Alamos Gold has become the latest company to add Cat R2900 XE diesel-electric loaders to its fleet, with the Canada-based miner reporting in its latest quarterly results that the LHDs have contributed to a significant increase in mining rates at the Young-Davidson mine in Ontario.

The R2900 XE features a switch reluctance electric drive system alongside a Cat C15 diesel engine, which offers up to 335 kW of power. Caterpillar says the machine comes with about 30% increased fuel efficiency compared with the R2900G, with its lower engine revolutions per minute resulting in reduced fuel burn, heat, noise, vibration and exhaust emissions.

Since being launched in 2023, these loaders have had significant market uptake – thanks to these traits, as well as the increased payload benefits they offer over the diesel-only equivalent.

In Australia, Gold Fields, MMG and WestGold now have units on their books. In Egypt, Centamin’s Sukari underground gold mine also has R2900 XEs within its fleet. Other loaders have also made their way to Africa, with the first two of a nine-strong fleet having already arrived at the Newmont-owned Subika underground mine in Ghana.

Alamos Gold is the latest company to joint this list.

In its June quarter results, the company said its Young-Davidson mine had been positively impacted by the arrival of two of these machines.

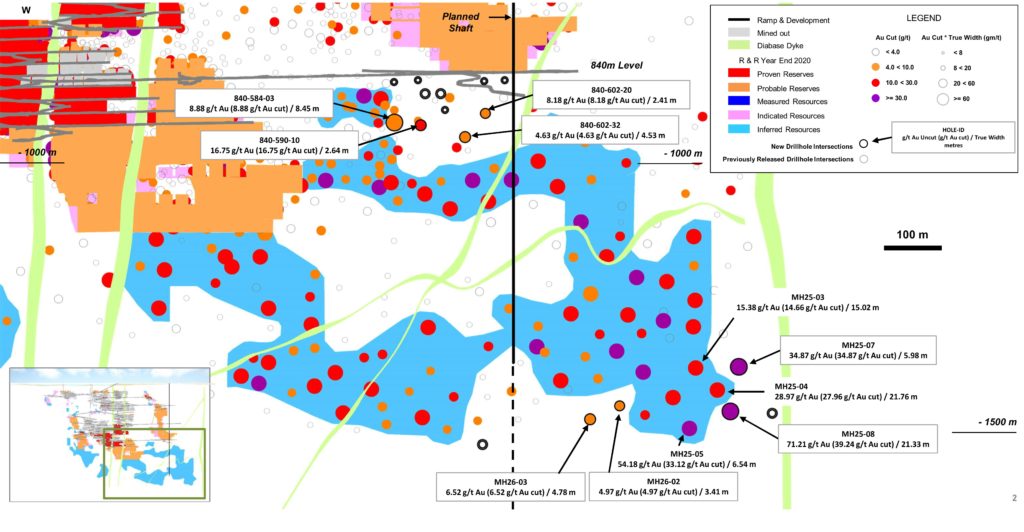

Young-Davidson is accessed via two shafts and a ramp system to a depth of 1,500 m. The operation uses large modern equipment, high productivity bulk mining methods (long hole open stoping) and paste backfill. LHDs load, haul and transfer stope production to the ore pass system from where it is hoisted to the surface with minimal ore and waste re-handling. A multi-year expansion of Young-Davidson was completed July 2020 with the transition to newly constructed lower mine infrastructure which is larger, highly automated and more productive. The lower mine infrastructure is designed to operate at 8,000 t/d and replaces the mid-mine infrastructure which was designed for 6,000 t/d.

In the three-month period ended June 30, Young-Davidson produced 44,000 oz of gold, 10% higher than the March quarter and slightly lower than the prior year period. Underground mining rates averaged 7,885 t/d in this quarter, a significant increase from the March quarter, reflecting the delivery of these new “hybrid production scoops” and temporary downtime during the previous quarter to replace the head ropes in the Northgate shaft, Alamos noted.

The new loaders have replaced two R2900G XTRA loaders and one R1700 loader, the company told IM. The standard R2900G comes with a payload of 17.2 t, whereas the R1700 has a 15-t payload. The R2900 XE offers 18.5 t of payload. The gold miner said it was expecting this increased payload and power to boost the loader’s productivity by 101.6% (on a tonnes per hour basis) when compared with the R2900G.

Alamos also highlighted the reduction in emissions expected to be achieved with the new diesel-electric loaders, explaining that fuel consumption was estimated to come in 34% lower than the R2900G, with 54.9% lower CO2 emissions during “high idle”.

The gold miner said its Young-Davidson operation was planning to purchase one new Cat R2900 XE unit “every year” for the foreseeable future.