Serabi Gold is planning for the start-up a second sensor-based sorting solution from COMEX as it looks to commence operations at its Coringa project, in Brazil.

The company confirmed in its June quarter results that construction of the classification plant was well underway at Coringa, with the crusher expected to be operational in August and the ore sorter remaining on track to being operational by the start of the December quarter.

A spokesperson for Serabi explained that the ore sorter being used is a COMEX OCXR-1000 model. This sorting unit is manufactured to sort a feed fraction +15 mm/-45 mm, with a maximum volume of 30-40 t/h. The stated maximum rejection rate is approximately 35% and it operates at a maximum belt speed of 2.7 m/s.

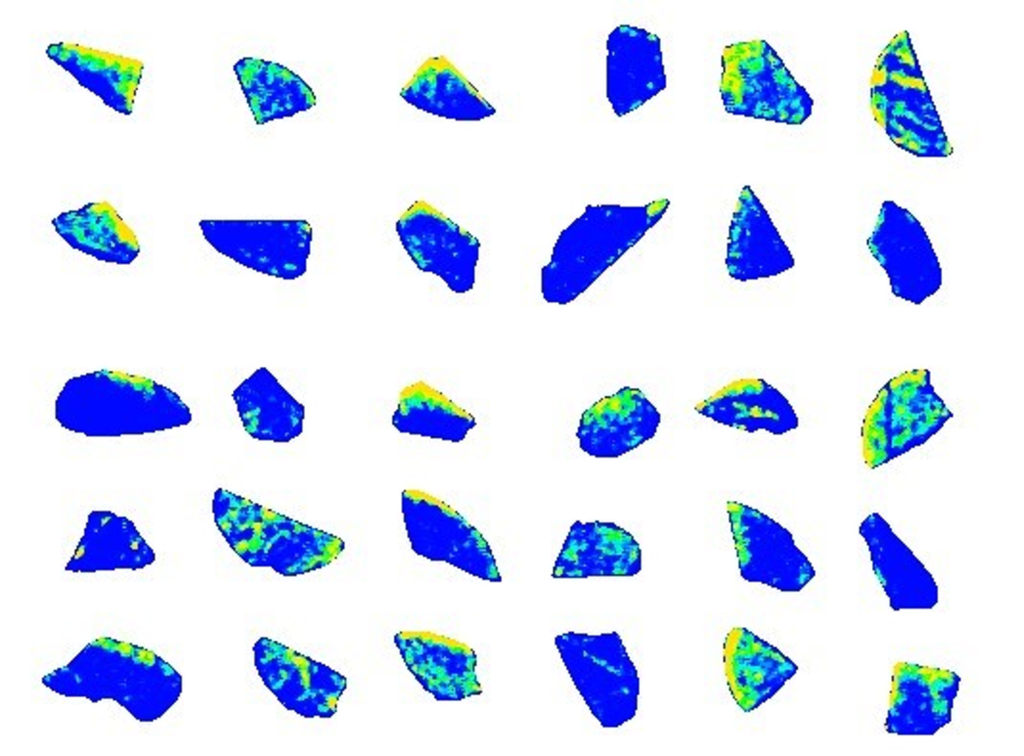

The COMEX OCXR-1000 is equipped for both X-ray sorting and colour sorting, with the latter using a 4K RGB camera. The whole unit at Coringa is within a single 13,500 x 3,500 x 2,900 mm (length/width/height) size envelope.

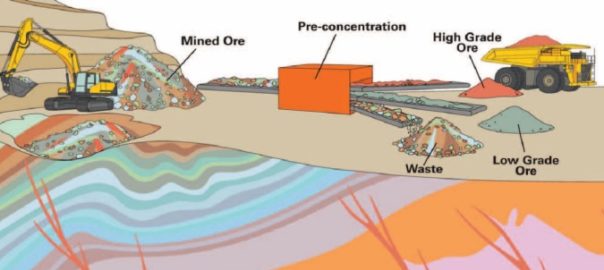

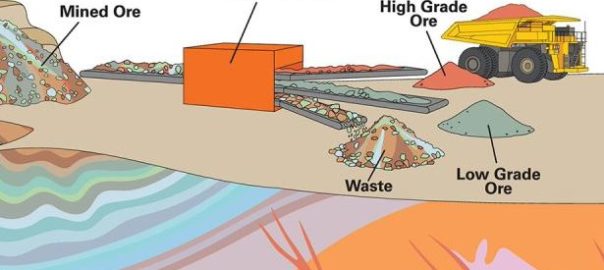

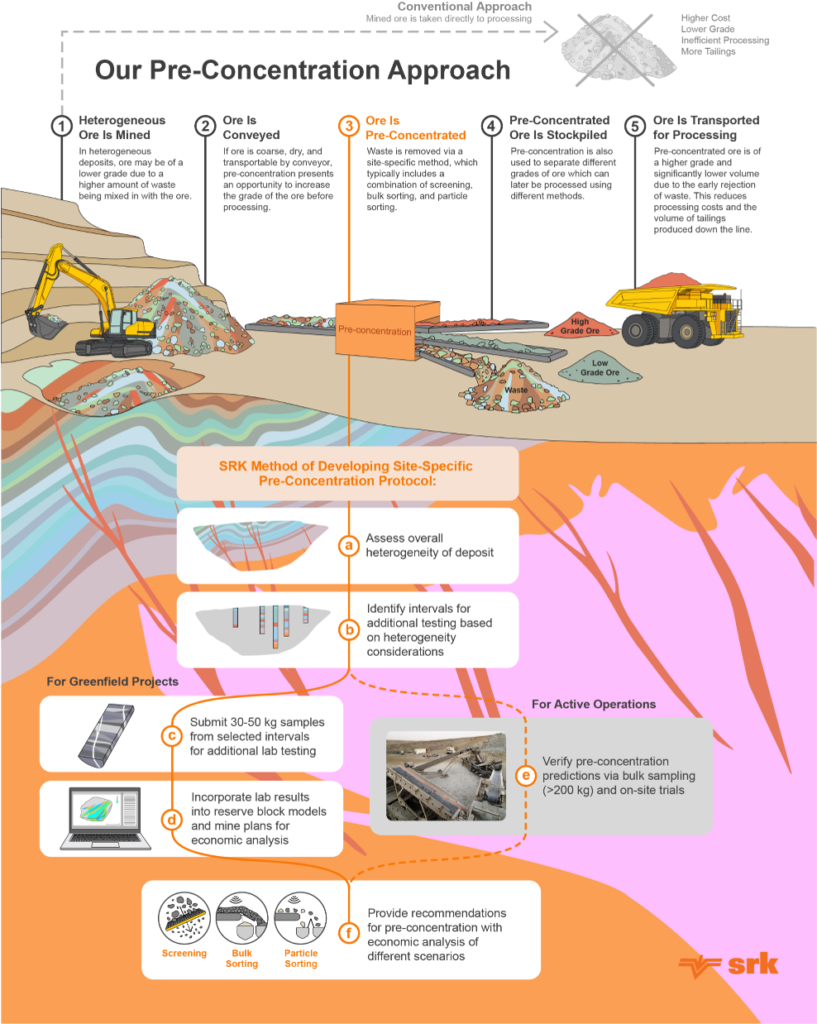

In a June corporate presentation, Serabi Gold said it is using ore sorters to remove waste and pre-concentrate run of mine material, as well as to liberate plant capacity. It noted the Coringa ore was highly amenable to ore sorting, with the company having carried out geological and metallurgical reviews and “pre-tested” its use at its Palito Complex, some 200 km from Coringa.

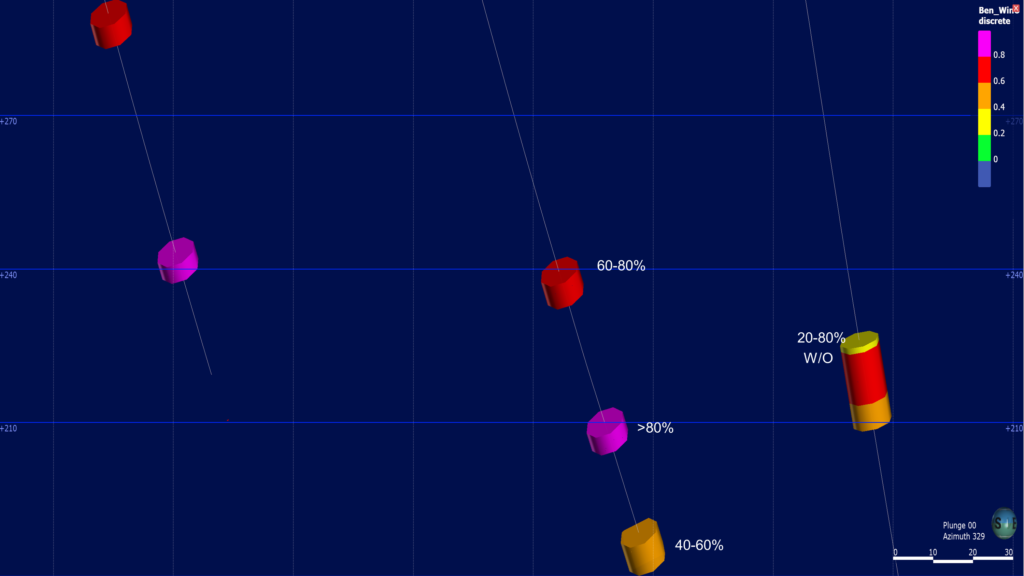

Since 2020, Palito has fed 40,891 t of material at 1.7 g/t Au through the same ore sorting system. This has generated 4,899 t of product at 8.8 g/t Au, with 35,992 t at 0.7 g/t Au rejected.

Coringa is viewed as a low-risk, low-cost operation, being a “carbon copy” of Palito, according to Serabi Gold. Palito was set to produce 38,000-40,000 oz of gold in 2024 from an operation made up of an underground selective open stoping mine, a 600 t/d conventional flotation, carbon-in-pulp, ore sorting operation. Coringa, meanwhile, is set to use a classification plant made up of a crusher and ore sorter to produce 38,000 oz/y of gold through an integrated flowsheet still in development.