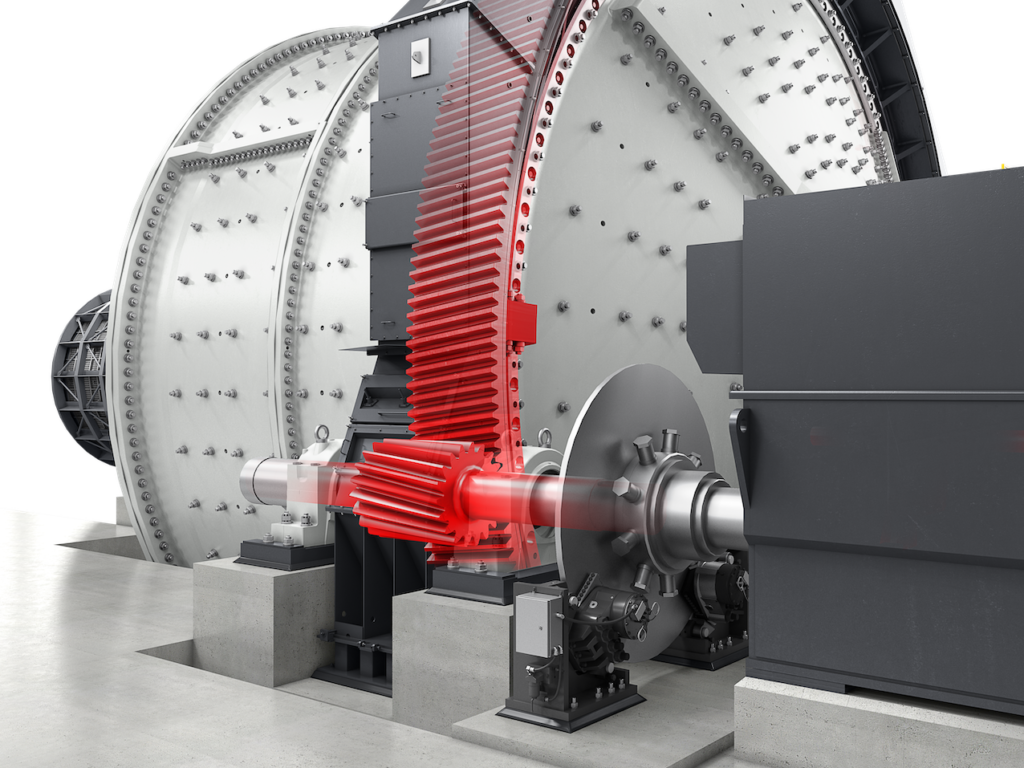

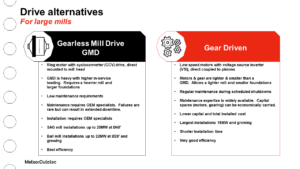

It is well known in the mining industry that the biggest mining concentrators, with the highest throughputs and largest mills, have long used gearless mill drives (GMDs). Since their introduction into the market in the 1960s, the GMD installed base has increased steadily, both with respect to cumulative install power and individual drive power. Gearless drives offer many upsides – high operational reliability with minimal maintenance, high efficiency, and very high mill power.

Perhaps less well known is that gear driven mill power has also increased significantly, to the point where decisions on which technology to use have become much less clear cut.

IM Editorial Director Paul Moore spoke to Metso Outotec Vice President Horizontal Grinding Mills, Nick Green and Damon Bordi, Director – Premier™ Grinding Mills to get the inside track on the pros and cons of each, plus how the comminution market is evolving in terms of drive technology.

Metso Outotec’s Vice President Horizontal Grinding Mills, Nick Green (left) and Director – Premier™ Grinding Mills, Damon Bordi (right)

Green commented on the industry shift: “Facilitated by collaboration between mill OEMs and gear suppliers, the increase in gear driven mill power has been propelled by improvements in gear manufacturing and design capabilities. Previous accuracy, hardness and size limits relating to gear casting (or fabrication) and machining have been surpassed. By contrast, GMD power has remained relatively static at a ceiling of 28 MW for SAG mills and 22 MW for ball mills in the last decade. Having said that, in collaboration with GMD suppliers, we are more than ready to take the next step in mill size and power. Current GMD and grinding mill technology is ready to be supplied with installed power exceeding 30 MW, on mills larger than 42 ft.”

He adds: “Equally on the geared drive side, there is a lot of work being done to push geared solutions into higher power levels. There are distinct advantages to the gear driven option and we are seeing a lot of interest in this area. The main one is the accessibility of gear drive technology, which attracts projects that are CAPEX sensitive or targeting an accelerated schedule. At Metso Outotec we firmly believe there is a place for both gearless and gear driven mills.”

Green says that going back 20 years, GMDs dominated in the 15-20 MW range. “But today, as geared drive power has caught up, you would very rarely see a GMD in that power range. Plus, many customers are interested in geared options with installed power exceeding 20 MW. Above approximately 22 MW, GMDs remain the preferred technology. So, there is growth on both sides.”

Tackling the tradeoffs

Bordi adds: “One of the other things that has swayed the tradeoff in recent years is advancements in low-speed motor technology for gear driven mills. Historically, one of the big arguments for a gearless drive was that it had significantly higher efficiency. Today, the differences in efficiency are minor – in the vicinity of 0.5%. Similarly, the functionality available with gearless drives, including inching and frozen charge detection, are now available for gear driven mills when low speed motors are utilised. However, looking at operating cost, the two clearly still have very different maintenance requirements, with GMDs requiring lower maintenance.”

So, have we reached the ceiling in terms of single mills at around 40 ft or 42 ft diameter? Bordi comments: “As Nick says, the market is currently very comfortable with 40 ft SAG mills, but there is space to grow. Metso Outotec has previously designed and delivered a 42 ft mill, but it is unfortunately yet to be installed. We also have a few opportunities in the pipeline for even larger sizes, where there are clear benefits of having reduced equipment lines in terms of operating cost and efficiencies. That can be related to footprint and/or just the pure installed power to be able to handle the required throughput. Like gear drive mills, large mill development has previously been limited by manufacturing and design capabilities. Today we are quite comfortable designing and manufacturing a 44 ft mill – we have designs ready to go and they have even been specified in some flowsheets as part of future project planning. So, the push for going beyond 40 ft is there and at Metso Outotec we have the tools and technologies to support the endeavour.”

Gear versus gearless – the pros and cons

Nick Green told IM that there is a complex array of pros and cons associated with the two technologies. “In a project sense, the upper end that we have today for both geared and gearless drive are dictated by two things – the actual limits of what can be designed and manufactured, then the perceived limits.” Both Green and Bordi emphasised that the mining industry remains very conservative – when investing in front of flowsheet capital equipment, no one really wants to be the first and most don’t want to be second either. So as design, engineering and manufacturing capabilities grow, equipment deliveries don’t necessarily always follow.

Bordi: “And I think that’s what we are seeing now, I believe the industry is ready for an adjustment. Miners are now comfortable with gear driven mills at 18 MW, and as Metso Outotec we are telling the market we are ready to take the next step. By collaborating with our sub-suppliers, and leveraging our state-of-the-art engineering tools, we are quite comfortable moving beyond 20 MW. Likewise, we are ready to deliver 42 and 44 ft GMD-driven mills, and we have seen mills of this size enter multiple feasibility stage flowsheets.”

Green adds: “We believe our responsibility as an OEM is to drive both technologies forward as much as we can to be able to present customers with choices. Explaining the tradeoffs ultimately allowing them to make a decision that suits the best interests of their project and their priorities at the time.”

Quad pinion possibilities

One other option worth mentioning is the Quadrex® or QDX4 drive – which was developed in partnership between Metso Outotec and Groupe CIF-Ferry Capitain. It enables gear driven mill power all the way up to 32 MW, territory that could previously only be filled with a gearless drive. This is because it is a quad, not a standard dual pinion solution. In the mining industry there are no installations yet, but the fundamental open gear design philosophy is unchanged from that of a dual pinion drive. The division of power between four pinions reduces the load per pinion, which allows ring gear sizing to remain below currently achievable limits. This also keeps the gear material hardness at present-day levels. Variable speed motors can be used with power up to 16 MW per drive, extending to 32 MW for dual drives. In this arrangment low speed motors with VSD are coupled to the Quadrex input shaft via a torque limiting coupling. To test the Quadrex Mill Drive torque dividing system under the most severe operating conditions, a full-scale instrumented test bench was designed and built. The test bench, driven by a variable speed motor, is composed of two torque splitting sub-assemblies operating in closed loop.

The comminution drive situation today

So where is the market today? Are these dual pinion 20-24 MW mills being factored into planned flowsheets and feasibility studies? Green says: “Increasingly, yes. This is mostly being driven by customers themselves where the tradeoffs land in favour of the geared solution.”

What are the advantages for Metso Outotec in giving customers more options? Green argues: “Our goal is technology leadership benefitting our customers and one of the main ways we show that is through innovation which maximises the options available to our customers at the lowest possible risk. To some extent we also have a responsibility to keep the industry moving forward where possible – in this case by growing mill size and mill power. It directly benefits our customers in terms of economies of scale enabling reduction in CAPEX and/or OPEX.”

Getting beyond ‘standardisation’

For the last decade or so, both Green and Bordi say the mining industry has more or less standardised large milling circuits to include 40 ft diameter, 28 MW SAG mills and 28 ft diameter, 22 MW ball mills – all GMD driven. Bordi: “We are increasing the ‘tools in the chest’ by offering some alternatives – for example – if the circuit actually needs a 38 ft, 20 MW SAG mill, you now have the option of a 38 ft gear driven mill. At this size gearless drive is a viable option, but it is significantly more expensive and therefore can pose a challenge. Likewise, the implementation of 42 and 44 ft mills facilitates novel circuit designs with improved efficiency and reduced footprint.”

Green adds: “Greater choice is essential and not just with respect to grinding mill size or drive type, we also have the most complete range of comminution technologies under one roof including stirred mills and the HRCe. This means we can consider all aspects holistically to provide the most efficient and cost-effective combination of products & technologies. And the customer is in the drivers seat setting the priorities.”

Change is in the air. Green: “There is enough momentum and interest that I am confident we will see steps up in both geared and gearless drive power in the short term.”