Danakali Ltd notes the United Nation’s decision yesterday (Wednesday, 14 November 2018) to lift the arms embargo and targeted sanctions imposed on Eritrea since 23 December 2009. The company is developing the major Colluli potash project in that country and is therefore very pleased with the move. Although the project is already well advanced, this lifting of sanctions makes its development much easier.

Danakali Executive Chairman and Colluli Mining Share Co Director, Seamus Cornelius said: “Danakali is delighted with the UN’s decision to lift the arms embargo and associated sanctions on Eritrea. This significant step should have a positive impact on foreign investment and enhance international trade opportunities, leading to improved economic outcomes for the people of Eritrea. I offer my congratulations to the Eritrean people on this achievement and for their exceptional resilience and determination over many years.”

Danakali is an ASX- and LSE-listed potash company focused on the development of Colluli. The project is 100% owned by the Colluli Mining Share Co (CMSC), a 50:50 joint venture between Danakali and the Eritrean National Mining Corp (ENAMCO).

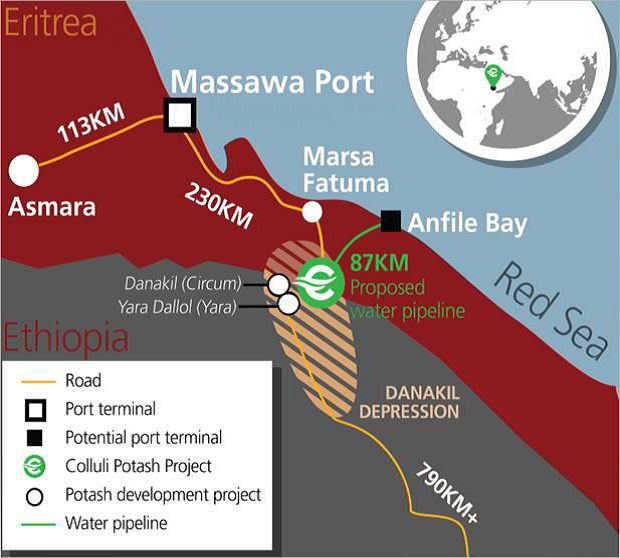

It is located in the Danakil Depression region of Eritrea and is ~75 km from the Red Sea coast, making it one of the most accessible potash deposits globally. Mineralisation within the Colluli resource commences at just 16 m, making it the world’s shallowest known potash deposit. The resource is amenable to open pit mining, which allows higher overall resource recovery to be achieved, is generally safer than underground mining, and is highly advantageous for modular growth.

CMSC has completed a FEED for the production of potassium sulphate, otherwise known as SOP. SOP is a chloride free, specialty fertiliser which carries a substantial price premium relative to the more common potash type; potassium chloride (or MOP). Economic resources for production of SOP are geologically scarce. The unique composition of the Colluli resource favours low energy input, high potassium yield conversion to SOP using commercially proven technology. One of the key advantages of the resource is that the salts are present in solid form (in contrast with production of SOP from brines) which reduces infrastructure costs and substantially reduces the time required to achieve full production capacity.

The resource is favourably positioned to supply the world’s fastest growing markets. A binding take-or-pay offtake agreement has been confirmed with EuroChem Trading for up to 100% (minimum 87%) of Colluli Module I SOP production.

The Company’s aim is to bring Colluli into production using the principles of risk management, resource utilisation and modularity, using the starting module (Module I) as a growth platform to develop the resource to its full potential.

Colluli has a JORC-2012 compliant Measured, Indicated and Inferred Mineral Resource estimate of 1,289 Mt @ 11% K20 Equiv. and 7% Kieserite. The Mineral Resource contains 303 Mt @ 11% K20 Equiv. and 6% Kieserite of Measured Resource, 951 Mt @ 11% K20 Equiv. and 7% Kieserite of Indicated Resource and 35 Mt @ 10% K20 Equiv. and 9% Kieserite of Inferred Resource.