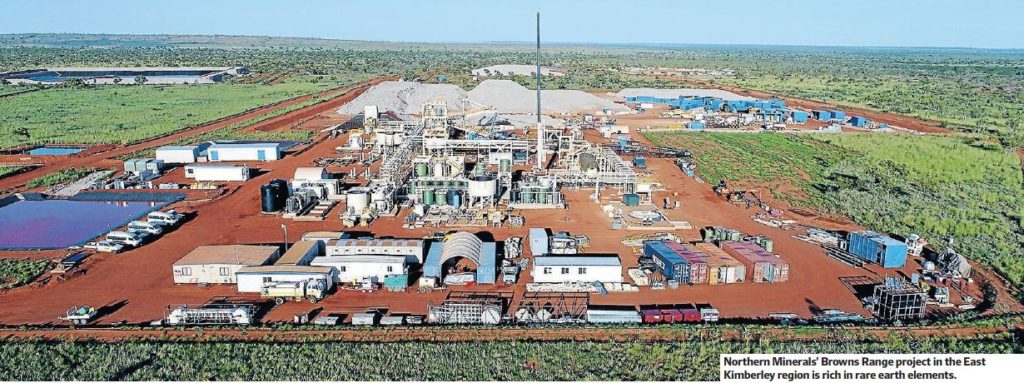

The following is based on an article in yesterday’s Financial Review Digital Edition. While investors scout for potential winners among lithium and nickel plays, an ASX-listed rare earths miner is on the cusp of cashing into the looming growth in the electric vehicles market. Eight years after it was first considered as a greenfield exploration venture, rare earths miner Northern Minerals’ Browns Range project in Western Australia is finally set to start production by June-end.

The fully owned project, 160 km southeast of Halls Creek in the East Kimberley region, is rich in high-value, heavy rare earth element dysprosium. This is a critical additive in permanent magnet motors that are used in wind turbines, industrial robotics, and electric vehicles. “Currently, 98% of the global supply of dysprosium comes from China, which means Browns Range would be the first major non-Chinese production facility in the world,” the article reports.

‘‘We plan to produce 50 t initially so we will be a small player, but what we want to do is demonstrate the security of supply outside of China,’’ Northern Minerals Managing Director George Bauk says.

The company revised its plans in 2017 and decided the best way to develop the project was to first build a pilot plant. It has since taken about 13 months to complete the fabrication and installation of the facility. Northern Minerals has so far spent A$175 million on the development of the project, including the pilot plant with annual capacity of 72,000 t of ore, along with two stages of processing at site – beneficiation and hydro-metallurgy.

The three-year pilot project is targeted to produce 573 t/y of total rare earth oxides, of which 50 t will be dysprosium. First shipment is due for the September quarter.

Bauk says the decision to start small was one of the best choices the company has made. ‘‘OEMs and global buyers are quite cautious about the capability of small companies transitioning from early stage explorer to being a producer of an industrial mineral,’’ he says.

‘‘The pilot plant is all about evaluating the technical and economic aspects of the project. It is really important in industrial minerals like rare earths to demonstrate we can provide to the market a product within specifications.’’

The pilot plant has been constructed at 10% of the potential full capacity, at which point the miner is targeting an annual output of 300 t of dysprosium, or roughly between 10 and 12% of the global production at that time.

But before that, it has outlined other plans for expansion. Northern Minerals is evaluating ore-sorting technology, and plans to implement this by end of the year. It also wants to move into the downstream phase by eventually implementing separation technology at the site. This will allow it to convert the mixed rare earth carbonate into separated oxides.

‘‘The biggest benefit is reaching a much broader market,’’ Bauk says. ‘‘A major risk of producing mixed rare earth carbonate is you have a limited market of buyers, but separated oxides open up a lot other opportunities.’’

Given the unique nature of the project, as well as the opaque markets for dysprosium, funding for Browns Range has been somewhat challenging. But the company has tackled this in rather innovative ways.

It set up a debt-factoring deal with New York financier Brevet under which it has received quarterly advance payments against research and development funding support due from the Australian government in 2017/18.

It also negotiated an A$11 million deal with EPC contractor Sinosteel for a deferred payment system where Sinosteel funded 20% of expenditure, and also tied up a A$10 million prepayment against a forward sales of its pilot plant output to a unit of China’s Guangdong Rare Earths group.

Northern Minerals has also done several equity placements, including a convertible note issue in the US. It last raised A$12 million through a heavily oversubscribed share purchase plan in January from existing shareholders.

The explorer now aims to resume drilling shortly. As per the current resource estimate spread over its six deposits, Browns Range has a mine life of 11 years, but Bauk says this has been limited by how much drilling has been done so far.

Given its massive land area spread over 60 km by 30 km, and the fact that resources are open at depth and spread in many directions, he estimates there is much more life in the project. ‘‘The potential upside is significant,’’ he says.