In a wide ranging presentation forming part of its just completed 2024 Chilean copper site tour, BHP provided a comprehensive insight into how it intends to continue delivering copper growth at its operations, including its flagship Escondida operation, via a series of pathways.

Escondida like a number of other long life copper mines is facing grade decline and increased ore hardness. But it remains the world’s largest copper operation. It has been in production since 1990, with a remaining mine life of 65+ years and a Resource of 26 billion tonnes at 0.53% copper. Ore is extracted from two open pits – Escondida and Escondida Norte.

Major investments in the mine have included a focus on water and energy efficiency. Some US$4 billon has been invested in desalinated water supply for BHP’s mines in Chile over last 15 years, including for Escondida; and Escondida’s concentrators have operated exclusively with desalinated water since January 2020. Plus BHP’s mines in Chile have been using 100% renewable power since January 2022 via Power Purchase Agreements. The Energy and Fresh Water Sustainability Program at Escondida also uses digital innovation to collect data in real time to manage and control water and energy consumption. The reductions in consumption delivered are significant – 3.5 gigalitres of water since FY22 and 118 GWh of electricity since FY22.

The broad long term timeline for Escondida moving into the 2030s will see an initial production decline as the ageing Los Colorados concentrator (96,000 t/d) is demolished, followed by a production increase as a new concentrator ramps up and high-grade ore from PL2 is accessed. BHP Leach application on ripios will also begin to contribute. In the near term, BHP is looking to extend the life of Los Colorados with timing optionality and also make expansions at the Laguna Seca concentrators (LS1 currently handles 130,000 t/d and LS2 147,000 t/d).

A major focus is increasing mining intensity to support the long term growth of concentrator capacity. The current Escondida ex-pit mine movement is ~400 Mt/y. Some 170 Mt/y of this 400 Mt/y is ore, of which 134 Mt/y goes to the concentrators, with an average grade 0.82% Cu ‒ while 36 Mt/y to sulphide leach, with an average grade of 0.42% Cu. Key changes in mine design, a fleet upgrade and productivity initiatives could enable increase this to >500 Mt/y. There is also potential for a new open pit in Pinta Verde to exploit oxide leach latent capacity.

Moves could include larger pushbacks, more access ramps, a change in pit wall angle plus more and larger trucks (the new ultraclass fleet potentially increasing to around 190), and larger shovels – the mine is already one of the first users of Komatsu’s P&H 4800 XPC so more shovels at this scale are likely to be deployed.

Current mining equipment and fixed infrastructure at Escondida totals 188 trucks plus 18 electric shovels then about 65 ancillary equipment units. There are four primary crushers and a conveyance system for transport to concentrators plus one primary crusher and a conveyance system for the leaching route ie cathodes. A full fleet replacement is underway to the previously announced new Caterpillar diesel-electric 400 ton class 798 AC truck fleet which will help unlock additional capacity and enable transition to autonomous operations. This was discussed by IM Editorial Director Paul Moore with BHP’s Vice President Technology, Minerals Americas, Pedro Hidalgo, at the EXPONOR show in Antofagasta earlier this year, along with its autonomy progress at Spence, where a total of 33 Komatsu 980E trucks were successfully automated by March 2024.

IM Editorial Director Paul Moore with Pedro Hidalgo, BHP VP Technology, Minerals Americas, at EXPONOR 2024

All the autonomous trucks are currently operating in an autonomous zone in Escondida Norte – to date 15 out of a fleet of 36 Caterpillar 798 AC trucks (see lead image) with all 36 there expected to be running autonomously by July 2025. The total conversion of 141 trucks is expected by FY30 (with 52 trucks converted and operating at Escondida Norte by FY27). BHP says the main achievements during the eight months of operation so far include zero safety events and over 17 Mt of waste movement. Autonomous drilling (Epiroc Pit Vipers using the OEM automation system) is also progressing aligned to plan (20% to date) with zero safety incidents during deployment.

On to the processing plants themselves. BHP has identified 40,000 t/d latent capacity in the Laguna Seca concentrators due to the impact of hardness on balls mills and flotation circuits. So one option for additional production is to prepare Laguna Seca for the hardness increase by utilising new technologies to increase recovery. The plan is to deploy a new third line with another SAG mill to deliver the additional 40,000 t/d (~15 Mt/y above the current 100 Mt/y) of throughput ‒ but combining this with large mechanical cells and an Eriez Hydrofloat coarse particle flotation (CPF) plant to improve recovery by ~1-4 ppt from 85% in FY24. This move at Laguna Seca represents capital efficient expansion and requires minimal incremental ongoing operating costs. A final investment decision (FID) will be made CY27/28.

This latest capacity will also align with plans for Los Colorados. There is the option to extend the life of the Los Colorados plant beyond FY27 to FY29 (FID CY25/26) with an optionality to FY31. This would deliver an incremental 130-145,000 t/y copper production without the need for a new environmental permit. Once it is demolished, it will enable access to key mine pushbacks as it is underlain by high grade ore. This plant will be replaced by an all new concentrator (FID CY27/28) with a 125,000 t/d (45 Mt/y) capacity. This will include a traditional comminution circuit with SAG mill, pebble crushing and ball milling (SABC) for more flexibility ‒ but as at Laguna Seca will use innovative industry-proven technologies in flotation – large mechanical cells and Eriez Hydrofloat coarse particle flotation (CPF).

How the new concentrator to replace Los Colorados might look

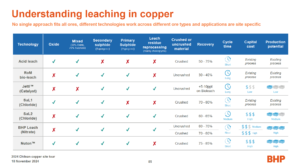

Finally to leaching – which has the advantage of no tailings plus lower water and energy consumption. It produces cathode (so no smelting) and can operate in parallel with the concentrator. It is also another way to economically treat low grade ores and coarse material. BHP is assessing multiple opportunities for Escondida, including a new oxide leach pad, leach residue reprocessing (ripios), a sulphide leach run-of-mine pad along with other new sulphide pads. BHP is actively trialling a wide range of technologies, across both BHP and third-parties as well as partnership technologies.

It already has 20+ years of development and delivery of new leaching technologies and has a competitive advantage in having the BHP Innovation Leaching Facility at Escondida, which covers the full innovation chain. Here there is a demonstrated track record with bio-leach, chloride leach and nitrate leach technologies. It has pilot scale testing with scale-up across a range of column sizes (1 m to 10 m high). Variability testing and process improvement work is currently underway.

BHP is looking at a variety of current and new leaching technologies for Escondida

Current Escondida cathode production is about 200,000 t/y with a latent capacity of about 100 t/y expected to grow as oxide ore depletes. There is the opportunity to leverage water and renewable power supply to site plus the scale and breadth presents several locations for deployment of existing and new leaching technologies. There is also the potential to enhance synergies between concentrator and leaching.

Looking at the options – chloride leaching (Full SaL) improves recovery and enables new crushed material (mixed ore and secondary sulphide) to be processed on the oxide leach pad. Jetti Catalyst can improve recovery at the existing sulphide leach pad by ~5-10 ppt. Then BHP’s own BHP Leach patented nitrate leaching has the potential to recover additional copper from ~20 years of leach residues (ripios) plus process sulphide ROM at higher recoveries and shorter cycle times than the current bioleach process. BHP also has optionality through Nuton leaching technology.

In more detail, the Escondida BHP Leach ripios application (FID CY27/28) will turn otherwise leached ore back into usable material. It offers shorter leaching cycle times (-55% vs. conventional leaching) for processing as well as recovery benefits (~50% additional recovery on the remaining copper that can now be leached). BHP says the ripios application is a fast option for large-scale implementation and shows potential for a higher IRR versus processing ore ‒ a demonstration plant is under construction and will prove the technology on run-of-mine material at scale. Initial results are planned late CY25 that will bring data on copper recovery, reagent consumption and gas management. Cycle times will be ~250-350 days, with recoveries of ~60-70%.