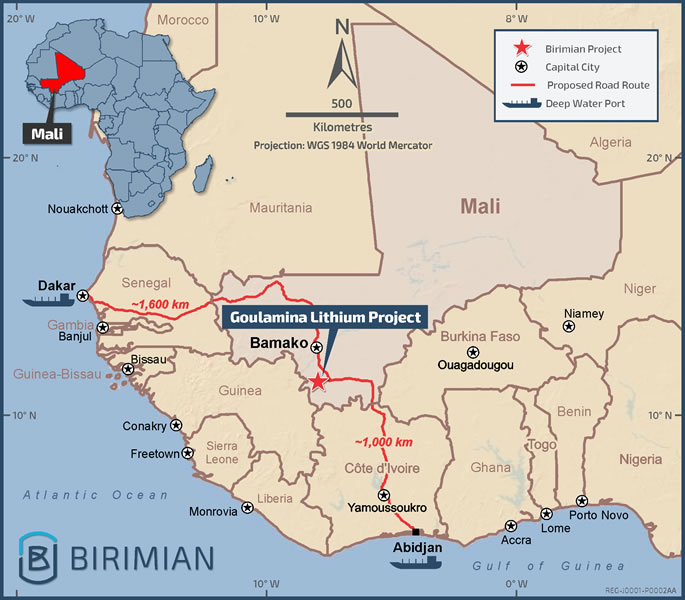

Both Birimian Ltd, lithium in Mali (see map), and Battery Minerals, a second graphite mine in Mozambique, are hoping to bring their respective projects online in 2020.

Speaking on the third and final day of the three day Paydirt 2018 Africa Down Under mining conference in Perth, ASX-listed and Perth-based Birimian CEO, Greg Walker, said the company had adopted a five step schedule to get its 2 Mt/y,A$199 million Goulamina lithium project in southwest Mail into production in the next 19 months, subject to achievement of remaining key development milestones.

“We have made substantial progress with Goulamina this year but now need to complete environmental and mine approval processes, feasibility and definitive engineering studies, and secure suitable project financing,” Walker said.

“Binding offtake agreements also need to be finalised and signed and we have a well detailed construction, commissioning and production ramp-up schedule to insert this new Mali lithium mine into the global lithium supply chain,” he said.

“We are favoured by a very strong Mali Government which has a track record of facilitating and rapidly permitting mineral development projects so we are confident of meeting our March 2020 first production target.

“Goulamina is one of the world’s largest undeveloped high-grade lithium deposits and our updated PFS has produced very strong project metrics.

“The PFS has confirmed that Goulamina can be profitably developed as a large-scale, low cost, hard rock lithium mine with a 16-year operating life for total output of 362,000 t/y of 6% lithium oxide spodumene concentrate.

“Independent analysts have assigned a rating to Goulamina of the fifth lowest cost ex-mine gate hard rock lithium project worldwide so it sits at right end of the lithium mine cost curve.”

Walker said the equities market had been hard in recent months on lithium stocks but the project’s NPV had increased fivefold to sit currently at A$920 million, and its mineral resource remains open along strike and at depth. Goulamina’s inventory sits at 103.3 Mt at 1.34% Li2O.

He also said the project had enjoyed a substantial (666%) increase in the size of the deposit and value of the project in the past 20 months and despite the fact its projected output would represent 15% of current global lithium concentrate supply, this profile was yet to be reflected in the on- market value of the company.

Goulamina’s latest studies point to a C1 cash cost of $281/t and an all in sustaining cost of $319/t with a payback period once production commenced of only 2.6 years.

Meanwhile, a BFS for a graphite mine in Mozambique should be delivered next quarter according to its Australian developer, ASX-listed Battery Minerals Ltd. The focus on the second potential mine, Balama Central, comes as Battery moves through project financing negotiations for the remaining $38 million needed to bring its first Mozambique graphite mine, Montepuez, into mine completion and commissioning in 2020.

Earth and civil works on Montepuez are already well advanced with first concentrate exports expected to occur, at a target rate of 50,000 t/y concentrate graphite, within 12 months of finance completion.

Speaking at the conference, Managing Director, David Flanagan, said completion of the Balama Central feasibility study would allow the company to finalise its mining licence application for the project. It is a higher jumbo and large flake graphite opportunity, which will help it attract higher graphite basket prices.

The company earlier this year doubled the inventory at Balama Central to a total mineral resource of 32.9 Mt at 10.2% TGC for 3.36 Mt of graphite at 6.0% TGC cutoff.

A scoping study on Balama Central was completed in March this year with the company proceeding soon after to the BFS. “We expect these key study outcomes to be available next quarter which will help Battery Minerals springboard the project into our broader Mozambique graphite aspirations including becoming a two mine graphite producer over the near-term,” Flanagan said.

On Montepuez, Mr Flanagan said the onsite works had been ramped up in recent months including major siteworks, the accommodation camp and installation of processing plant. Battery Minerals has been able to enter contracts for long-lead time plant and equipment, with subsequent payments and plant delivery to site subject to finalisation of the current project funding negotiations.

“The development of two mines in Mozambique is on track. This will help ensure Battery Minerals is positioned to capitalise on the strong demand for graphite forecast to flow from the surge in lithium battery production.”