Germany-based drivetrain specialist Flender has further expanded its production and service capacities in Australasia by opening a new facility in Sydney, New South Wales.

With its Winergy brand for wind turbine drives, the company has one of the largest installed bases in Australia aiming to scale up the local presence and be close to customers. The same is the case for the industrial drive portfolio with a track record in Australian industries such as mining, cement, harbour equipment and more. The new facility sets the industry standard for customer service in these branches, it says, while Flender’s gearboxes and couplings continue to power some of Australian industries’ heaviest machines.

Flender Group CEO, Andreas Evertz, said: “For both our wind and industrial business we see enormous growth potential on the continent. To reach the goals from the Paris climate agreement we must not only ramp up renewable energy capacities but also transform our industries towards sustainability. This includes recycling and establishing a circular economy. Our workshops are perfectly equipped for servicing and refurbishing the existing installed base, not only for our own fleet but all gearbox types in the market.”

The new Sydney facility will be over 1,800 sq.m and has the structural capacity for a 50 t crane. It will have all equipment required to deliver the OEM standard to customers, Flender says. The company will be able to repair gearboxes up to 40 t, as well as equipment like main shafts for wind turbines, lube systems, fluid couplings and brakes.

Sydney is Flender’s fourth service hub in Australia besides the locations in Rockhampton, Perth and Melbourne.

Kareem Emara, Managing Director of Flender Australia and New Zealand, said: “It is important to be close to our customers. With the new facility in Sydney, we are continuing to be more agile and respond to their needs as quickly as possible. We have been in the industry for many years. Using our OEM knowledge and technical expertise we can provide proactive support.”

Flender says its facilities are set up to support the entire lifecycle of a product from installation to decommissioning and refurbishment. With the digital drivetrain intelligence AIQ, Flender also provides digital services that allow preventive maintenance and maximise plant availability.

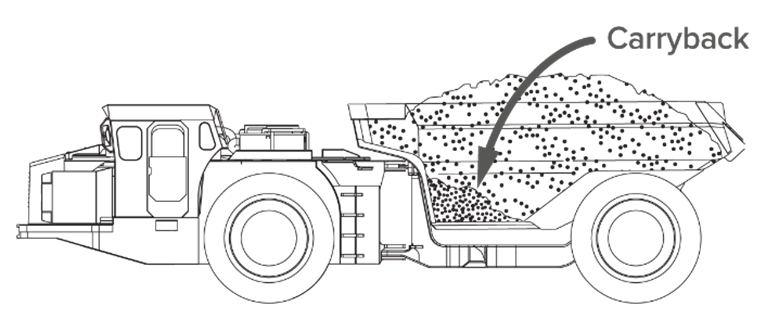

“One of the most important factors that the MPS can highlight is the incidence of carryback (or haulback), where material isn’t discharged from the bin during unloading and is carried back into the mine portal, reducing effective payload and having a considerable impact on productivity and, ultimately, revenue,” Loadscan says. “By identifying carryback, the material can be accounted for, deducted from shift tallies where necessary, and removed from the bin to ensure accuracy and improved payload capacity.”

“One of the most important factors that the MPS can highlight is the incidence of carryback (or haulback), where material isn’t discharged from the bin during unloading and is carried back into the mine portal, reducing effective payload and having a considerable impact on productivity and, ultimately, revenue,” Loadscan says. “By identifying carryback, the material can be accounted for, deducted from shift tallies where necessary, and removed from the bin to ensure accuracy and improved payload capacity.”