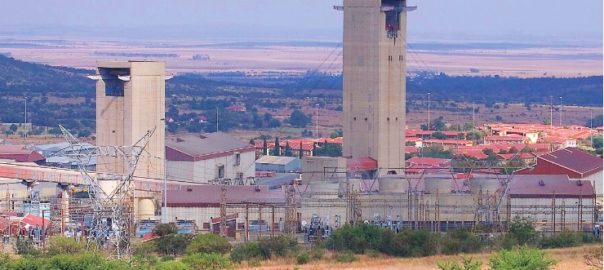

Making the transition from an open pit mine that has been operating successfully for 30 years to an underground operation that could become one of the most mechanised and automated in the world is not something that happens overnight.

De Beers Group embarked on the $2.3 billion underground expansion of its Venetia asset in Limpopo Province in 2012, in a move that represented the biggest single investment in South Africa’s diamond mining industry in decades.

Underground production began at the mine back in June this year, at a point when construction completion was estimated at 70%.

The introduction of autonomous mining systems performing multiple mining processes to deliver up to 6 Mt/y of kimberlite ore – for circa-4 Mct/y of diamonds – is now beginning, with a ramp-up process occurring over the next four years, according to Moses Madondo, Managing Director of De Beers Group Managed Operations.

“The technologies we are implementing – some of which are under development themselves – will be gradually phased in,” he told IM. “Where appropriate, we will take advantage of ‘proven’ technologies first to ease the change management process, before advancing to less mature technologies thereafter.

“The process should see us start operating areas of the mine in autonomous capacity by 2027.”

De Beers has engaged Sandvik Mining and Rock Solutions for its automated production machines, with the OEM delivering a 34-strong fleet made up of LHDs, ADTs, twin-boom drill rigs, roof bolters, cable bolters and production long hole drills. A further 12 units will be delivered in the future. These iSeries machines include 17- and 21-t payload LH517i and LH621i LHDs, 51-t payload TH551i ADTs, DD422i face drills, DS412i roof bolters, DS422i cable bolters and DL422i production drills.

The underground mine will use sublevel caving to extract material from its K01 and K02 orebodies. Initially the ore will be hauled to surface using a combination of underground and surface haul trucks. As the operation matures, the hauling systems will transition to an automated truck loop in combination with vertical shafts for steady-state production.

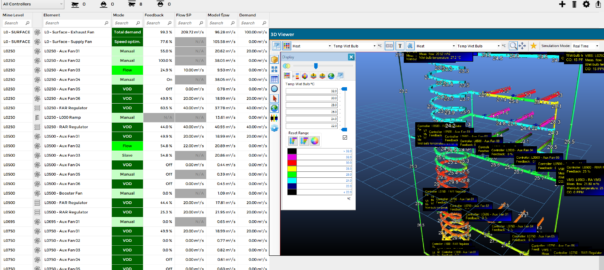

Sandvik is also providing its AutoMine® system for the remote operation of loaders and trucks and its OptiMine® system for machine health monitoring, task management and location tracking.

Automation will be applied through a phased approach, beginning with manual operation and close monitoring of performance through data analytics. Automation will then gradually be introduced with the necessary training and experience in the operation and support of these technologies.

Madondo explained: “Our current fleet is made up of manually operated machines, which are optimised with automated task management. This process still requires an on-board operator, although many functions are automated.

“The next step would be autonomous machines, operated and overseen from surface, with our training centres already set up to deliver that.”

A pilot project to prepare the production team for the use of remote loading at the drawpoints and autonomous tramming to the tip is in the process of being established, with trials set for later this year and into 2024.

With sublevel cave mining, there is a risk of mud rushes and water ingress at drawpoints and remote loading will allow material to be loaded without putting operators at risk.

This pilot project will have a single loader operating under AutoMine Lite in a dedicated area on 46 Level that is isolated from other areas of the mine, with the machine controlled locally from a mobile tele-remote station just outside the autonomous operating area (ie not from surface).

An integrated operations centre on surface has been constructed and is in the final stages of commissioning.

This is but a fraction of the emerging technology the company plans to employ at the mine, as Madondo highlighted.

“Of course, we will be integrating more technologies into the mix – digital mobility, data analytics, a cave management system, collision prevention, personnel alert systems, equipment location and tracking, production management through digital platforms, centralised blasting systems and digital twins,” he said. “All of these projects have people working on them to deliver our project objectives.”

For Madondo, the business case for employing such high levels of mechanisation and automation has only strengthened in the 11 years since the first shovel was placed in the ground for the underground project.

“This is a challenge with deep underground mining projects – they take a long time to develop and, in that period, technology and economics change,” he said. “It is, however, clear that mechanised mining allows you to take on these advanced technologies as the years go by.

“The investments are not just for technology’s sake. The business case must be built on our ability to improve safety and keep our people away from harm; as well as to make us more efficient and beat inflation, ensuring the margins we promised investors are realised.”

On the former, the company has partnered with Booyco Electronics on rolling out the South Africa-based company’s Level 9 – as defined by the Mining Industry Occupational Safety and Health (MOSH) organisation of South Africa – Booyco Electronics CWS850 collision prevention system at the mine.

“All of our Sandvik equipment is Level 9-enabled and we’re busy on this rollout,” Madondo said. “We’re already employing Level 7 (a system that warns pedestrians of their proximity to trackless mobile machinery) for this equipment. It’s now just a matter of getting to that new advanced level efficiently and safely.”

The company is also employing the Mobilaris Mining Intelligence platform for personnel location and situational awareness to help locate individuals in case of an emergency and notify them of incidents should they occur.

On the productivity side, the company is employing a cave management system to prevent overdrawing, Madondo says, linking the sub level caving mine plan with on-board LHD diagnostics and bucket weighing for efficiency and safety.

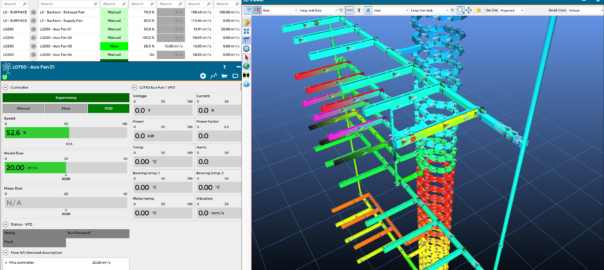

On top of OptiMine and AutoMine from Sandvik, the company is looking to integrate Howden’s Ventsim™ CONTROL system for monitoring, control and optimisation of underground mine ventilation in a ventilation on demand (VoD) application.

“We will gradually introduce VoD and Ventsim CONTROL as it allows us to 1) optimise the use of air and ventilation; and 2) retain the right condition and hygiene levels in the areas of the active mine,” Madondo said.

In an automated mining scenario, Ventsim CONTROL could potentially start ventilating an area of the mine in line with the expected arrival of the autonomous equipment, optimising the process and environment, and, as a result, reducing energy use.

Reaching the pinnacle

Also part of that discussion is decarbonisation – an area the company has already made significant progress on with its move underground.

“Transitioning from surface to underground has reset the energy balance,” Madondo said. “This has seen the site become far less reliant on energy from fossil fuel sources, with the big trucks and loaders from the pit replaced with smaller underground equipment and more electrical infrastructure.

“We predict by that, by 2030, 85% of all energy consumed will be electrical and only 6% will be diesel. That is a significant shift from the open-pit operation where nearly 85% of all energy consumed was from diesel.”

The company’s broader electrification work is currently in the review stage, but Madondo did provide some insight into the focus areas.

“We are looking at battery LHDs and trucks; we will consider trolley assist hauling loops and tethered electrical loading in some of the areas too,” he said. “It is all part of a progressive shift that will be integrated with the sourcing of renewable power for the mine.”

De Beers itself has set targets to become carbon neutral across its operations by 2030, Venetia Underground included.

The first electrification project the company is likely to embark on is a battery-electric retrofit of one of its light duty vehicles, Madondo said, explaining that this technology is relatively mature and comes with less infrastructure requirements due to the ability to charge the machines on surface.

“Our wider electrification plans are being influenced by the maturity of the technology; it may be more beneficial to wait until the adoption rate and learnings increase before we commit,” he added.

Even with the planned integration of such advanced technology at Venetia Underground, Madondo says De Beers still has some way to go to achieve the FutureSmart Mining innovation-led approach to sustainable mining that its parent company, Anglo American, advocates for.

“The pinnacle of De Beers mining expertise will probably be realised when we get to rollout our Diamond FutureSmart Mining, which ultimately is a mine design that we can use to develop future mines that make mining safer, more efficient, more sustainable and with a smaller environmental footprint,” he said.

“Of course, Venetia is certainly a steppingstone to that, but we will hopefully apply the learnings from Venetia for Jwaneng Underground (in Botswana) in the not-too-distant future. That could represent a different, more technologically advanced proposition where all processes are setup to benefit from the latest innovations.”

He concluded: “This will ensure we help create a healthy environment, that we catalyse thriving communities, and that we build trust as a corporate leader. We are shaping a future that creates shared value for all our stakeholders.”