Eramet plans to restart construction of its lithium production plant in Argentina after signing an agreement with Tsingshan that will see the China-based steel group finance the build in exchange for a 49.9% interest in the project.

The construction of the 24,000 t/y lithium carbonate equivalent plant will start during the March quarter of 2022, with commissioning scheduled for early 2024.

Eramet and Tsingshan have an existing relationship with the two companies jointly owning the Weda Bay nickel operations in Indonesia.

“With this project, Eramet will become the first European company to develop sustainable and large-scale lithium production, supported by a performing process developed in-house by its R&D centre,” Eramet said.

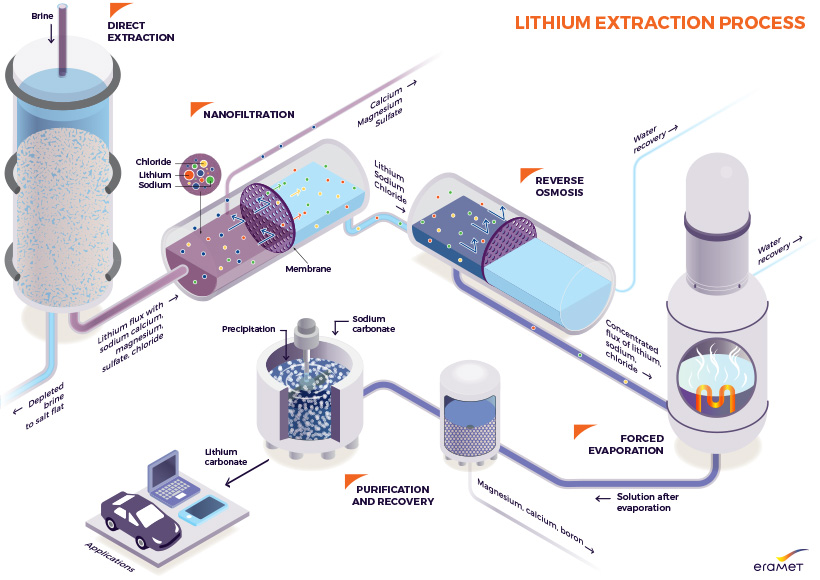

This is a two-step process that, firstly, uses an active solid to extract and concentrate the lithium. Developed by Eramet in liaison with IFPEN (the French Institute of Petroleum and New Energies) and Seprosys, this works like a sponge, capturing the lithium contained in the brine. Fresh water is then used to release the stored lithium. To further concentrate the extracted metal, two successive processes are then conducted: nanofiltration and reverse osmosis.

The lithium is then purified, after which a reaction occurs with sodium carbonate to convert it to lithium carbonate. Once filtered again and washed, it achieves the chemical quality of the finished product, Eramet said.

The lithium project was mothballed in April 2020 during COVID-19, as the conditions were not met to launch construction.

“Based on the partnership signed with Tsingshan and factoring in solid fundamentals as well as excellent outlook for the lithium market, the group’s Board of Directors has considered that the conditions are now met to launch the plant construction,” Eramet said.

Eramet will control the project, with a 50.1% interest. For its part, Tsingshan will contribute up to $375 million to the project through the financing of the plant’s construction, leading to it earning a 49.9% stake in the project.

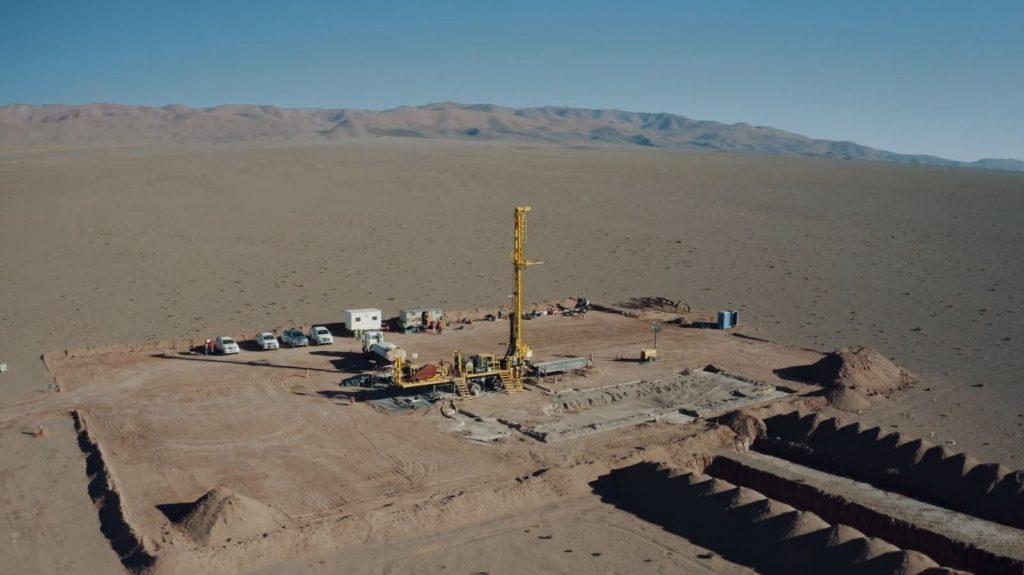

Eramet owns perpetual mining rights over a major lithium concession, in the form of brine, located on the Andean highlands in Salta Province. The project plans to extract brine from the salar and process it into lithium carbonate. The 24,000 t/y LCE project is expected to have cash costs of around $3,500/t LCE ex-works, with large-scale drainable resources.

A pilot plant installed on the site since 2020 has demonstrated, in real conditions, the lithium carbonate production, which brought very high direct extraction yields of around 90%, according to the company.

“The project has strong ESG performance, notably as demonstrated by the quality of the relationships tied with local communities during the preparatory phase of the project,” the company said. “Eramet’s process also presents an advantage in terms of hydric resources use compared with projects supported by a conventional extraction process. All Eramet’s CSR standards will be applied on the activity.”

Christel Bories, Eramet Group Chair and CEO, said: “Our decision to carry out our lithium project in Argentina is in line with the dynamic of strong market growth. It is a key milestone in the deployment of our strategic roadmap, which aims at positioning Eramet as a reference player in metals for the energy transition.”