At the MINEXCHANGE SME conference in February 2024 in Phoenix, Wenco International Mining Systems’ President and CEO, Andrew Pyne, presented on open autonomy. He began by suggesting that it may not be business as usual for AHS in the medium to long term.

“What we’ve seen in mining, is that the adoption of autonomy in more complex environments – that aren’t the Pilbara in Western Australia – is starting to stagnate. We are starting to see fleets being decommissioned and we are seeing some real adoption challenges. We are also seeing some really interesting evolutions in the early adopters of autonomy – companies like Fortescue changing direction on how they are going to deploy autonomy. Rio Tinto approached Wenco more than five years ago and today we are engaged with them on their right-sized autonomous truck project. As we see the emergence of new technology in the area of automation – along with the requirements for carbon emissions targets – the premise that bigger is better in the haulage fleet is really being challenged.”

He added that while Wenco is working directly with Rio Tinto, it knows other major miners are also adopting or evaluating the adoption of this capability. “We are looking at a future where you will have mixed fleets of larger haul trucks but also smaller haul trucks as well.”

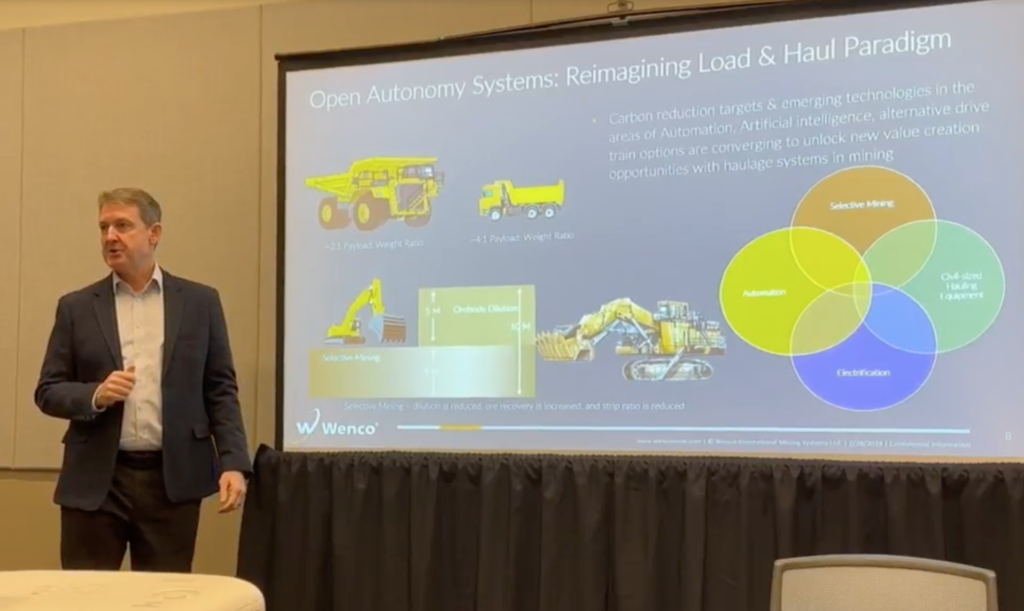

Pyne argues that the mining industry is facing challenging market dynamics – ESG obligations and ambitions, workforce constraints, access to capital and marrying increased costs with pressure to up productivity. “Innovation in the mining business model is not optional. Emerging technologies are addressing challenges so that miners can plan in advance and accelerate operational benefit. Open autonomy is a keystone in innovation and an industry-based initiative focusing on creating new value-based haulage models. Open autonomy systems and a convergence with electrification initiatives are enabling a growing trend in mining toward the use of smaller, more versatile autonomous haul trucks to tackle mining challenges.”

Wenco is a leading global fleet management system company with fast growing fatigue management, open autonomy, machine guidance and asset health management technologies. It has been a wholly owned subsidiary of Hitachi CM since 2009 – and today has about 100 customers using its Wencomine FMS – “some of those customers are saying they want to adopt autonomy but in the current domain of how autonomy is deployed, that means we would have to stop using your FMS, and we really don’t want to do that, so they asked us what we were going to do about it. Innovation happens when there is a crisis – and our crisis was that our customers were telling us – this trend towards automation in the current way in which it is being delivered by Caterpillar and Komatsu – means that we will have to stop using your technology. And we had customers sharing some of the limitations of the established automation solutions. What Caterpillar and Komatsu have done in autonomy is very valuable. So, we are focused on where there is additional value that the industry can gain through the emergence of a new generation of technology providers.”

But what is Wenco’s definition of open autonomy? “It is a term that one of our engineers came up with in 2018. It is a contrast to an OEM-based closed stack solution coming from Caterpillar and Komatsu. So, in that generation of technologies, if you wanted to go autonomous as a miner, that meant you were effectively committing yourself to one OEM and – all the truck fleet are one make, all the technology stack comes from the OEM and all the IT/OT integrations are locked to what the OEM decides. You can’t have a mixed fleet – and in many cases it would mean you would have to buy new trucks that you hadn’t planned to. The change management, adoption and capital cost are all significant. Those companies had built very integrated, tightly coupled systems where all the key building blocks – trucks, situational awareness, autonomous driver, traffic management and FMS, were from one vendor. Very monolithic – but it delivered a value – no question. But the locked value of a single OEM approach and commitment does not represent what the market now is looking to invest in.”

He continued: “We are not a truck OEM – while we are owned by Hitachi Construction Machinery, we operate quite independently from them in the way we do business. When we embarked on the task of contributing to an Open Autonomy framework, we started by defining what are the logical separation points between the various technology pieces that make up the system. You can have the truck, perception tech and drive by wire from one supplier, for example, then the different implementation and integration services from another, and the FMS and traffic management from another.”

Pyne said that it was clear this had to be an industry led initiative and since it started on this path, one of Wenco’s engineers has taken a leading role in a workgroup to define and establish a new ISO standard – ISO 23725: Autonomous System and Fleet Management System Interoperability. And this standard Application Programming Interface (API) is readily available for anyone that wants to use it. “There is now a growing number of companies that we have been engaging with that reinforces the industry need for open systems approach. Wenco understands that the ISO standard is expected to be published by end 2024. And this approach creates the opportunity for new entrants, not deters them.” Hideshi Fukumoto, Hitachi CM CTO summed it up well in 2019: “We believe that if you have an open approach, and help new entrants integrate with customer operations, you won’t get new competitors, you’ll get new partners – and together we will be able to provide better autonomy solutions to customers.”

Enabling this paradigm evolution, Pyne said, requires three things from miners – establishing the open architecture/protocols; proving a commercially ready and available solution; and influencing the OEMs to adhere to the protocols through demand side pressure – or living with reverse engineered drive by wire solutions. But the key benefits are significant – open systems enable new innovations to be deployed to capture incremental value from traditional Level 4 OEM autonomy. It also provides further cost reduction and productivity increase outcomes. Furthermore, it accelerates the ESG drivers for miners through emissions reduction by using electric drives, trolley systems, battery powered and smaller payload trucks.

Back to this truck sizing question – what is the right size for autonomous trucks? Pyne: “Taking the three big Pilbara players as an example, they all have the same issues – they have a lot of big mines, they’re mining 100s of millions of tonnes of iron ore each year, plus a lot of rail and overland conveying and crushing infrastructure. Rio Tinto is producing over 300 Mt a year alone – so a lot of mineral resources need to be replaced on an annual basis – if you are opening up new mines many 10s of kilometres away from existing operations and infrastructure – what are your options? Rail and overland conveyors come at a huge cost. But if you have a high speed, Level 5, autonomous and electrified truck option, that precludes the need for that expensive infrastructure.” Pyne said he had had similar conversations with a mining client in Chile where it had identified potential deposits that were currently not economic with existing scenarios, but with these smaller flexible trucks, they could be.

Smaller trucks also come with other financial benefits such as payload to weight ratio. With a large rigid 200 t truck, for every one tonne of steel you can only carry two tonnes of payload, plus it requires a significant amount of diesel for material haulage. For a smaller 40 to 50 t truck, the ratio works out to be one tonne of steel for four tonnes of payload. Smaller trucks can support more selective mining facilitated by new technologies – with reduced dilution and strip ratio and increased ore recovery. Smaller trucks also allow for narrower haul roads and higher speed longer hauls. With more trucks it also means your production is less affected by breakdowns. On the electrification front, it is still going to be some years until large battery trucks achieve the required productivity in a full fleet sense – with smaller trucks it is likely going to be a reality within the next few years.

Pyne then reviewed some of Wenco’s existing projects. Rio Tinto have been quite open they are testing lower profile 50 t Scania trucks at their sites. In this instance, AHS-FMS messages are integrated over the cloud, so Scania can deliver AHS within the cloud based on a combination of sensors but requiring less real time connectivity. Staffed Digging Units are equipped with Wenco High Precision Guidance to spot autonomous trucks. This right-sized autonomous truck project is a collaboration between Rio Tinto, Scania and Wenco that joins together a team of over 300 engineers.

Wenco is part of Rio Tinto’s right-sized autonomous truck project along with Scania

Pyne said whilst there is still considerable work to be done, we aren’t too far from reaching estimated the required technology readiness level (TRL) to support deployments.

At Roy Hill, Wenco’s FMS and Open Autonomy service adopted by ASI Mining’s Mobius platform has established the interoperability demanded for mixed HME equipment fleet in autonomous operations. Well documented by IM in several articles, this is a mixed Cat and Hitachi fleet and will soon have 96 autonomous trucks running – though these are larger rigid mining trucks.

Pyne concluded: “A number of big miners have now done the sums and are looking to adopt both open autonomy and smaller trucks where they make sense. In some cases, they are also investing in us to help accelerate delivery and be able to support this. And of course, underlying a lot of it are the carbon emissions reduction targets they have committed to, where smaller battery trucks will get them there sooner.” Our company vision is ‘reshaping the future of mining’ and with the right partners from the technology sector and collaborative innovative miners, we are on the right path to achieving that.”