Horizonte Minerals says it has awarded all major and long-lead-time process plant equipment contracts for its flagship Araguaia nickel project in Brazil, with FLSmidth, Metso Outotec, Uvån Hagfors Teknologi AB (UHT) and Inteco Melting and Casting Technologies GMBH named as recipients.

Following completion of the competitive tender processes and detailed negotiations, the company has now secured equipment supply and technical support services for the balance of the Araguaia process flowsheet from these leading suppliers, it said. This is in line with the strategy employed for the award of the furnace contract to Hatch Ltd earlier this year.

“The successful completion of these contract awards is a significant de-risking event for the project,” it said. “Importantly it provides more certainty on costs for a material portion of the overall capital expenditure and builds confidence in the project schedule by gaining commitments for the delivery of key equipment on site in the timeframe required.”

To date, the company has awarded contracts totalling $293 million (including the $135 million of process equipment noted above) on budget and on time, according to CEO Jeremy Martin.

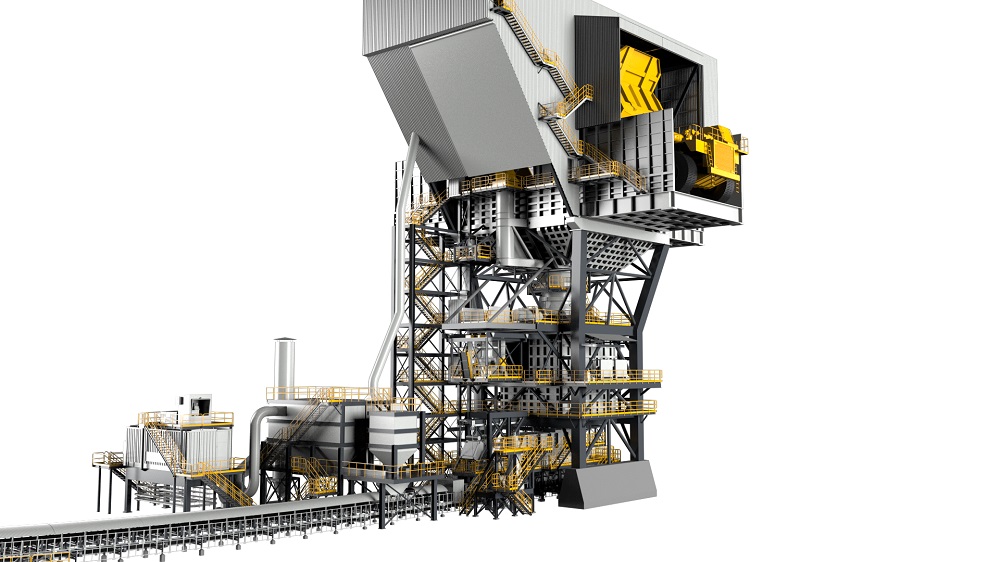

The rotary kiln, rotary dryer and associated dust handling equipment supply contract has been awarded to FLSmidth. FLSmidth, Horizonte says, is a market-leading supplier of engineering, equipment, and service solutions, particularly to the ferronickel industry, notably to Anglo American’s Barro Alto and Vale’s Onca Puma nickel operations in Brazil. FLSmidth has a strong track record of providing equipment and technical support services, with extensive experience in processing ore with characteristics similar to Araguaia, it said.

The ore preparation equipment contract involves the provision of primary, secondary and tertiary crushing, as well as the apron feeder that feeds the dryer. A primary dust control system for the reduction and refinery furnace, in addition to the secondary dust removal system, will also be supplied. This contract has been awarded to Metso Outotec, a leader in end-to-end solutions and services for the minerals processing and metals refining industries. Metso Outotec, Horizonte says, has extensive experience in providing equipment for the mining industry, including for operations worldwide with similar processing plants. It has a substantial presence in Brazil to provide ongoing technical support.

Horizonte has also awarded a contract for the supply of metal granulation equipment to UHT and a contract for the supply of the refinery equipment package to Inteco, which will transform the crude ferronickel produced by the electric arc furnace to high grade ferronickel for sale to customers.

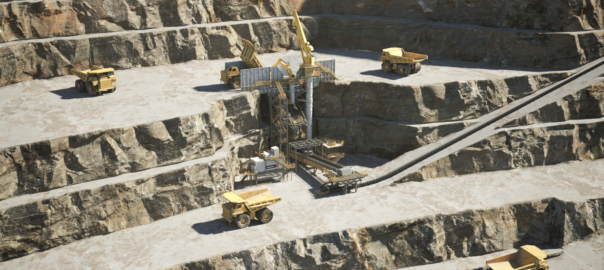

The Araguaia project comprises an open-pit nickel laterite mining operation that delivers ore from a number of pits to a central rotary kiln electric furnace (RKEF) metallurgical processing facility. The metallurgical process comprises a single line RKEF to extract FeNi from the ore. After an initial ramp-up period, the plant will reach a full capacity of approximately 900,000 t/y of dry ore feed to produce 52,000 t of ferronickel, in turn containing 14,500 t/y of nickel. The FeNi product will be transported by road to the port of Vila do Conde in the north of the state for sale to overseas customers.