BluVein, after officially receiving agreement and project approval from all project partners, has initiated the third phase of technology development and testing of its underground mine electrification solution, BluVein1, it says.

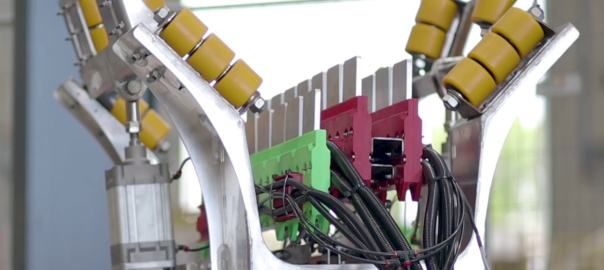

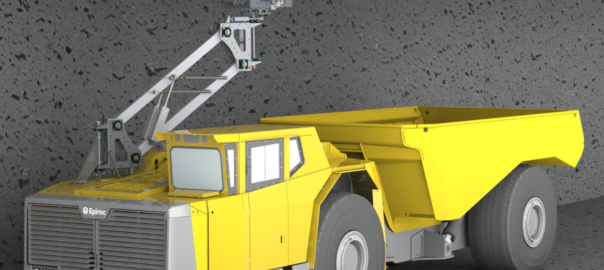

BluVein is a joint venture between Australia-based mining innovator Olitek and Sweden-based electric highways developer Evias. The company has devised a patented slotted (electric) rail system, which uses an enclosed electrified e-rail system mounted above or beside the mining vehicle together with the BluVein hammer that connects the electric vehicle to the rail.

The system, which is OEM agnostic, provides power for driving the vehicle, typically a mine truck, and charging the truck’s batteries while the truck is hauling load up the ramp and out of an underground mine.

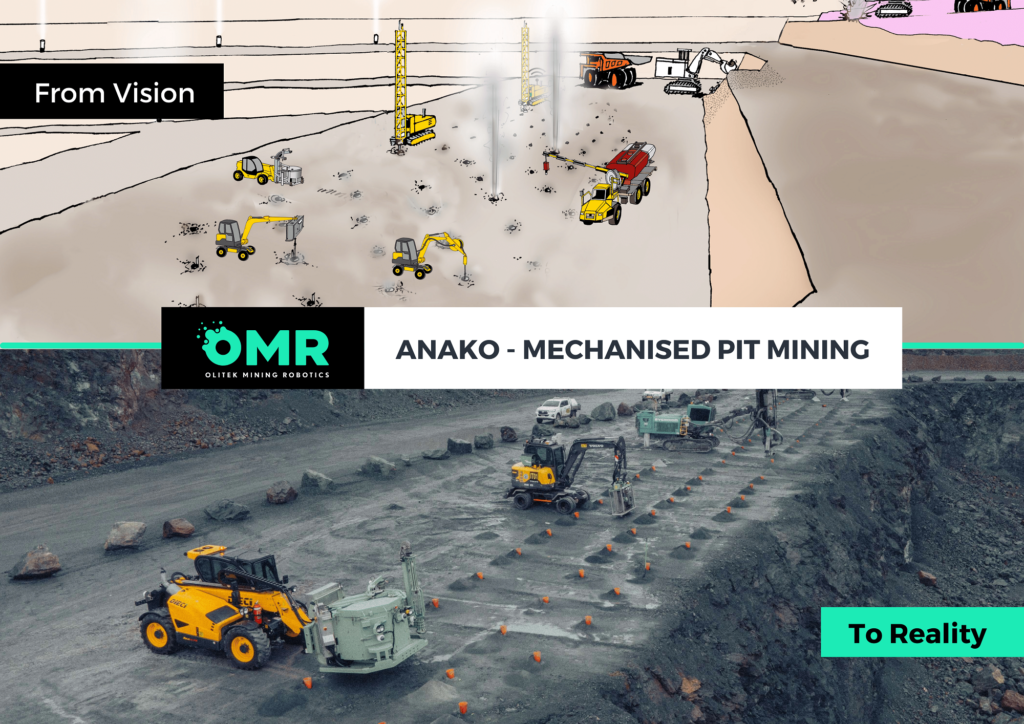

The underground-focused development under BluVein is coined BluVein1, with the open-pit development looking to offer dynamic charging for ultra-class haul trucks called BluVein XL. This latter project was recently named among eight winning ideas selected to progress to the next stage of the Charge On Innovation Challenge.

The purpose of the third phase of the BluVein1 technology development is to:

- Conduct a full-scale refined hammer (collector) and arm design and testing with a second prototype;

- Execute early integration works with mining partners and OEMs;

- Provide full-power dynamic energy transfer for a vehicle demonstration on a local test site; and

- Confirm a local test site for development.

IM understands that the company is close to sealing an agreement for a local test site where it will carry out trials of the dynamic charging technology.

James Oliver, CEO, BluVein, said the third phase represents an essential final pre-pilot stage of BluVein1.

“It excites me that the BluVein solution is becoming an industry reality,” he said. “The faster BluVein1 is ready for deployment, the better for our partners and the mining industry globally.”

“This MoU also ensures that we are designing and developing the system into a real-world BEV for full-scale live testing and demonstration on a pilot site in 2023,” BluVein says.

In addition to Epiroc, IM understands BluVein is working with Sandvik, MacLean, Volvo and Scania, among others, on preparing demonstration vehicles for the BluVein1 pilot site.

The BluVein1 consortium welcomed South32 into the project in May, joining Northern Star Resources, Newcrest Mining, Vale, Glencore, Agnico Eagle, AngloGold Ashanti and BHP, all of which have signed a consortium project agreement that aims to enable final system development and the construction of a technology demonstration pilot site in Australia.

The project is being conducted through the consortium model by Rethink Mining, powered by the Canada Mining Innovation Council (CMIC), which CMIC says is a unique collaboration structure that fast-tracks mining innovation technologies such as BluVein and CAHM (Conjugate Anvil Hammer Mill).

Carl Weatherell, Executive Director and CEO, CMIC/President Rethink Mining Ventures, said: “With the urgent need to decarbonise, CMIC’s approach to co-develop and co-deploy new platform technologies is the way to accelerate to net zero greenhouse gases. The BluVein consortium is a perfect example of how to accelerate co-development of new technology platforms.”

Oliver concluded: “The BluVein1 consortium is a great reminder that many hands make light work, and through this open collaboration with OEMs and mining companies, we’re moving faster together towards a cleaner, greener future for mining.”