This report will be released in Q1 2019.Vanadium pentoxide prices averaged $24/lb in October, while European ferrovanadium prices reached over $118/kg V. Prices for the month averaged around $114/kg V. Prices are now at 13-year highs. In 2005, nominal prices reached over $120/kg ($155/kg in real terms).

Roskill’s new report will contain detailed analysis of the key factors underpinning the recent spikes in vanadium prices.

Price increases have been underpinned by several factors. On the demand side, Roskill forecasts steady growth in demand for vanadium in steel because of both volume growth in the market as well as an increasing intensity of use of vanadium. This intensity of use is likely to be accelerated through Chinese regulation. China’s new high-strength rebar standard (which will be enforced from November) is designed to limit the use of inferior steels in construction and will (if adequately enforced) see more production and consumption of vanadium-bearing rebar.

With demand set to increase – supply remains tight in the wake of some high-profile closures and shows little sign of easing. Chinese output remains below its 2015 peak and while some of the major Chinese producers will see 2018 output exceed 2017 levels, others have seen production curtailed by environmental inspections. Roskill’s updated report will assess the future of vanadium primary production, co-production and secondary production with a focus on how stone coal producers and new projects might take advantage of high prices in 2019 and beyond.

Roskill’s updated report provides a comprehensive overview of the vanadium market covering production, trade, consumption and prices. The report is complete with ten-year outlooks for supply, demand and prices and sold on an annual subscription basis with quarterly updates.

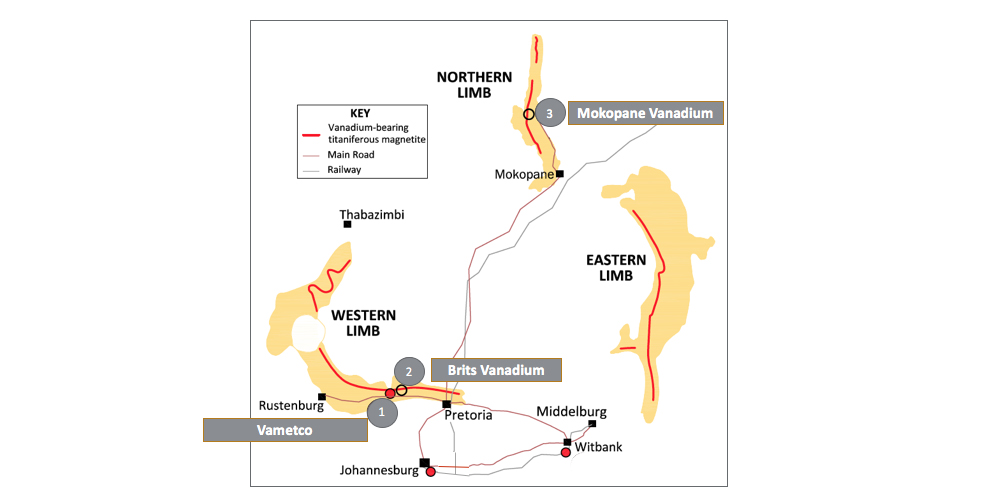

The map shows Bushveld Vanadium operations/projects in South Africa. Its vision is to grow into one of the world’s most significant, lowest cost and most vertically integrated companies comprising low cost primary vanadium production. It says “a primary vanadium platform means having one of largest high-grade primary vanadium resource base and the largest primary vanadium production in the world.

“Low cost means targeting the lowest cost position on the vanadium production cash cost curve, leveraging the high in-situ and in-magnetite V205 grades and the open-pit mining proposition of Bushveld Minerals’ deposits as well as access to low-cost brownfield processing infrastructure. The company’s vanadium assets are either positioned in the first quartile or show the potential for first or second quartile cost positioning. Vametco, the flagship asset is one of the lowest cost primary producers while enjoying some of the highest grades. The company’s strategy is for the assets to be in a position of generating cash in every phase of the commodity cycle.

“A vertically integrated primary vanadium platform means development of downstream operations beyond production of end-use vanadium products to also include development and deployment of vanadium applications in the energy storage market, where Bushveld intends to manufacture vanadium electrolyte and to assemble large-scale VRFBs.

Bushveld Vanadium comprises three key assets:

- Vametco mine & processing plant in Brits, North West Province. Vametco is a low cost primary vanadium mining and processing company with a 142.4 Mt resource. Vametco produces a trademark vanadium product, Nitrovan as well as modified vanadium oxide (MVO). Bushveld owns an effective controlling interest of 75%

- Brits vanadium project in Brits, North West Province. This is a strike extension of the Vametco mine. The company‘s interest in the asset ranges between 51% and 74%, through three different companies

- The Mokopane vanadium project in Limpopo Province comprises one of the world’s largest known primary vanadium resources with a 298 Mt JORC resource and high in-situ (1.4%) and in-concentrate (1.7%) V205 grades. The company owns an effective interest of 64% in the project.

Together, the three deposits constitute a minimum total of 439.6 Mt JORC resource base, including 55 Mt of JORC reserves. The resource vanadium grades include some of the highest primary grades in the world. These high-grade deposits are located on the Bushveld Complex, host to the world’s largest known primary vanadium resources. The company continues to search for and evaluate complementary brownfield processing facilities close in proximity to its current resources.

Bushveld Minerals intends to build its core processing capacity around brownfield processing infrastructure close in proximity to its primary vanadium resources. The attraction of brownfield processing facilities lies in the potential for significant reductions in capital expenditure and lead-time to achieve production.