A proposed new Northern Territory open-pit tungsten mine would deliver a net outcome of more than A$100 million over its seven year life and potentially could expand underground, a new economic study has found. The mine would generate more than A$500 million in revenue on known mining reserves and an IRR of 59% and deliver its owners an early payback of under 18 months from first production.

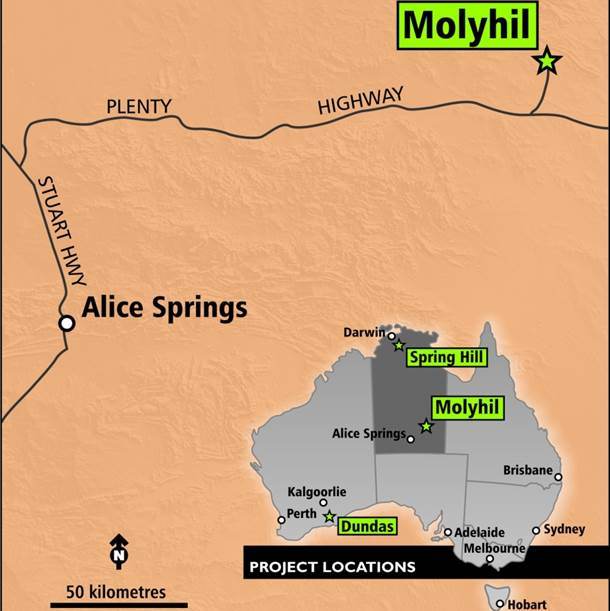

The new economic findings announced today are from an enhanced DFS into the proposed A$69 million Molyhil open-pit tungsten mine, 220 km northeast of Alice Springs. Molyhil has an open-pit probable ore reserve of 3.5 Mt @ 0.29%WO₃ and 0.12% Mo and is 100%-owned by Adelaide-based Thor Mining Plc.

The findings are a major boost for the project. Tungsten is considered a strategic metal by the US, China and the European Union and was confirmed this year by the US Department of the Interior as a ‘critical commodity’.

Prices for the commodity have been on the rise since January 2016 and with this new report, and subject to final approvals and financing, could see first tungsten and molybdenum concentrate produced from Molyhil as early as 2020.

Tungsten’s unique properties include its high melting point, hardness and tensile strength. It has few substitutes and is used in the manufacture of hard metals, steels, alloys and mill products.

Thor Executive Chairman, Mick Billing, said the enhanced attractive returns and early payback at Molyhil resulted from process improvements and longer operating life at the open-pit.

“There is further significant upside at Molyhil from expanding into potential underground mining and open-pit mining the nearby Bonya tungsten deposits, 30 km east of Molyhil,” he said.

“Strategically, the results of the enhanced DFS are based only on Molyhil’s known mining inventory and do not include the additional upside of either potentially going underground or mining Bonya.

“Molyhil will be a very low cost tungsten producer on a global scale. The upgraded NPV in excess of A$100 million demonstrates the substantial value this project holds for the company.”

Billing said the new findings were the results of years of detailed work at Molyhil, but provided further confidence in Thor’s ongoing engagement with third parties which have expressed a specific interest in the project’s funding and offtake opportunities. He described Molyhil as a ‘construction ready’ project.

“Subject to the submission of an acceptable Mining Management Plan once project level mine construction financing is confirmed, the 12-month mine construction schedule can commence. We are targeting first production by early in 2020.”

Other highlights of the new report include:

- EBITDA of A$245 million

- Total capital expenditure of A$69 million including a project finance requirement of A$58 million

- The remaining ~A$11 million in capital finance (for mining fleet, power generation equipment, mining camp etc. over which mortgages can be exercised) can be funded via asset finance

- Simple open-pit mining operation and conventional mineral processing techniques

- Very high tungsten grades in the first two years of open-pit mining

- Production cost of US$90/metric ton unit (mtu)

The project will operate as a fly-in fly-out operation.

Thor has already received environmental approval from the Northern Territory’s EPA for the project to proceed and also has agreements with traditional owners.

Billing said the next steps for the project would involve securing the balance of concentrate sales (off-take) agreements and financing project development.

“After that, it is planned to commence detailed engineering studies, along with completion of the Mine Management Plan and onsite civil works in preparation for mine and process plant construction and development.”

Thor has a non-binding Memorandum of Understanding with Pennsylvania-based Global Tungsten & Powders for between 70% and 75% of Molyhil’s tungsten offtake.

The mine is anticipated to return an average feed grade after ore sorting of 0.48% WO₃ and 0.20% Mo at a crushing and sorting rate of 531,000 t/y to produce an annual production average of 125,000 mtu or about 1.2% of the current global market for tungsten. (1 mtu = 10 kg of contained WO₃).