.