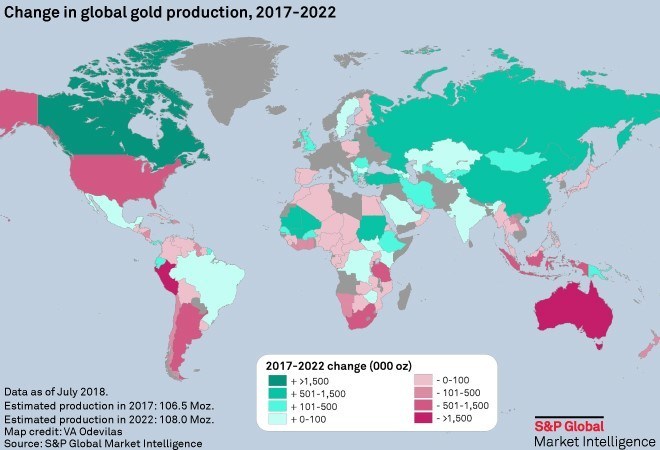

Although gold production grew for nine consecutive years to reach an all-time high in 2017, and is expected to rise further to new highs in 2019-2020, the mid-term outlook for some key countries is set to slump to generational lows, according to the newly published S&P Global Market Intelligence Gold Pipeline annual report.

Chris Galbraith, analyst at S&P Global Market Intelligence, says: “With many new operations ramping up and a steady stream of assets progressing toward production, we project further production increases through 2020 to as much as 111.7 Moz before falling output at existing operations outpaces new growth in 2021.

“However, we do not see growth across the board. In the case of Australia, despite production being on track to hit a 26-year high of 10.2 Moz in 2019, we estimate that Australian gold production will start to decline thereafter. We are forecasting a 9% fall year over year in 2020, and we expect country’s production to reach a generational low of 6.8 Moz by 2022, a 33% drop within only three years.”

Key findings from the Gold Pipeline report:

- Following the growth of global gold production for a ninth consecutive year in 2017, reaching an all-time high of 106.5 Moz: S&P Global Market Intelligence expect production to rise further this year to 108 Moz

- Project further production increases through 2020 to as much as 111.7 Moz before falling output at existing operations outpaces new growth in 2021

- Current operations to fall short of 2017 production by as much as 3% and by almost 15% by 2022 – due to depletion or production decreasing due to falling grades

- Growing Canadian production outpaces all other jurisdictions: strongest growth expected to come from Canada – with potential increase of 62% above 2017 production

- Australia and Peruvian production to drop the most by 2022.

Indicators point to a decline in Australia after 2019 highs attributable to the short mine lives of the recent start-ups and some significant mines approaching the end of their life. S&P Global Market Intelligence also expects Peru’s output to contract as no new gold mines have begun production since early 2017.

West Africa continues to rise in production league tables as the world’s second largest gold producer after China with a healthy pipeline.

Pipeline looking less golden in longer term: Global discovery rates have fallen – with some projects in the pipeline facing significant delays. As a result, the pool of potential assets for development looks very limited.