A significant product launch in the in-pit crushing and conveying (IPCC) space was announced in parallel with the headline-grabbing co-operation agreement signed by Metso Outotec and FAM GmbH in June.

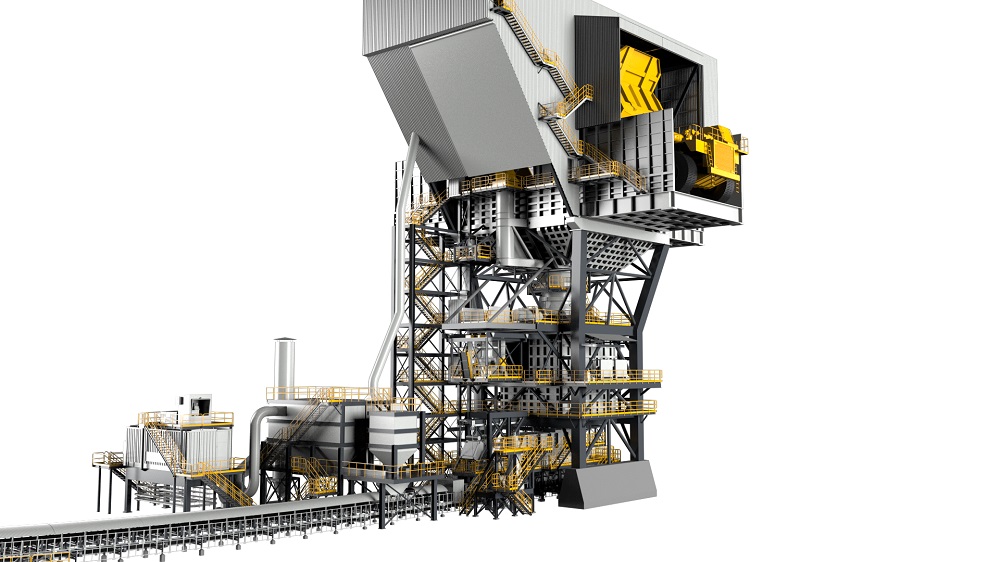

On the same day the two companies shook hands on a global non-exclusive pact to deliver integrated end-to-end solutions for IPCC and tailings management plants in mining, Metso Outotec, in a separate announcement, highlighted its Foresight™ semi-mobile primary gyratory (SMPG) station.

The SMPG station, which features the Superior™ MKIII primary gyratory crusher and patented SmartStation technology for “optimal processing”, is arguably the piece of the IPCC puzzle Metso Outotec has been missing.

Lokotrack® crushing plants have a solid reputation but only have capacities up to 3,000 t/h – one of the larger installations being a Lokotrack L200 at the Altay Polimetally copper operation in Kazakhstan. Such capacities work for most fully mobile IPCC installations, which tend to come with the highest complexity and are, therefore, a rare proposition, but semi-mobile hard-rock installations normally call for a much higher throughput.

This is where the SMPG station, with a maximum 15,000 t/h throughput capacity when equipped with the Superior MKIII PG 60110 primary gyratory crusher, fits the bill.

This station, when equipped with SmartStation technology, allows automated material size control and reduced wear, downtime and plant height, according to the company. It is also advertised as offering an up to 30% higher capacity on the same crusher size and 70% reduced downtime with the Superior MKIII primary gyratory technology, plus up to 30% power savings with patented Energy Saving Idlers. Maintainability is also boosted through improved crusher access and plant area isolation.

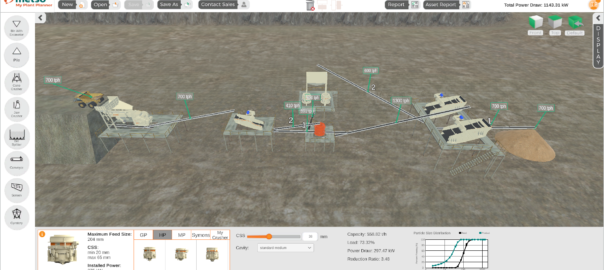

The station was included as part of an integrated IPCC solution launch from Metso Outotec that consists of crushing, conveying and stacking equipment, combined with IPCC planning and lifecycle services.

Leif Berndt, Director, IPCC at Metso Outotec, acknowledged that the SMPG is the core addition to this refreshed IPCC portfolio, but believes the company has already displayed its IPCC expertise in “a number” of large capacity (20,000 t/h) crushing and conveying system deployments in iron ore and copper applications in South America. It also recently sold a Foresight SMPG equipped with a MKIII 60110 primary gyratory to Codelco for its Radomiro Tomic operation, in Chile.

“In terms of crushing and conveying, we have carried out these building blocks to the same large capacities as others that call themselves the incumbents in this market,” he told IM. “With the new and experienced planning team we have in our Düsseldorf facility, we now have the in-pit development around those solutions to prove this.”

He expanded on the topic when discussing the ability to address the higher capacity IPCC segment with the SMPG: “It is one thing to look at it from the instantaneous, hourly, or shift throughput perspective; it is another thing to look at it from the design of the whole system, the plant and the mine planning to come to the customer with a workable solution that will produce, over the year, the tonnes required.

“You then need to sustain those numbers by having the right planning, system and service to sustain the crusher’s performance.

“That is where the true success for the customer is.”

Berndt says the company has all this in its offering, asserting that Metso Outotec should be considered a leading market player in the IPCC sector.

“It is quite simple: we are the number one in large capacity primary gyratory crushers; we are also the number one in service,” he said. “That covers, with technology and services, two very important aspects for a successful IPCC operation.

“We now have a very experienced IPCC team in Düsseldorf, and we are leveraging the engineering and product development group in Sorocaba, Brazil, to be closer to the markets east of the Atlantic. With that, we have the right team for planning, engineering and project delivery, the right technologies and services driving availability and, hence, productivity.”

That is even before mentioning the tie-up with FAM, which will allow Metso Outotec to play a significant role in end-to-end solutions across the IPCC space thanks to the inclusion of FAM spreaders and crawler-mounted conveyor bridges for waste IPCC applications and dry stacking of tailings.

Such a collaboration shouldn’t surprise anyone in this space.

Metso Outotec has been open – and remains open – to partnering with other OEMs for IPCC systems, evidenced by an agreement with Komatsu that sees Komatsu sizers fitted on Lokotrack systems for soft-rock applications.

“Technologies that are delivering advancements in sustainability, productivity and maintainability that are complementary to our offering, which we don’t own ourselves, are always interesting to us,” Berndt said.

Ready at the right time

Metso Outotec appears to have got its ducks in a row at exactly the right time as, with a strong environmental tailwind behind it, the IPCC market is on the up.

The need to electrify operations and reduce reliance on fossil fuels in line with ambitious decarbonisation targets is leading more and more miners to considering an element of in-pit work at their operations.

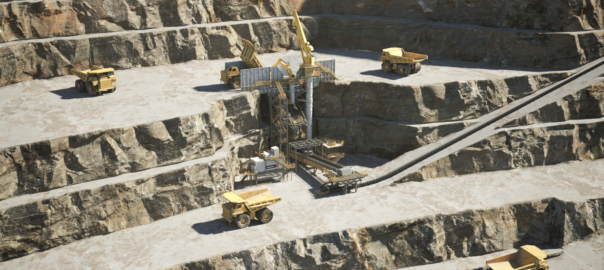

Greenfield mines are working on tradeoffs in the study phase to pit conventional truck and shovel against the use of more conveyors and in-pit crushing equipment, while brownfield operations are getting the mine models out again to see if an element of the operation can be reconfigured to make the most of fixed, semi-mobile or fully-mobile IPCC systems.

Berndt said many clients decide to go for modularised, configurable and semi-mobile solutions for ease of construction and assembly away from the run-of-mine (ROM) pad to improve scheduling. Such a configuration could allow parallel development of, for instance, crusher pocket development and the ROM pad.

Also, when it comes to a greenfield project, the cost to “buy yourself the option of relocating the plant”, when compared with the capital associated with installing a stationary plant, is, on many occasions, “insignificant”, according to Berndt.

“As a result, customers decide to ‘buy’ that option and, when the pit develops in the future, relocate the plant,” he said. “That, in itself, is a strong driver in the IPCC market.”

Adapting existing hard-rock operations designed for truck and shovel operations by incorporating large capacity semi-mobile IPCC systems with crushing plant locations inside the pit remains a complex task from a planning perspective, but Berndt has seen an increase in interest in this option too.

There are mine engineering professionals in the Metso Outotec Düsseldorf office that have specific experience of adapting operations for IPCC solutions, he said.

“However, that being said, we all know conveyors don’t have wheels, and the cost of deploying or redeploying these conveyors requires pit ramp developments or pit pushbacks earlier in the mine process and, hence, earlier cash-out on overburden compared to a truck shovel development.”

The economic tradeoff that has led to such developments is starting to change in favour of IPCC solutions.

“In the mine investment decision and methodology selection, the net present value impact of ‘early overburden’, or pulling forward the push-back phases in conical pits to advance ramps for conveyor access, was formerly only offset against the lower production cost, which drove the payback point to a 150-200 m vertical lift component level,” Berndt said. “Carbon credits for energy saved against early cash-out will shift this payback point upward, increasing demand for IPCC solutions.”

Which is why Metso Outotec’s reinvigorated IPCC pursuit is considered timely.

More and more mining companies are becoming comfortable with carbon accounting and factoring it into project studies – whether these studies are distributed internally or externally. They are cognisant of the fact it may be a voluntary addition in the Excel spreadsheet formula today, but, in the years ahead, it will become a requirement of doing business.

“Metso Outotec, for example, has sustainability targets included in its recent renewal of a financial instrument,” Berndt said. “Access to funding and the cost, thereof, will increasingly depend exactly on that.”

Yet, this doesn’t spell the end of truck and shovel in the IPCC mining operations Metso Outotec is likely to serve, according to Berndt.

He sees an electrified future where the two elements will play happily together in the pit.

“You need the flexibility of trucks, whether that be from a hydrogen-, battery- or trolley-powered source at some point in time, to allow for the required selectivity and blending in the pit,” he said. “Given that the deployment of conveyors is limited by very short phases and the space/geometry of a typical hard-rock mine, it is not simply a convey or truck situation; it is a matter of using truck and convey to find the best interface.

“Obviously, the more you can take out of the vertical lift component by conveyors, the better, but, in the context of a majority horizontal haul, trucks are likely to be a lot more efficient.

“The developments now happening are the truck interfacing or delivering onto the conveyors in the pit and the ability to make that a more flexible process.”

Armed with Lokotrack solutions for a fully mobile IPCC solution, its family of FIT™ and Foresight™ modular crushing stations, the new SMPG, and a strong planning, engineering and service offering, Metso Outotec says it has all the necessary elements to deliver the mining sector’s next generation of IPCC systems.