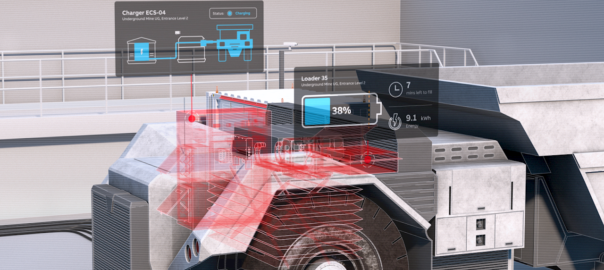

Ampcontrol has launched the new Ampcontrol MegaWatt Charger, designed to support the electrification of the mining industry, showcasing the solution at The Electric Mine 2024, in Perth, Western Australia.

Ampcontrol says it is challenging the future by delivering innovative solutions that make electrifying mining operations a reality. The Ampcontrol MegaWatt Charger uses high-capacity charging technology to reduce charging time and operational impact.

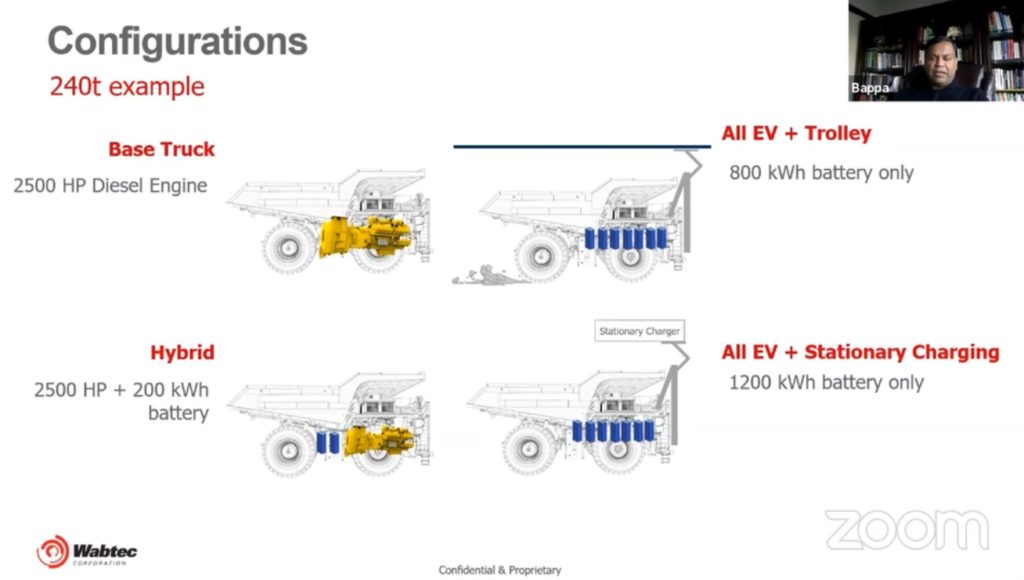

The Ampcontrol MegaWatt Charger’s dual-mode charging feature enables multiple vehicle types to be charged via a single unit. It powers vehicles ranging from light passenger vehicles, such as Ampcontrol Battery Electric Vehicle DRIFTEX, to large machines, including electric haul dump trucks, trains and buses.

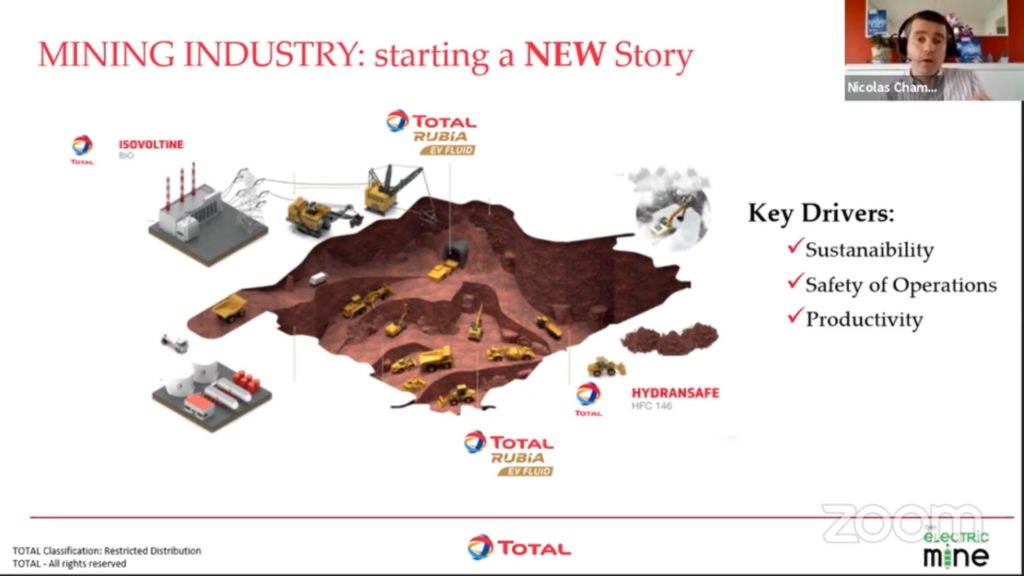

“With the mining industry pushing towards decarbonisation and net zero targets, we have developed cutting-edge charging technology that balances charge time and energy management,” Rod Henderson, Ampcontrol Managing Director & CEO, said.

Through radical thinking and innovative collaborations, Ampcontrol continues to develop award-winning solutions that help mining industry customers electrify operations and minimise carbon emissions.

Ampcontrol has been supplying the resources sector with electrical infrastructure and service for decades. A provider of power infrastructure, renewable solutions, electric vehicles, fleet charging solutions and cabling, all underpinned by extensive electrical engineering services.

Henderson added: “We listen to the needs of industry and develop products using our advanced technology and innovative solutions to support our customers. We are excited by the opportunity to showcase how Ampcontrol is challenging the future at The Electric Mine 2024 by launching the Ampcontrol MegaWatt Charger.”

The Ampcontrol MegaWatt Charger and other innovative power solutions will also be showcased at Ampcontrol Kewdale on May 24, 2024.