On November 6/7 this year, IM had the privilege with a small group of mainstream journalists to get a detailed insight into Anglo American’s Woodsmith polyhalite project in North Yorkshire, which included a visit to the foreshaft area of the service shaft, the base of the MTS shaft, the transport tunnel itself at the Lockwood Beck access point, the port site area including the tunnel portal, and the Redcar Bulk Terminals and Bran Sands area where direct ship loading of the POLY4 product for global markets will eventually occur.

It was clear that the project is significant in many ways. First off, there is the potential for POLY4 (Anglo American’s brand for its processed polyhalite for market) to change the competitive playing field in fertiliser minerals both as a premium alternative to NPK as well as an enhancement by being blended with it – reducing NPK and therefore MOP (derived from mined potash) requirements, and reducing the impact of leaching from farm soils.

Numerous crop trials have shown it to have had really groundbreaking results with 3-5% yield uplift. As outlined at the visit by Alexander Schmitt, Chief Marketing Officer, Crop Nutrients at Anglo American, POLY4 contains four of the six essential macro nutrients required for plant growth: potassium, sulphur, magnesium and calcium. POLY4 is also a fully soluble fertiliser with a sustained nutrient delivery profile that matches crop demand and reduces wastage. It has no requirement for chemical processing and has the lowest CO2 emissions compared to other fertiliser products.

Then there is the importance of a new very long life mining project on this scale for the UK and for the region – 1,650 direct jobs (of which about 60% will be from the local area) and all the others that filter down from that. Plus of course the development of at least a $1.4 billion per year earnings (EBITDA) long term industrial minerals asset for Anglo that is very distinct from its core copper and iron ore businesses in terms of market drivers and fluctuations. And this earnings figure is conservative, based on a selling price of about $190/t – this in itself is largely based on existing achieved prices in the market for a chipped product, with Woodsmith’s pelletised product expected to gain a premium on this.

While project costs have increased since Anglo American took over – largely due to optimisation programs to get it back on track – the potential upside is still huge. Worley was brought into the project in 2022 to provide program management services and engineering, procurement and construction management (EPCM) for Woodsmith and help steer it to final production. First production is expected in 2027.

Setting new standards in mining & tunnelling

From a mining point of view, Woodsmith is also notable for a number of reasons, not least the 25 m seam that is much thicker than equivalent potash seams being exploited. It is also only the third major mining project after BHP Jansen and the Slavkaliy potash mine in Belarus to deploy Herrenknecht’s Shaft Boring Roadheader (SBR) technology, Woodsmith having SBRs number 5 and 6. These latest SBRs incorporate learnings from the first four machines. SBRs are inherently more automated and far safer than conventional drill and blast with workers hardly ever exposed to the unsupported excavation bench.

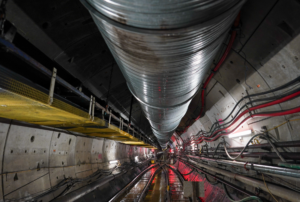

On to the tunnel – on October 28 its Herrenknecht TBM ‘Stella Rose’ broke the word record for a single TBM tunnel drive when it passed 25.9 km. This was a massive achievement on the way to the final 37 km and a real nod to STRABAG which has been quietly working consistently through the ownership change and the pandemic.

Inside the polyhalite transport tunnel at Lockwood Beck – the TBM set a new world record at 25.9 km on October 28

Third, the two shafts will be the deepest in Europe when completed. And finally, the mine is likely to be one of the largest room and pillar operations in the world when it reaches final capacity – more on that later.

Anglo American will not be the first in the world to mine polyhalite commercially – its neighbour ICL Boulby has that accolade – now producing 1 Mt/y from the same seam that Woodsmith will exploit which sits within the EZ2 Fordon Evaporite sequence and with plans to ramp up to 3 Mt/y by 2030. However, Woodsmith will be a state of the art operation given that it is an all new mine with the latest technology available and the might of a global Tier 1 miner behind it, plus it will be on a much larger scale – initially in 2027 ramping up to 5 Mt/y following the initial expected Board investment decision but within a few years following an additional investment nod reaching its final steady state production of 13 Mt/y.

ICL is also producing a chipped product (branded Polysulphate) following crushing and screening – the Woodsmith mine will produce a form of pellet which it says results in better nutrient release in use. That said, Boulby has to some extent paved a way by establishing a market for polyhalite already which has helped familiarise farmers and fertiliser mineral competitors with it. Plus, there are a number of Woodsmith staff that have come from years of working at Boulby, representing a lot of retained experience. And many forget today that Anglo American itself also owned Boulby as a co-owner with ICI in Cleveland Potash, and then fully owned it directly through Minorco until divesting it to ICL in 2002.

The transport tunnel – key to long term stability and success

But unquestionably the biggest plus point for Woodsmith versus Boulby, or any of the global potash mining operations, is that STRABAG as mentioned, is already most of the way through its 37 km tunnel to the final processing and shipping point, giving it a unique logistical advantage over its very long life of mine which will be a minimum of 40 years. That is a lot of trucks off the road. The tunnel currently houses a rail track for TBM operations supply and support, mainly bringing concrete segments up to the TBM for installation as well as transporting workers and TBM maintenance related materials. The conveyor for material is currently suspended from the tunnel soffit but in final operations once the tunnel is complete it will be replaced by a larger conveyor and will also likely be suspended rather than resting on a steel structure though this decision has yet to be made.

The tunnel transport compares to the potash logistics from the large global mines in Canada, most of which export via rail to the West Coast USA – a distance of about 2,000 km. This will also be true of Jansen which will join that same rail corridor via a 47 km spur. Boulby for its part sends its product to Teesside by surface rail. Woodsmith also has no real waste or tailings issue, having a 1:1 ore to product ratio due to the geologic nature of the orebody.

IM Editorial Director Paul Moore at the bottom of the Woodsmith MTS shaft

And there will be no visible surface headframe, with the small number of permanent buildings largely hidden by bunds (themselves made of graded material from shaft excavation) – so Woodsmith for all intents and purposes will be largely invisible in terms of surface works when fully running – all processing will be done at Wilton, an existing industrial area. This will still be quite basic with only five steps – crushing and grinding, mixing, granulation (similar to pelletising), drying and coating.

Shaft sinking update

The two deep shafts are the 7.5 m diameter service and production shafts – both of which will reach approximately 1,600 m in the polyhalite seam and will be the two deepest shafts in Europe when complete. And in fact Anglo American has widened them by 10% to give more operational flexibility. Redpath Deilmann is handling this part of the project (along with the MTS shaft). On the day of the IM visit the service shaft had reached 631 m and the production shaft 386 m where pumping station excavations are taking place.

A lot of the learnings made on the service shaft SBR are now being applied to the production shaft. Andrew Johnson, Woodsmith Project Director: “We are consistently seeing that the production shaft is delivering better daily production meterage to the service shaft at an equivalent level.” The production shaft will use double drum OLKO Blair winders, which are in place and being used for construction support operations; while the SBRs themselves are being supported by eight stage winches from SIEMAG TECBERG (four per shaft).

The Mineral Transport System (MTS) shaft, which IM also visited, has largely been completed and is primarily a construction access point for development of the MTS level, which will involve as much as 4 km of underground development, including connecting the main service and production shafts laterally as well as acting as the connecting point between a polyhalite handling station where it is brought to the MTS level from 1,600 m underground and transferred to the main tunnel conveyor for transport to Wilton.

The MTS shaft has already been sunk to about 354 m, just short of its final 360 depth. As with other shafts aside from the service and production shafts, it has been sunk using a conventional galloway with drill and blast methods, with initial lateral development using jackleg drills on one side and an AM50 roadheader. An Epiroc Boomer face drill jumbo and small LHD have already been acquired to speed up lateral development in the coming months.

The Sherwood Sandstone break through

So, given all of that what are the big elephants in the room left for the project? From a mining point of view they are clear – getting through the Sherwood Sandstone and coming up with a final lateral mining plan for when the polyhalite is reached, including mining approach and fleet commitment and implementing as much autonomy as possible.

The Sherwood Sandstone, which Anglo American will encounter next year, varies from 250-300 m in depth. Its competency and 120 MPa hardness will see sinking rates reduced from the current 1 m a day to something between 0.5 m and 0.75 m a day and this will impact Woodsmith for most of next year and early 2025. So it is no walk in the park compared to the relatively soft Redcar Mudstone that is being sunk through (and tunnelled through) today. But to put things in perspective, ICL Boulby already went through this horizon to sink its 1,150 m shafts many decades ago in the late 1960s/early 1970s using conventional shaft sinking with ground freezing and grouting so there is no reason to think Anglo will have any issues given the technology it has at its disposal.

Plus Anglo American already has some experience on its side, having hit a 2.5 m layer of the material in October 2023, bringing valuable learnings from this that it needs to make some adjustments to the cutter heads and cutting picks, and now it is far more prepared than it would have been otherwise.

Johnson said at the visit that it has four contingency plans in place – the main one being looking at a different pick geometry on the SBR cutter head combined with Generation 2 Element Six (owned by Anglo American sister company De Beers) PCD picks. Test work is already well advanced at locations in France and Germany with input from Redpath Deilmann, Element Six and Herrenknecht. Other options include potential use of lasers, plasma blasting and/or microwaves if needed, and in a worst case scenario the SBRs could be raised up enough using the support cables to carry on with drill and blast if required.

In addition to its hardness, the sandstone has a risk of high-water flows in small sections so there will be a need to seal the shaft via grout from the shaft. This means as the sinking comes across water, Redpath Deilmann will inject chemical grout into the fractures to block water bearing cavities and control water inflow.

Deciding on final mining approach

The other main challenge is coming up with a viable plan for the lateral polyhalite mining itself. Not much has been said publicly of the actual mining plan. IM got some insight from this from Anglo American Crop Nutrients CEO, Tom McCulley, on the visit.

The obvious choice you might think for a mine that is aiming eventually at 13 Mt/y is a fleet of large borer miners – that is what most of the large potash mines in Saskatchewan use, as well as the big Russian mines like Uralkali (including its Silvinit operation) and Eurochem’s Usolskiy. BHP went as far as to co-develop a new super large MF460 full face borer miner with Sandvik for Jansen. Then there is soft rock longwall mining in the fertiliser minerals industry – used for example by Belaruskali as well as some of the trona mines in Wyoming.

However, McCulley stated that due to polyhalite having a higher hardness than typical carnallite potash ore, that the plan at Woodsmith, as it was dating back to plans drawn up during Sirius ownership of the project, is to use large continuous miners with room and pillar mining.

Notably there is no lateral development required to get to the polyhalite at Woodsmith – it will be straight into ore. McCulley said on initial mining that it is also looking at several options. One is to start with one or two years of roadheader mining then transition to larger scale CM mining. And it may be more efficient to use a contractor for this initial production phase.

Woodsmith will use a suite of continuous miners for room and pillar mining, one possibility being Komatsu’s 12HM46

Anglo American is now working very closely and in partnership with its main existing contractors STRABAG, Worley and Redpath Deilmann, emphasising the importance of its one project, one team approach. This basically means everyone is focused on solutions to problems without placing blame. Focusing on solutions creates an open and physiologically safe workplace, meaning the project becomes a place where people like to work. Clear goals, objectives and priorities are set which all parties align to together – there are no top-down mandates or owner mandates.

To achieve final planned production levels you are looking at a large fleet of CMs and possibly customised larger capacity CM models – which McCulley said was an option, though of course anything not from an existing range would require added development time and cost.

ICL Boulby uses mainly the Joy (Komatsu) 12HM36 CM which was developed for industrial minerals mining – these have been deployed with shuttle cars and are proven in the same material. There is another Komatsu industrial minerals-focused machine above this in size and power, the 12HM46, which was introduced in 2021 and has a 3,500-6,000 mm cutting height, and a cutting width of up to 4,572 mm. ICL Boulby has one of these running. For comparison, ICL Boulby currently operates four continuous miners within its polyhalite operations. Typically, three CMs are operational and producing at any one time whilst one is undergoing maintenance and repairs. Aside from the Komatsu machines, the only other real option is Sandvik’s MC470 which is also aimed at salt and potash operations – it has a 2,800-5,000 mm cutting height and 3,800 mm cutting width.

At the scale of the Woodsmith operation McCulley says it will need a suite of large continuous miners – right from the initial 5 Mt/y mining rate. On CMs themselves, Anglo is well experienced in their use in coal for development of its longwall metcoal operations in Australia such as Grosvenor, Aquila, Grasstree and Moranbah North. The continuous miners would likely be deployed with flexible conveyors, for more uninterrupted operation. Again, Anglo already has some experience of this technology through trialling of Sandvik’s PM100F flexible haulage system at its Twickenham platinum operation in South Africa.

On the final mining plan, McCulley said he and Johnson will be making a decision on the way forward together with its main mining engineering teams in Brisbane in the next few months, part of an overall finalisation of remaining project engineering and related costs. What was also clear, is that McCulley is looking for the greatest degree of automation possible, and with CMs this is entirely feasible using existing technology – many CMs are already operated remotely anyway.