South African chrome and PGMs miner Tharisa is gearing up for its Karo open pit platinum mining project in Zimbabwe. The company now owns 70% of Karo Mining Holdings, with 30% held by Leto Settlement. Karo Mining Holdings fully owned subsidiary Karo Zimbabwe Holdings in turn owns 85% of Karo Platinum, the operating company, with 15% held by the Government of Zimbabwe via Generation Minerals, its SPV.

Karo is currently set to have an annual PGM production of 194,000 oz (6E – platinum, palladium, rhodium, ruthenium, osmium and gold), and a mine life of 17 years and will add further to the fairly exclusive list of open pit platinum producers in southern Africa which includes Tharisa’s namesake mine, Anglo American’s Mogalakwena and SPM’s Pilanesberg Platinum Mines, all in South Africa. Currently all the major platinum mines in Zimbabwe are underground, including Ngezi, Unki and Mimosa.

“Developing a tier one project in this unique geological setting comes once in a lifetime,” said Bernard Pryor, MD Karo Mining Holdings in a recent investor presentation on the project, which has seen over $70 million of investment to date but will ultimately cost over $390 million. The project is located on the Great Dyke, south of the Zimplats Selous Metallurgical Plant and north of the Zimplats Ngezi underground operations. It is in the Mashonaland West district of Zimbabwe, approximately 80 km southwest of Harare and 35 km southeast of Chegutu.

Development will take 24 months of a low risk, fully licenced open pit. Phoevos Pouroulis, CEO of Tharisa, commented in the company’s FY22 results ending September 30: “We have advanced our position in Karo Platinum, which is on track to become the second world-class asset in our portfolio. The next major milestone is ‘ground-breaking’ at the Karo site in December 2022, as this PGM asset moves into the construction phase, with inaugural production planned for within the next 24 months.”

First Ore In Mill (FOIM) is scheduled for July 2024. The mining plan will target mining 2.1 Mt/y of run of mine material for the Phase 1 operations, at a grade of 3 g/t (5PGE+Au). The mining operations will be undertaken by a mining contractor, which has already been appointed but not yet named. An owner’s mineral resource management team will be in place for oversight of the mining operations and grade control. The mining operations will see the development of four open pits being developed sequentially, up to a maximum pit depth of 100 m over a total strike length greater than 20 km.

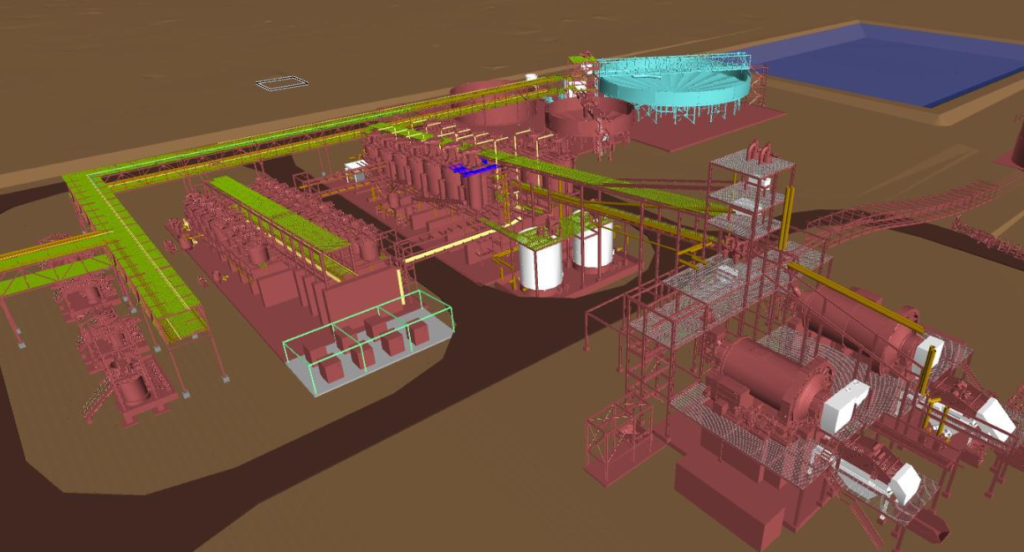

The processing of the ROM will be through an MF2 PGM flotation circuit, processing 175,000 t/mth of ROM. The average annual production of PGMs in concentrate will be 150 kozpa (5PGE+Au). The processing plant has been designed using proven technology and beneficiation processes. Primary crushing will reduce ROM to F80 -120 mm followed by secondary (F80 -40 mm) and tertiary (F80 -15 mm) cone crushing following by primary ball milling to F60 -75 micron followed by a bank of six primary rougher flotation cells and three high grade cleaner stages, thickening and filtration using a tower press filtration. Primary rougher flotation tails go to secondary ball milling (F80 -75 micron) then a bank of six secondary rougher cells and two low grade cleaner stages prior to the thickening and filtration. The long lead time items – including the two ball mills and the flotation cells have already been ordered.