Hitachi Energy and BluVein, an innovator in dynamic charging technology, have signed a Memorandum of Understanding (MoU) to, they say, accelerate the electrification of heavy haul mining fleets and solve one of the biggest challenges in decarbonising mine operations.

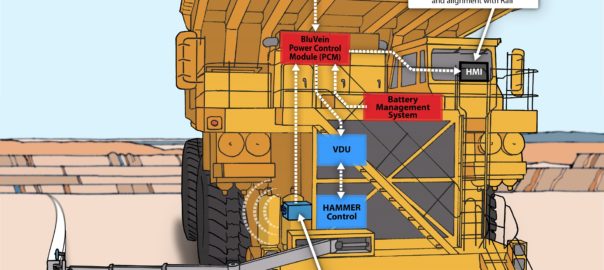

Hitachi Energy’s advanced power electronics and digital charging technologies allow BluVein’s e-rail charging technology to deliver electricity safely and reliably to haul trucks of up to 400 t while transporting materials.

The collaboration will fast-track the development of a high-powered, fast and flexible dynamic charging solution for surface and underground mines and quarries in Australia and across the globe. BluVein will focus on its leading-edge e-rail and connection of the truck, which Hitachi Energy will further complement with advanced power electronics and digital solutions to power and monitor the whole system.

“This strategic collaboration with BluVein will enable our mining customers to trial next-generation dynamic charging solutions vital for achieving net-zero emission targets without compromising on operating practices or productivity,” Marco Berardi, Head of Grid & Power Quality Solutions and Service business at Hitachi Energy, said. “We believe this new collaborative approach will deliver on our common goal to accelerate the transition to all-electric mining and a carbon-neutral future.”

James Oliver, CEO at BluVein, added: “This MoU supports BluVein’s mission of partnering with a technology leader to deliver a universal dynamic connector that facilitates the removal of fossil fuel from mines and help propel the industry globally to meet its decarbonisation goals. Together, we are helping the industry move to a more sustainable and responsible future.”

Hitachi Energy and BluVein are also exploring the off-vehicle hardware requirements for BluVein1 for underground and smaller fleets, while actively cooperating on BluVein Proving Grounds, currently under construction in Queensland, Australia.