West African gold explorer and developer Azumah Resources Ltd advises that a comprehensive technical and costs review underway at its Wa gold project in Ghana is indicating a higher plant throughput is achievable, whilst capital and operating costs can be materially lowered. This review, inclusive of an Ore Reserve update and revised financial metrics, will be completed by the end of 2018. A fully updated feasibility study is on-track for delivery in Q3 2019.

Total Ore Reserves for the project currently stand at 624,000 oz grading 2.14g/t Au. Based on the technical and costs improvements being achieved, the successful drilling campaigns conducted during 2018 and expectations for planned drilling campaigns in 2019, the project’s partners are hopeful of reporting a series of material step-ups in Ore Reserves and delivering a project that will be strongly positioned for development.

A re-estimation of Mineral Resources at existing deposits plus maiden estimates for several new prospects drilled during this year will be reported shortly. The review work and update to Azumah’s 2015 feasibility study is being managed and is fully-funded by Joint Venture partner and Project Manager, Ibaera Capital.

Commenting on the recent work, Azumah Managing Director Stephen Stone said: “There is renewed momentum around the Wa project as a result of the joint venture with Ibaera Capital and its highly-motivated technical team.

“We have a clear path and are fully funded to a development decision in Q3 2019, with a tight schedule for key deliverables.

“With capital and operating costs already heading in the right direction, our main focus is to increase Ore Reserves. With many new and established targets to test during the remainder of 2018 and into 2019, we are optimistic in that regard. Drilling will recommence shortly after the annual break for seasonal rains.

“The Ghana Government is extremely keen to see the first gold mine established in the Upper West region and is actively supporting the project on several fronts”.

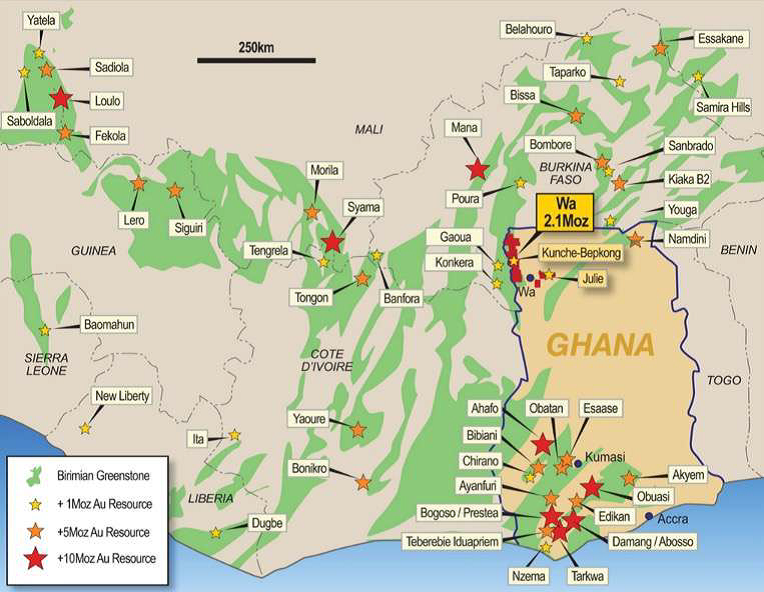

Three main deposits have been discovered and extensively drilled at Kunche and Bepkong, adjacent to the Black Volta River and Ghana’s border with Burkina Faso, and at Julie ~80 km to the east. Several satellite deposits, including Aduane and Collette, have also been delineated.

To date, the company has delineated a JORC 2012 Mineral Resource of 2.1 Moz of gold grading 1.5g/t Au, including 1.4 Moz Measured and Indicated grading 1.7g/t Au, with these evenly distributed between Kunche-Bepkong and Wa East (Julie deposit). Within this a JORC 2012 Ore Reserve of 624,000 oz Au (9.1 Mt at 2.14g/t Au) has been defined.

Extensive metallurgical test work has confirmed a high average overall gold recovery of ~92% for the combined Kunche, Bepkong and Julie deposits.

Mineral Resources have been progressively grown through a focused, systematic approach to exploration of the company’s 2,400 km2 licence holdings, which encompass large tracts of prospective Birimian terrain, the rocks that host the majority of West Africa’s gold mines. Much of this is covered in soil, alluvium or laterite so most discoveries have been ‘blind’. Azumah anticipates Mineral Resources will grow substantially as it continues to test its large pipeline of target areas and specific prospects.

Azumah’s exploration strategy is primarily driven by its need to boost Mineral Resources to increase the existing Ore Reserve base from 624,000 oz towards 1.0 Moz. This would more solidly underpin a development decision and improve funding capability.

At Wa, Azumah has one of the largest footprints in one of the world’s most fertile gold regions:

- +150 km strike of prospective Birimian greenstones – host to most of West Africa’s +5 Moz deposits

- Widespread gold anomalism

- Prolific target generation and testing

- Geological breakthroughs i.e. Kunche inferred ‘feeder zone’: 44 m at 5.37g/t Au from 99 m (including 20 m at 10.27g/t Au)

- Enormous opportunity to grow resources and reserves.

Azumah has two 15-year Mining Leases over its key deposits (Ghana government holds a 10% free carried interest in their ‘rights and obligations’ and is also entitled to a 5% gross gold royalty).

No technical, social or environmental impediments to development have been identified, no communities need to be relocated and rehoused and there is strong support from key stakeholders for the project. It benefits from excellent regional infrastructure including grid power to site, good quality bituminised and non-bituminised roads, easy access to water, a 2 km sealed airstrip at the regional centre of Wa and good general communications.