Polymetal International has entered into a legally binding agreement with Chaarat Gold Holdings Ltd for the sale of the Kapan mine in the Republic of Armenia for a total consideration of $55 million. “The sale of Kapan is a step towards shrinking Polymetal’s asset base to focus on large long-life projects”, said Vitaly Nesis, Group CEO of Polymetal. “The transaction will have immediate benefits as it is expected to improve our cost position and reduce leverage. On behalf of Polymetal, I would like to thank the team at Kapan for their hard work and dedication and wish them all the best going forward.”

The total consideration payable for Kapan will be $55 million, subject to working capital and other customary adjustments. This represents $99/oz of gold equivalent (GE) Ore Reserves.

Kapan is the smallest and highest-cost mine in Polymetal’s portfolio, representing:

- 3% of the group’s Ore Reserves as at 1 January 2018 (0.5 Moz of GE)

- 3% of the group’s LTM production ending 30 September 2018 (51,000 oz GE) and 5% of its expected 2019 production (90,000 oz GE) including feed from Lichkvaz

- 3% of group’s LTM adjusted EBITDA ending 30 June 2018 ($22 million)

- 7% of company’s workforce as of 30 September 2018.

In 2017, Kapan’s TCC of $871/oz and AISC of $1,292/oz were above Polymetal’s average of $650/oz and $877/oz (excluding Kapan).

Polymetal acquired Kapan in April 2016 for $38 million including $9 million fair value of the Net Smelter Return royalty on future gold production. The transaction is expected to result in a $3 million accounting profit for the company. Polymetal plans to use proceeds from the transaction to reduce debt.

Chaarat is an AIM listed gold development company focused on the 7 Moz, high-grade Chaarat gold project in the Kyrgyz Republic. Management believe that the Chaarat project has the potential to sustain 3-400,000 oz/y of production for a prolonged mine life.

Initially, the Tulkubash heap leach project is being developed to build a strong operating base in the Kyrgyz Republic and provide long term financial strength. The larger, higher grade Kyzyltash sulphide resource will be developed at a later stage by leveraging operating cash flow.

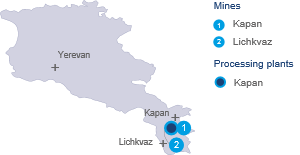

Kapan is an underground mine processing 750,000 t/y (flotation + offtake) with Reserves (JORC) of 0.5 Moz GE, 4.2 g/t average grade and Resources (JORC) of 1.9 Moz GE, 5.9 g/t average grade.