Developers of one of the world’s largest graphite deposits say the project does not face the high up-front minimum capital raisings of $100 million-plus typical for getting new industrial mines off the ground but can be into profitable production sooner and at much lower cost.

Addressing the first day today of the two day Paydirt 2018 South Australian Resources and Energy Investment Conference in Adelaide, Renascor Resources’ Managing Director, David Christensen, said the company is looking to have its two year old Siviour graphite discovery on SA’s Eyre Peninsula, commence first mining by the 4Q next year. This would deliver first production in the first quarter of 2020.

Christensen said it was extremely difficult in the current equity market to raise the minimum $100 million asking price emerging from most bankable feasibility studies to get new Australian industrial mines constructed and into production.

“Such BFS outcomes are generally based on the economics of ‘whole of mine’ scenarios,” Mr Christensen said. “Siviour is a much different project. We can get into graphite production for as low as $29 million (A$39.2 million) producing at 22,000 t/y of graphite product and do so profitably.

“This is because Siviour can be mined and processed at an opex of ~A$600/t by taking advantage of the project’s location near established infrastructure. We can then sell into global markets looking for long-term secure low cost suppliers as an alternative to China, for A$1,000/t.

“We don’t have to be our biggest and best mining operation first up – but we can be profitable from the first concentrate output from a Stage 1 approach. This will ensure we can establish long-term markets before we build towards Siviour’s ultimate planned output of 156,000 t/y at a further capex of A$91 million but with opex slashed to A$333/t.”

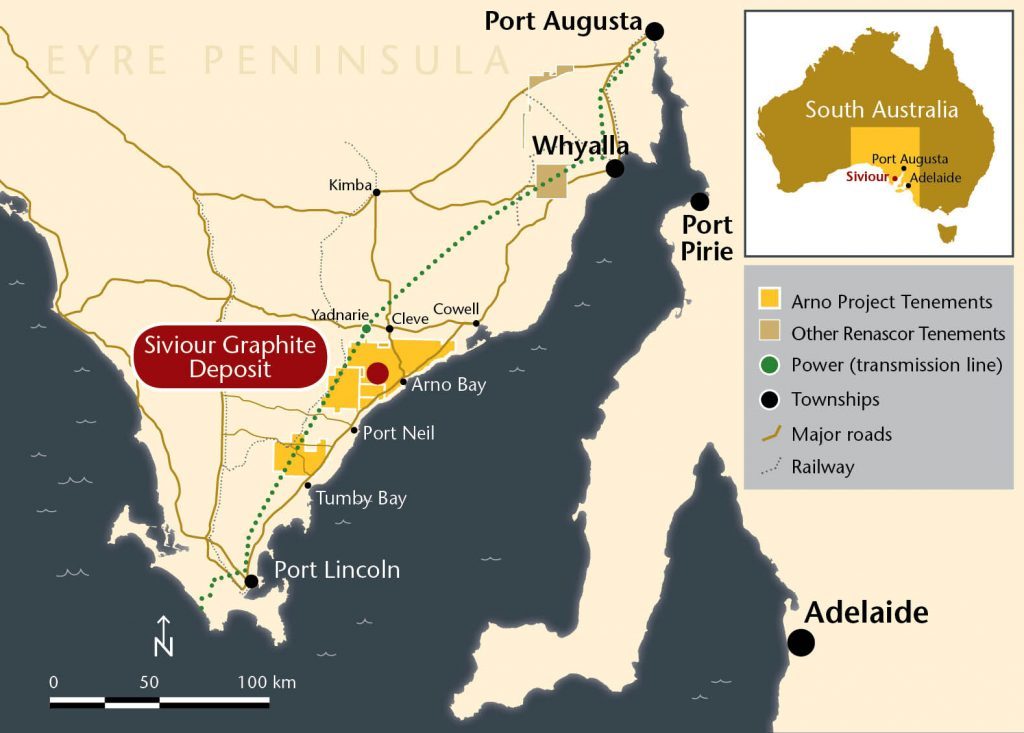

Located near Arno Bay on Eyre Peninsula’s east coast, Siviour was only discovered by Renascor in 2016 but has quickly carved a sector recognition as one of the world’s largest high-grade flake graphite deposits.

It has a mineral resource of 80.6 Mt @ 7.9% TGC for 6.4 Mt of contained graphite but remains open along strike, offering the potential for further expansion. Its mineralisation easily upgrades to high purity suitable to the lithium-ion battery market. The project is close to existing road, rail and sea export infrastructure.

Christensen said Renascor’s timetable scheduled initial mining in Q4 2019 with maiden production in 1Q 2020. The project’s DFS and a separate PFS study on Siviour’s spherical graphite upside were underway.

“We are hopeful of being granted our mining lease early next year which would allow mine construction to commence in the third and fourth quarters of calendar 2019,” he said. “Test bulk samples are in potential customers’ hands and this will help progress offtake developments through the remainder of this year.”