Metso Outotec says it has been awarded an order for the supply of key minerals processing technologies to OZ Minerals’ West Musgrave copper-nickel project in Western Australia.

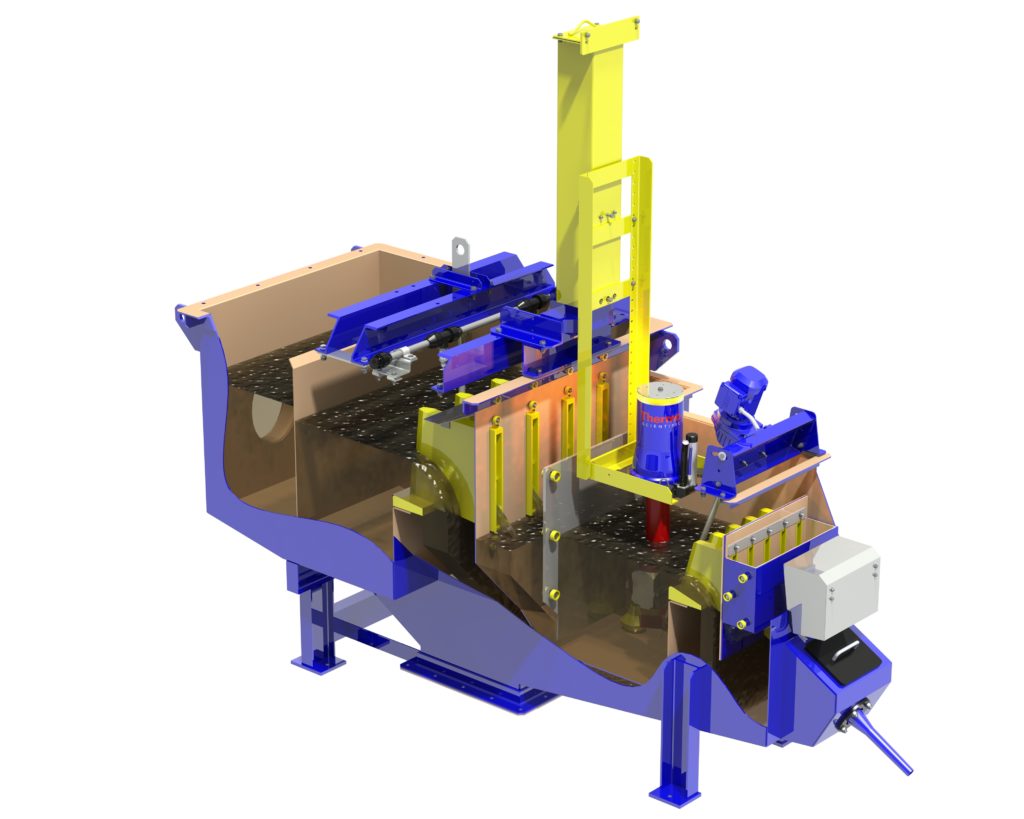

The OEM’s scope of delivery includes an MP1250™ cone crusher, as well as Planet Positive classified flotation units and high-rate thickeners.

The TankCell® e630 flotation units (pictured) are the most proven large-scale cells in the 600 cu.m-plus category and come with the largest installed base of operating cells in the world, according to Metso Outotec.

Metso Outotec’s high-rate thickeners, meanwhile, were selected for their state-of-the-art technology and based on references from similar process plants, it said. Laboratory test work was conducted by Metso Outotec to aid thickener selection.

Kai Rönnberg, Vice President, Minerals Sales – Asia Pacific at Metso Outotec, said: “We are very excited to work on the West Musgrave project with OZ Minerals. We were able to align with the project’s key value drivers at an early stage and provide expert technical support.

“OZ Minerals has selected leading-class Planet Positive process equipment for their nickel and copper production process, and they will also be able to benefit from our extensive aftermarket capabilities and footprint in Western Australia.”

In September, the OZ Minerals Board greenlit the build of the West Musgrave copper-nickel project. The feasibility study the board signed off on detailed a 13.5 Mt/y operation with average production of circa-28,000 t/y of nickel and circa-35,000 t/y of copper over a 24-year operating life.