Metso Outotec says it will deliver thickeners for a nickel laterite hydrometallurgy project owned by China’s Ningbo Lygend Resources Technology Ltd on Ono island in Indonesia.

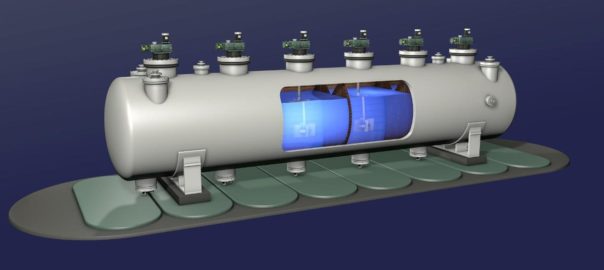

The order covers 25 state-of-the-art thickener units for its nickel laterite HPAL (High Pressure Acid Leaching) project, the OEM says.

Metso Outotec’s scope of delivery includes several Planet Positive thickening products, including High Rate, High Compression, and Paste Thickening technologies equipped with ReactorwellTM feed system where applicable, it added.

“Ningbo Lygend produces high quality MHP (Mixed Hydroxide Precipitation) raw material for battery production in Indonesia,” Paul Sohlberg, Senior Vice President, Minerals Separation, Metso Outotec, said. “They chose Metso Outotec thickeners for their project, thanks to our sustainable, state-of-the-art technology combined with our good understanding and references of similar process plants. The Metso Outotec thickeners enable optimised production and high recovery rates.”

Metso Outotec says it is a global leader in the design, fabrication and supply of thickening and clarifying solutions and related services for the mining industry and has delivered over 2,400 thickeners to its customers worldwide.

The Ningbo Lygend Resources order strengthens the company’s position in nickel laterite HPAL applications, it added.