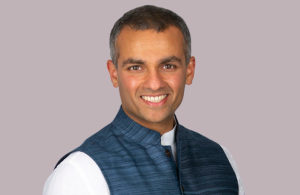

The 2023 Future Minerals Forum will take place in Riyadh, Saudi Arabia from 10-12 January, including a Ministerial Roundtable, followed by the Forum and Exhibition itself. The International Council on Mining and Metals (ICMM) President & CEO Rohitesh Dhawan spoke and participated at the first Forum in 2022 and will do so again at this second event. But what is Dhawan’s view of the progress made in Saudi Arabia and where the focus for the future needs to be? IM had the chance to have an in-depth interview recently with Dhawan to answer these and other questions.

Q How do you see Saudi’s new approach to mining and its importance for the region? What role is the Future Minerals Forum playing in this?

Saudi Arabia has been thinking about mining becoming a much greater part of its economy for some time, and I am pleased to see that principles of sustainable and responsible mining are front and centre of that. Clearly with the 2022 Future of Minerals Forum and the imminent 2023 event there is fresh interest today. Their Vision 2030 is also not just a Saudi project, it is a regional project – and that is reflected in the broad participation of Ministers and business leaders from the region. At the 2022 Future Minerals Forum Ministerial Round Table there were 32 Ministers and Ambassadors from around the region present, and in 2023 there will be even more – over 50 at last count. This shows that it is a regional move for the Middle East and North and East Africa in particular. The Future Minerals Forum itself is a valuable gathering to bring governments, mining operators and others together to have high level conversations – if you think about it, the oil and gas industry has OPEC and several other forums where it comes together – mining has not really had that with significant ministerial and industry leadership level participation before, and for the MENA region and to some extent the wider world, it is now performing that function. The most important outcome from this is a shared commitment to the development of a responsible and sustainable mining industry that meets the needs of all stakeholders and leaves no one behind.

Rohitesh Dhawan, ICMM President and Chief Executive Officer

Q Why is this region important for mining development and mining best practice from an ICMM perspective?

I would not be surprised if Saudi became a hub for all things mining related in this part of the world. That is attracting increased exploration dollars and other investments, particularly downstream. It is worth remembering that while the Middle East and North Africa, often referred to as MENA, represents about 23% of the global landmass and geologically rich and diverse, it only accounts for about 6% of global mineral exploration spending. Yet its mineral reserves are already estimated at over $1.6 trillion. This untapped potential is not just an attractive commercial proposition, but it provides a unique opportunity to make giant leaps in sustainable and responsible mining practices. Saudi Arabia and everyone who participates in its mining industry has the chance – and I would even go as far as to say the responsibility – to look at every sustainability challenge in the mining industry with a fresh set of eyes, and apply the same ambition and entrepreneurial spirit as on commercial aspects to those challenges, to find solutions that can be globally scaled. In that regard, I am very pleased that Saudi Arabia’s leaders have been proactive in reaching out to us quite early in their journey of thinking through how they want to build their mining industry.

Q What issues are important to the Saudi government when it comes the impact of mining and the right way to mine? How can the ICMM help?

I have been really encouraged and impressed on the level of detail that both the Minister of Industry and Mineral Resources, His Excellency Bandar Al-Khorayef, and Vice Minister of Mining Affairs, His Excellency Khalid Saleh Al-Mudaifer, have spoken of on various occasions on the issues they are focussing on. To give one example – water. As you know, MENA is a water stressed region; and mining and processing of metals is water intensive, so Saudi Arabia needs to think very carefully about how it and its neighbours will manage already stretched water resources. The aspects of the new Saudi mining law that relate to water are actually drawn from the ICMM guidance on water which was updated extensively in 2021. This is an example of industry-led guidance that is being adapted appropriately into a national context by the Saudi government. Similarly, I have had lengthy discussions with the Ministry about how they align with other principles that are of major importance to our ICMM member companies. A good example is the managing of the relocation of local communities – and this is something we know from these talks that the Saudi government has already thought deeply about itself. These are just two examples of areas where we are working together on a substantive basis. Our interest from an ICMM point of view is quite straightforward – we want to raise the ESG standards of mining wherever it takes place. Saudi is still at quite an early stage of what looks like becoming quite an important mining jurisdiction. The closer our collaboration and cooperation with Saudi Arabia at this stage can be, can help ensure that best practices, both those that we have to share and that they may already have and that we at ICMM can learn from, that these then become the foundation of their industry. It is much easier to do it now than to try and ‘retrofit’ it once mining takes off in a big way.

His Excellency Bandar Al-Khorayef (right), Minister of Industry and Mineral Resources and His Excellency Khalid Saleh Al-Mudaifer (left), Vice Minister for Mining Affairs

Q What direct experience have you had of the Saudi mining industry?

At the last Future Minerals Forum I had the opportunity to visit Ras al-Khair, known as the Minerals City, which is being built by the national mining company Ma’aden in the Eastern Province of Saudi Arabia on the coast, about 60 km north of Jubail. It has one of the world’s largest phosphate plants, one of the world’s largest integrated aluminium smelters plus already has a world class hybrid gas-fired power and desalination plant. That gave me an opportunity to see for myself what is happening on the ground in Saudi. Plus when NEOM and other Red Sea developments are up and running, these could potentially give Saudi Arabia new bases into which it can attract international companies who subscribe to high sustainability standards. I also spent a lot of time at the last Forum with the executive team at Ma’aden, including the CEO, hearing their views on sustainability in mining and sharing with them our key principles.

Q How are you working with Saudi Arabia’s mine operators and government on ESG and can you give any examples?

I was pleased to hear Bob Wilt announce last month in London that Ma’aden is applying to join ICMM. Irrespective of that, I’ve been encouraged to hear the company’s leaders state numerous times in its Sustainability Reports and elsewhere, that it has adopted these principles throughout its operations and adopted them as the foundation of Ma’aden’s Sustainability Strategic Direction, under Ma’aden’s Strategy 2025. Areas we have discussed with them in detail include responsible mine closure, where they are very keen to get ahead on that from a financial, social and environmental point of view. We also have talked about water resources and their management, just as we have with the Ministry. The Minister and Vice Minister have both said that their approach to sustainability is to go beyond compliance which is very encouraging. One topic they want to look at is how to best measure the social and economic benefits that are generated from mining – where up until recently there was no consistent set of metrics to use. If I say to you I am going to mine and create 5,000 jobs, there was no consistent way to define if those are full or part time jobs or if they are permanent or temporary contracts and how those benefits flow to different people, particularly under-represented groups. In May 2022, the ICMM published a new Social and Economic Reporting Framework which was two years in the making and commits members to report against a set of social and economic indicators, empowering stakeholders such as communities, governments, and investors to assess the contribution of mining to social and economic development more easily. I have been encouraged by my discussions with the Saudi Ministry as to whether this could also form the basis of a Saudi framework for what would be expected of mining companies operating in the country. Localisation is an important part of their push – to ensure that it is local communities that are getting the major benefits in the areas where mines are located. The framework will help put the metrics in place to know if that is actually happening.

The ICMM is working closely with Saudi Arabia’s Ministry of Industry and Mineral Resources, Ma’aden and others on sustainability principles and initiatives

Q What about tailings, is this also a subject you have discussed?

Along with UNEP and PRI in 2020 the ICMM launched the Global Industry Standard on Tailings Management and of course we have strongly advocated that Ma’aden and all operators in Saudi Arabia should adopt the Standard to manage existing tailings facilities. And if we are to take tailings seriously in all its respects, then what we would hope to see from Saudi operators would be to be among the first movers and adopters of tailings reduction technology. In September 2022, we published a new Tailings Reduction Roadmap which lays out innovative approaches and solutions capable of significantly reducing tailings from the mine life cycle, as part of a broader Tailings Innovation Initiative. sets out short and long-term technology options. These include mature solutions that can be implemented in the short-term, such as coarse particle flotation technology which enhances the recovery of coarser particles of ore that has traditionally been seen as waste, and solutions with the potential to reduce tailings in more significant quantities, but that will require further development over the next 10-15 years, such as higher precision mining and artificial intelligence. We have discussed the roadmap with key players in Saudi Arabia as we believe it is easier if you are relatively new operator or fast growing operator in a new mining region to plan for these technologies and in some cases retrofit these technologies to existing operations. There is actually an opportunity for Saudi to lead the way on tailings reduction.