Copper Mountain Mining Corp has reported positive results from its feasibility study on its 100% owned Eva copper project in Queensland, Australia. Highlights from the study are summarised in the table. All costs and values use bank consensus metal prices with long-term metal prices of $3.08/lb of copper and $1,310/oz of gold. The Australian Dollar to U.S. Dollar exchange rates used for years 1 to 3 are 1.40:1 (spot), 1.38:1 and 1.36:1, followed by 1.35:1 long term. All dollars are in US dollars unless otherwise indicated.

|

After-tax Net Present Value (NPV) (8%) |

$256M |

|

After-tax Internal Rate of Return (IRR) |

28% |

|

Annual copper equivalent (CuEq) production first two full years(1) |

129M lbs |

|

Annual copper equivalent (CuEq) production (1) (full years 1-9) |

98M lbs |

|

Annual copper production first two years |

121M lbs |

|

Annual copper production (full years 1-9) |

90M lbs |

|

Mine life |

12 years |

|

C1 cash cost (per lb of copper produced)(1,2) |

$1.74 |

|

Initial capital cost |

$350M |

“The results of the Eva feasibility study clearly demonstrate the quality and size of this asset,” commented Gil Clausen, Copper Mountain’s President and CEO. “Eva has the potential to add significant cashflow to our operating base, at one of the lowest capital intensities for near-term greenfield projects anywhere, in the best mining jurisdiction in the world.”

Clausen added, “Our intention is to finance the capital spend in a non-dilutive manner through restructuring our current debt and internal cash flow. We are currently in advanced discussions on debt options and are evaluating the best alternative for shareholders. Until we have a definitive full funding solution in place, which we expect in the coming months, we will not commence construction nor incur large project costs. Our objective is to provide low risk, high value development options to our shareholders and we will be conservative in financing our growth plans. The organic growth pipeline at Copper Mountain is impressive, and we believe it will be largely financed internally.

“In addition, this study assumes no benefit from resources in the oxide cap which are treated as waste material. The company believes that the oxide copper at Eva may be recoverable economically based on preliminary leaching test work. A metallurgical test work program is currently underway and we expect to complete our evaluation in early 2019.”

The Eva project is designed as a moderate sized truck/shovel copper-gold open pit mining operation. The pit designs for the five deposits that comprise the Eva copper project, Little Eva, Turkey Creek, Bedford, Lady Clayre and Ivy Ann, were based on a Lerchs-Grossmann optimization at $2.75/lb copper price, generated using Measured and Indicated Mineral Resources only. Mining costs are based on a first-principles model based on locally-sourced costs for major inputs. Little Eva is comprised of six pushback phases while Turkey Creek and Bedford are each based on two phases. Lady Clayre and Ivy Ann are each single-phase pit developments. Pit designs followed geotechnical constraints, with haul road design widths sufficient for the proposed haulage equipment. The Little Eva pit is mined during the project’s nine-year active mining plan, with Turkey Creek and the smaller satellite pits mining being distributed into the schedule concurrently. The Little Eva and Turkey Creek pits represent approximately 91% of the project’s Mineral Reserves. Mid- and low- grade stockpiles are processed during the last three years of the mine life.

The mine plan includes production of 334 Mt of ore and waste from five deposits over a minimum mine life of 12 years. Total ore mined is expected to be 117 Mt and total waste is expected to be 217 Mt, for a waste to ore strip ratio of 1.86 to 1. With an overall sulphide copper recovery of 93% and gold recovery of 78%, the project’s average annual production is expected to be about 90 Mlb of copper and 19,000 oz of gold, which is equal to 98 Mlb copper equivalent, based on base case metal prices and estimated recoveries. Total copper produced is estimated to be 959 Mlb. Ore will be mined using conventional earth-moving equipment and will be transported to a processing plant via haulage roads.

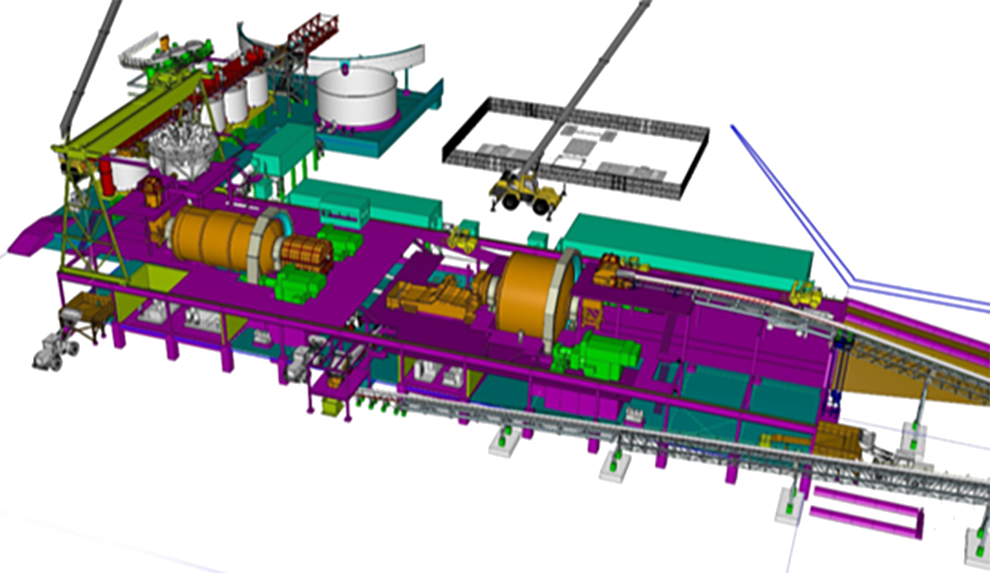

The process plan calls for an average throughput of 28,000 t/d) for the first five years and 25,500 t/d for the remaining life of mine based on the hardness variability incorporated into the geo-metallurgical model of the deposit. The processing plant and tailings management facility will be constructed on site. The flowsheet consists of primary crushing, primary and secondary grinding using a SAG-ball mill circuit (as the schematic), followed by flotation to recover copper and gold in concentrate form. Flotation concentrate will be thickened, filtered and stockpiled for shipping to the Mt Isa smelter. Full transportation, smelting and refining costs were based on the company’s existing long-term contract with Glencore’s Mt. Isa Smelter, which is located approximately 195 km west of Eva.

The project is near existing infrastructure with power available through a 220 kV powerline. Water for the operations will be supplied through a well field located near the processing facility, pit dewatering and from water reclaimed from the tailings storage facility located on company property. The well field has been drilled, pump tested and verified by independent hydrologists as sufficient for the project’s water consumption needs.

A summary of mining and production parameters is provided below.

|

Total ore mined (kt) |

117,041 |

|

Total waste (including 14,074 kt of oxide material) (kt) |

217,161 |

|

Waste to ore strip ratio |

1.86:1 |

|

Total ore processed (kt) |

117,041 |

|

Plant capacity |

28,000 tpd |

|

Total copper production (klbs) |

959,263 |

|

Annual copper production (full years 1-9) (klbs) |

90,400 |

|

Total gold production (oz) |

203,000 |

|

Annual gold production (full years 1-9) (oz) |

18,800 |

|

Average copper recovery |

93% |

|

Average gold recovery |

78% |

|

Average copper feed grade (full years 1-9) |

0.45% |

|

Average gold feed grade (full years 1-9) |

0.08 g/t |

|

Mine life |

12 years |