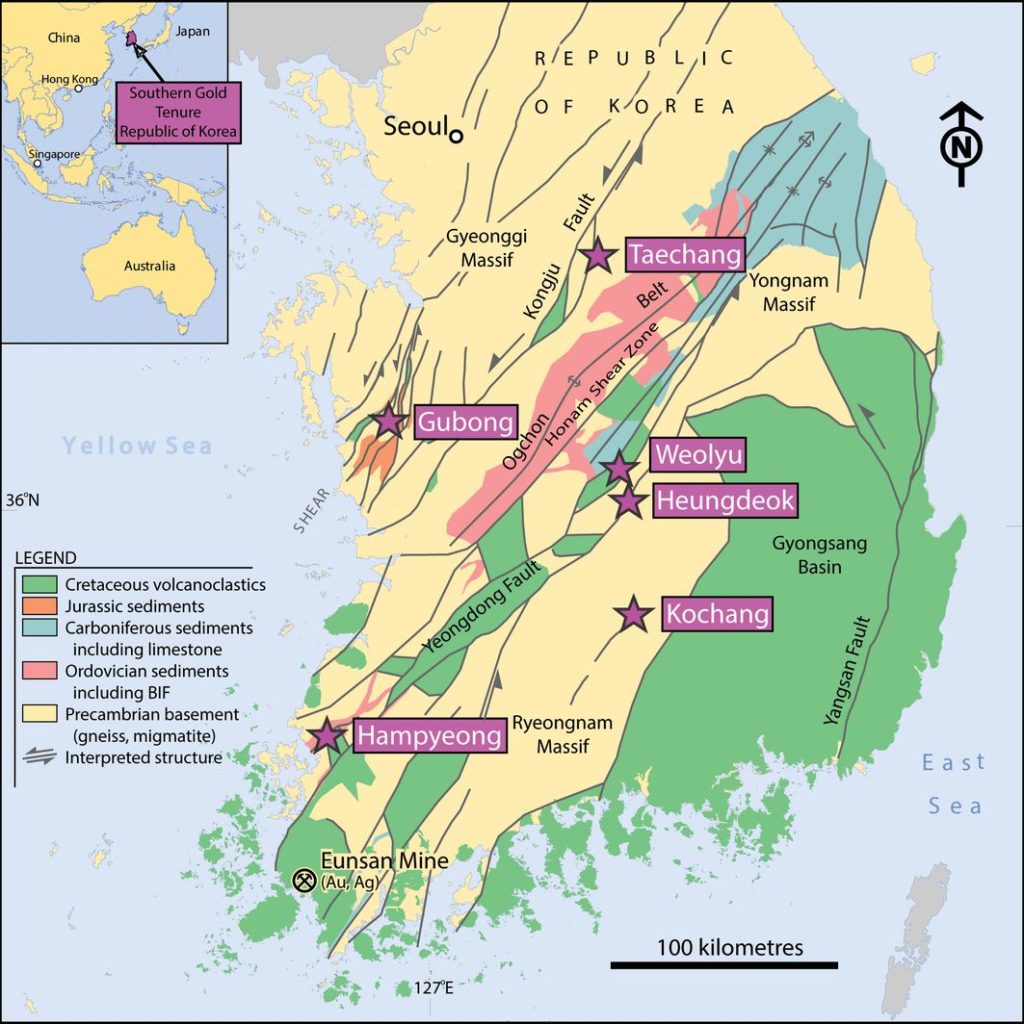

Australian gold producer, Southern Gold Ltd advises that its development partner in South Korea, LSE-listed Bluebird Merchant Ventures Ltd (BMV), has completed its initial report on the feasibility of re-opening the historic Gubong gold mine. This report is the required catalyst for the formation of a formal 50:50 joint venture between Southern Gold and BMV over the Gubong project. Over the coming months, Southern Gold will establish a Korean-based operating entity. BMV will be the operator of the joint venture.

BMV is confident that the mooted re-opening of the old gold mine will facilitate substantial immediate mining development with access to initial low-cost ore that can be cost effectively and quickly processed after a small scalable trial plant has been established. BMV has indicated that the project could advance to production late in 2019 and look to then progressively expand production over the next five years.

It is important to note that the BMV report has not been prepared in accordance with the JORC Code and this limits reporting further detail around the analysis of the report, particularly the quantitative elements.

Southern Gold Managing Director, Simon Mitchell: “The report on the feasibility of re-opening Gubong is a substantive document and a lot of work has gone into its development. I appreciate the hard work undertaken here by the Bluebird team and I think this document will serve as a solid foundation for future work as we build our knowledge base in each area. While the report has not been completed to a JORC standard, it has been prepared by highly experienced technical personnel very familiar with the mine re-development scenario at Gubong.

“From my perspective, the report confirms two key things, firstly, that the project can be developed very quickly and that, secondly, the low capital intensity of the re-development may be even lower than first targeted. The report provides confidence that the Gubong mine can be re-opened and recommissioned, with production late in 2019.”

The mine closed in 1971 predominantly due to the low gold price at the time combined with the mine getting deeper, low capex investment in infrastructure and the intensive manual mining method. Gubong, as quoted in Korean Government reports, had a historical production of 430,000 oz of gold and 110,000 oz of silver over an intermittent production period from 1926-1971. Korean government group, KORES, has stipulated a significant residual ’Mining Resource’ but this cannot be validated under any code (JORC 2012) and as such has not been reported.

The report highlights that a preconstruction phase is required that includes ongoing dewatering of lower levels of the mine, establishing a permanent entrance to the mine requiring key land acquisitions and a more extensive sampling and metallurgical program to refine process flow. This phase will also allow the completion of a full feasibility to prepare for the construction of the processing plant and commencement of mining. This preconstruction phase has been costed at $850,000 for the joint venture and has commenced.

The report indicates following this establishment phase, mining would initially be based around 150 t/d using a range of mining methods from semi-manual to mechanized narrow vein equipment. Initial metallurgical results show high recoveries are attainable with low capital cost associated with the proposed leach method.

The report on feasibility has indicated that the gold resource potential at Gubong is very high and that there are four main sources of readily accessible ore from broken stocks in stockpile, sweeping and vamping, small remnant pillars and unmined blocks of ore. As the mine was shut very quickly, there is a high likelihood that three to four months production capacity would have been available for haulage, drilled or prepared ore stopes would have been scheduled and development of ore blocks would have also been ongoing.

A combination of mining methods is envisaged using mechanised flat back stoping where possible or mechanized room and pillar or breast stoping as the ore dictates.