Paul Moore recently caught up with the senior management at Wenco: Andrew Pyne, CEO; Martin Politick, Director Technical Research; and Eric Winsborrow, EVP Corporate Strategy. They gave a unique in-depth insight into how an open autonomy vision that started as recently as three years ago is becoming a reality and how it will enable AHS in mining to evolve in a way that benefits the whole industry

To start with why have you gone down this open autonomy road and why are you investing so much energy in it?

AP: It became clear that it just wasn’t enough in this market to have a top performing FMS offering. The focus on open autonomy really goes back to a conversation I had with the CIO of a large mining company customer who said to me at the 2017 CIM: “You guys really need to understand, if you don’t do something fundamental to change the autonomy paradigm, we are going to have to remove Wenco from all of our sites and we don’t want to do that as we regard yours as the best FMS out there. But, it is highly likely we will go autonomous, therefore, we need you to do something.”

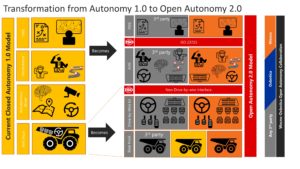

This was a big wake up call. They were referring to the fact that installing AHS with Cat and Komatsu is effectively committing to a closed stack of technologies and this is really where it all started. Martin Politick, our Director of Technical Research, came up with the true open autonomy concept, to drive this through an ISO standard while working together with the relevant stakeholders through the GMG sub-committees and working groups. He conceptualised what would be sustainable, and what could relatively easily be adopted by the industry. From the start, from the systems architecture side, our planning was driven by answering the fundamental question: what are the characteristics of an open system that is going to be robust and accepted by the mining industry? So, inherently, it had to be agnostic to any supplier side interest, including our own. The result of this is ISO 23725, the first public interface between an AHS truck fleet and the FMS system, which is essentially allowing the mining industry for the first time to ‘decouple’ fleet management and autonomy. So, it was driven from the start by a customer – and when we sought feedback from other customers we were getting comments privately from some of the biggest miners saying that they were “all in” on our approach and that it has to happen. But, at the same time, due to existing commitments, it wasn’t always possible for them to say this publicly so it hasn’t all been plain sailing.

So if the other players buy into the new ISO 23725 standard, what is to stop anyone offering “open autonomy”?

MP: This is exactly the point, and this is what we want to happen, to drive industry change. We want to open up the market and have multiple new interoperable technology players and OEMs come on board with ISO 23725. And the potential market is almost limitless – right now maybe 3-4% of the ultraclass haul trucks operating today are autonomous, but we know that 70% or more of the miners want to go autonomous and not just the Tier Ones. The sheer volume of customers and projects can’t be addressed by the two current market leading OEMs alone. It’s also not conducive to innovation in this technology area with only two suppliers. There are additionally a lot of different realities in terms of cultures, mine design types, mine geometries and mining techniques that have to be allowed for. There are multiple FMS solutions out there, of which Wenco is one – and ours has many attributes that we leverage successfully, but there are other solutions that also have attributes that are well regarded by their customers. And, the same is true in autonomy – currently autonomy is quite concentrated in Western Australian iron ore, but copper, gold and coal, for example, are all mined differently to iron ore. Even climate is a factor – if you are having to deal with a snowy Canadian winter, for example, that has big effects on autonomous operation, as does the changing nature of the Alberta oil sands from summer to winter. And, practically, just replicating the Cat or Komatsu system everywhere would first take a lot of time, time that the industry doesn’t have to achieve the productivity wins it needs. Secondly, as I’ve said, it is still quite Australia and iron ore centric – bringing autonomy to other types of mines, to smaller mining companies and to diverse locations geographically and culturally requires a new approach. Also, interestingly, some of our projects and partners are evaluating a whole new profile of autonomous trucks, much smaller in size and from other OEMs, which we will start to hear more about later this year. And, of course, it also allows Wenco to secure our installed FMS base and continue to grow it – that is the upside for us.

Will it allow you to grow in certain markets like Russia, where to date there hasn’t been much market penetration from outside? And can you comment on the wins not only for Wenco but also HCM?

AP: Actually we do quite well in Russia and already have a few big customers in Russia – Polyus, Alrosa and Nordgold all use our FMS – but yes it will also help us to grow further in that market. And back to the overall wins for Wenco – two things, we get to maintain the FMS customers that we have currently that want to go autonomous. We also have, we think, quite a technological advantage in respect of our system architecture which enables us to simply interoperate with other systems – we work well with others, both technically and philosophically. Our definition of interoperability is that we will work with anybody that our customer wants us to work with, as long as that doesn’t compromise our systems’ integrity. A good example of this commitment is how we interface with MineWare, which offers advanced monitoring technology for loading units but which is now owned by Komatsu. We did that integration because one of our customers asked us to, and MineWare were very easy and professional to work with. Our open architecture and this willingness to work with others to deliver value to our customers has been a significant factor in us capturing FMS market share in recent years, and will be a factor for those customers wanting to go autonomous. For Hitachi Construction Machinery (HCM), if autonomy becomes more widespread in mining, which it will, they will be able to better leverage their strong position in mining excavators. If a customer is going autonomous with Cat or Komatsu trucks, as an example, with an effectively closed system, it becomes more difficult for HCM to make its excavator argument in a tender – with open autonomy it is once again a more level playing field where the customer has access to the Hitachi excavator solution if they want it. And, yes, this applies to HCM building up its mining trucks business as well. And, while we are ultimately owned by Hitachi, we are also very independent which we need to be as we work with all OEMs. They give us a lot of freedom in order to operate our business as we need to but also give us all the support we need from a company as resourceful as Hitachi.

For a new AHS potential customer how does this change the practical experience of autonomy implementation?

MP: If I want to buy an autonomous fleet, yes, it makes sense that I want to buy a truck and autonomy layer of the same brand to minimise the implementation risk. But, today, I am forced to replace the FMS and database to also be of the same brand as the autonomous trucks. My only option is a closed full technology stack. Newcomers that have been developing autonomy solutions for the automotive industry, that could offer tremendous innovative step changes in this space, only want to focus on the technology they have and are looking at how to deploy it – with the open approach that becomes a possibility. They typically don’t have an FMS optimiser, fleet traffic management capabilities or high precision machine positioning required for the loading units, so they need to leverage these capabilities from traditional FMS providers.

A standard interface also allows for a single and a much clearer boundary when integration issues arise on site. The dispatchers will be able to use a single interface for all daily dispatching and autonomy activities. The FMS will display the rich site awareness available with autonomy. With this single Human Machine Interface (HMI), the dispatcher will be able to instruct specific trucks with AHS tasks or bypass autonomy faults (like obstacles), without having to switch to the vendor-specific autonomy HMI.

Even with this level of integration, the truck autonomy provider will also provide its own specific HMI to allow specific tailoring, configuring and diagnosing of its trucks and system.

Keeping the FMS means less risk and change management when implementing autonomy because the mine can keep the FMS component that is already commissioned and functional. It also provides the ability to upgrade or replace the FMS or autonomy independently.

Both systems could be certified independently by a third party. It also simplifies any blame game at site if something goes wrong. It means less project cost and maintenance cost because the interface is public (no NDAs required) and we are not re-inventing interfaces each time. There’s another natural interface: the interface between the onboard autonomy controller computer and the mechanical piece of equipment. This allows the control of a mixed fleet of trucks with a single autonomy orchestrator.

From a technical and change management point of view, does it make integration easier?

MP: Yes there is a big integration advantage to the customer. Enterprise Resources Planning (ERP) to FMS connectivity is not a single point of contact in the mine’s IT system. The FMS brings together about 12 other sources of information. Today, if you are deploying one of these AHS systems, even if it’s a Modular FMS and you are taking on a Komatsu AHS fleet, you still have to do a lot of work to redo all these integration points with all these systems, which is time consuming and low value because it is just an enabler to allow you to use everything you have already. It’s a collection of custom interfaces that were built and that have likely evolved over many years. We have even seen that with some of them: the knowledge left with a person that retired. Replacing the FMS means re-coding and re-validating all these connection points. It also means re-training all the staff. This replacement adds a lot of risk and change management to any AHS project that could be avoided.

So open autonomy makes change management for an autonomous fleet infinitely more straightforward and cost effective. On the technology side, AHS systems require a lot more validation than the FMS because a lot more safety elements are involved; but upgrades to FMS installations in terms of updated versions are much more frequent. An existing conundrum is: how do you allow for this when the components are highly integrated? The reality is you can’t keep up with the FMS technology changes with an embedded AHS. Open autonomy makes this a much simpler prospect. The ISO standard is international and published and it’s not a Wenco standard.

Why has the Pilbara been so dominant in AHS and what role will open autonomy bring in allowing AHS to benefit mines in other mining hubs?

AP: The first autonomous mines were Radomiro Tomic and Gaby in Chile. Rio Tinto sent a team to see the Gaby operation and they saw what was possible but also what would need to be put in place to make it work. Once the decision was made to bring AHS to the Pilbara, there were also three things about those mines that lent themselves to autonomy, which then helped it take off for the early adopters. The cost of labour and availability of labour was a big one – the savings brought by AHS were significant. Second, the wide, expansive mines and, specifically, the geometrically neat layout of the mines made them an ideal early adoption location, and this was proven in the long term. And, third, these mines were and are very well run and well organised; and were undergoing major expansions at the same time which could be tailored to AHS. Now that AHS has been established there for some years and the benefits in production cost terms have been proven, others want to make the same journey. But because of the nature of operations elsewhere the change management involved can be huge for many reasons, including social ones for mines that employ large numbers of people from nearby urban centres. Making autonomy truly open helps the transition on the technology change management side of things.

EW: Also with open autonomy you get to apply AHS to many different scenarios for new adopters where it previously wasn’t a feasible option. Truck choice is one factor – we are now working with customers with fleets of trucks that aren’t “ultraclass” – size classes in the 50-70 t range, as well as articulated dump trucks (ADTs) where there are tens of thousands of trucks operating not previously considered for AHS, but where those operators, including contractors, want to try out autonomy. This also applies to mines using tipper-type non-rigid trucks from the likes of Volvo, Scania and others – how do they get access to autonomy? Some of these operators, especially in the developing world may not even have an FMS in place to manage those fleets. The ability to accelerate autonomy adoption by making it truly open is a big win for the whole industry, and yes there are associated benefits for Wenco as well in opening up these new markets. But it doesn’t mean excluding others; it lends itself to including others to be able to offer a best of breed approach to AHS. This means the mine is getting an autonomous solution that is unique to them and the right one for them, it isn’t a fixed offering being imposed on them as the only route to AHS available. And, it isn’t just about trucks, and that’s one of the reasons we opted to work with Oxbotica.

What does Oxbotica bring that Wenco couldn’t do itself?

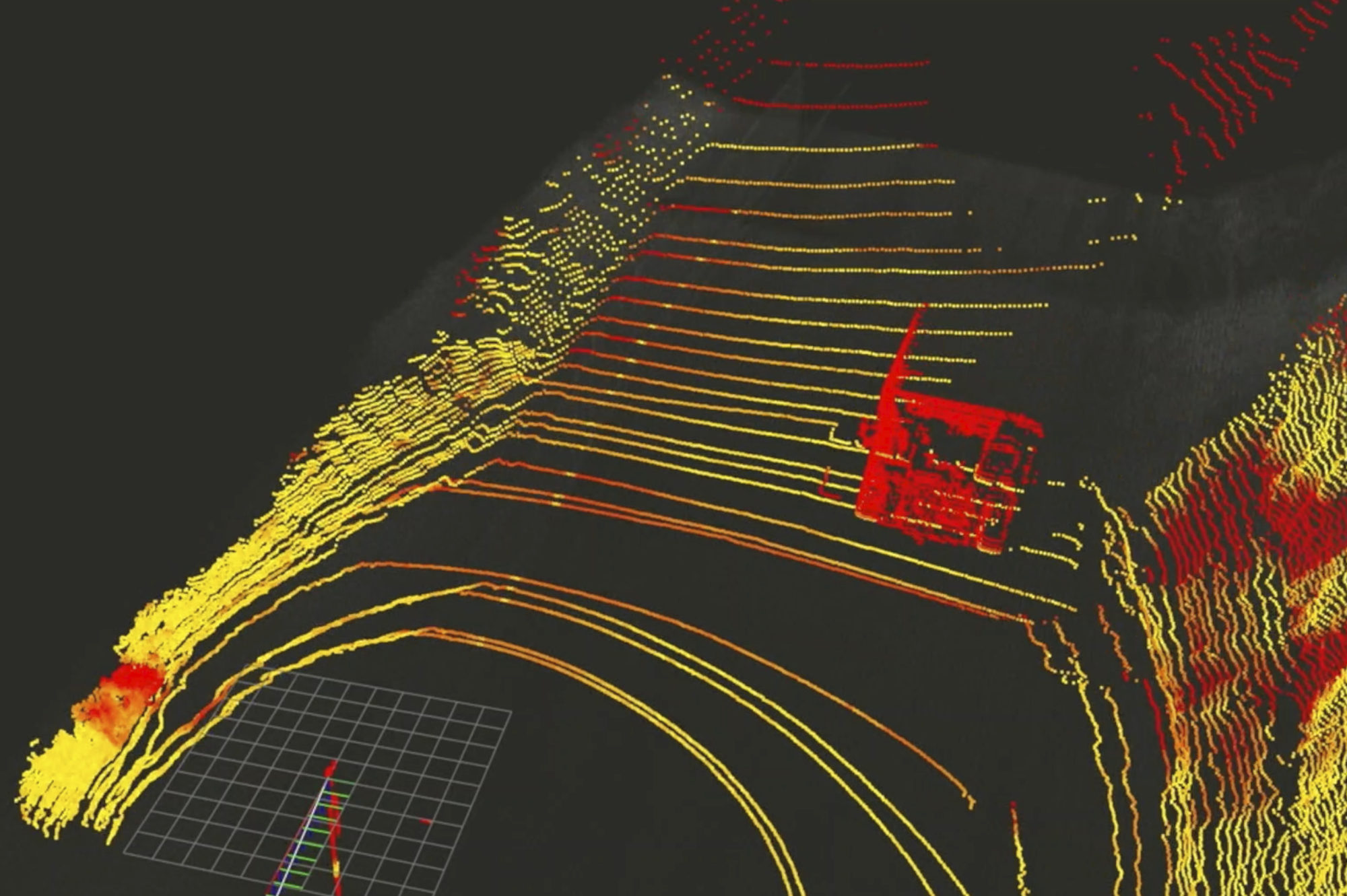

EW: We know what we do really well and we also know we can’t do everything. If you look at the closed stack model in the industry currently, the functionality includes FMS, traffic management, safety, drive by wire, the truck itself, other vehicles it will interact with and a host of other components involved. Allowing the customer to choose best of breed and take the pieces they want to use, enables a heterogeneous AHS fleet rather than getting locked into a single vendor. We looked at Oxbotica because they were very good at what they were doing in automotive and other sectors, they just weren’t operationally deployed in mining yet. Oxbotica’s technology has been designed for dynamic urban environments and off-road applications and some of their technology, particularly, their sensing, localisation, dynamic planning to account for obstacles (stationary or mobile) for example, is quite simply phenomenal. We recognised that, and are working with them to enable a step change in what’s possible in mining autonomy.

When Wenco supplies its FMS layer to a Hitachi system, it does so in an uncoupled way using a defined set of protocols but creating an interface layer that means that if Hitachi wants to sell its mining trucks using a different FMS, they are still able to. The new open approach has seen the addition of more interoperable layers to allow other best of breed providers to contribute to the overall solution and Oxbotica is now providing the autonomous layer that sits onboard the trucks themselves along with the mentioned obstacle detection technology.

Oxbotica isn’t our only partnership for open autonomy, but we went public with this relationship as our approach and philosophy is very aligned with theirs and we think their autonomy software is best of breed. We believe that there is a lot of potential with the partnership to prove the open autonomy concept. There are some really exciting things we think we can achieve.

What type of customer is right for trialling the open autonomy approach and when are we likely to see a trial?

AP: We need to find the right customer set-up to be a true open autonomy partner. There are a lot of companies interested in what we are doing, we want to work with those that have the right change management approach and whose philosophy is aligned with what we are trying to do. This includes having test areas where we can safely prove that an open system works as well as any other system. And, of course, we want to make sure that the first ‘at scale’ system is very successful.

We have already had significant experience prior to the Oxbotica agreement. We are already working with Rio Tinto on autonomous Scania XT 8×4 trucks. While we can’t discuss specifics, they and others including Vale see some real advantages of automating smaller equipment. We are also now involved at the Roy Hill iron ore project and at a European mining project where we are working with other technology partners. In terms of trials, with the solution including the Oxbotica layers, we are talking to several mines with mixed fleets and hope to be able to announce something soon.

EW: There may be companies out there who aspire to do it all but if you don’t have specific knowledge of all of the autonomy ‘parts’, it is very difficult to be able to provide an optimum autonomy solution for any customer, not just in mining but in any industry. With our standards based open and abstracted approach, the customer is able to put together their choice of best of breed components. Some of those may already be installed and operating in their existing infrastructure so why wouldn’t you keep using them? Having to rip out your existing FMS and other infrastructure to be able to apply AHS is instantly taking away some of the AHS productivity and cost saving value proposition you are trying to achieve in the first place. Why not leverage what you already have and add in only the new pieces you need? For the AHS and automation market to grow to its potential, it has to do what is best for the customer and the wider industry. Given we are only at 3-4% adoption today, whatever accelerates that adoption rate is going to help everyone in the industry. An open approach helps the established players, new entrants into mining, and most importantly the customers. Everyone can benefit.