Seven major mining companies have financially backed BluVein and its “next generation trolley-charging technology” for heavy mining vehicles, with the industry collaboration project now moving forward with final system development and construction of a technology demonstration pilot site in Brisbane, Australia.

BluVein can now refer to Northern Star Resources, Newcrest Mining, Vale, Glencore, Agnico Eagle, AngloGold Ashanti and OZ Minerals as project partners.

Some additional mining companies still in the process of joining the BluVein project will be announced as they officially come on board, BluVein said, while four major mining vehicle manufacturers have signed agreements to support BluVein controls and hardware integration into their vehicles.

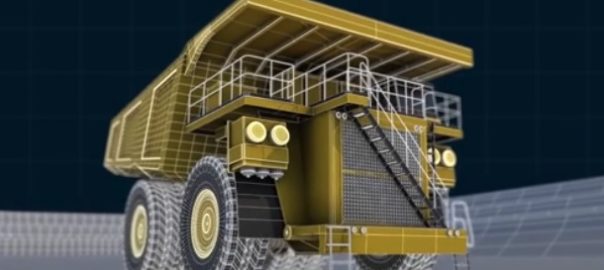

BluVein, a joint venture between EVIAS and Australia-based Olitek, is intent on laying the groundwork for multiple OEMs and mining companies to play in the mine electrification space without the need to employ battery swapping or acquire larger, heavier batteries customised to cope with the current requirements placed on the heaviest diesel-powered machinery operating in the mining sector.

It is doing this through adapting charging technology originally developed by Sweden-based EVIAS for electrified public highways. The application of this technology in mining could see operations employ smaller, lighter battery-electric vehicles that are connected to the mine site grid via its ingress protection-rated slotted Rail™ system. This system effectively eliminates all exposed high voltage conductors, providing significantly improved safety and ensures compliance with mine electrical regulations, according to BluVein. This is complemented with its Hammer™ technology and a sophisticated power distribution unit to effectively power electric motors and charge a vehicle’s on-board batteries.

BluVein has been specifically designed for harsh mining environments and is completely agnostic to vehicle manufacturer. This standardisation is crucial, BluVein says, as it allows a mixed fleet of mining vehicle to use the same rail infrastructure.

While underground mining looks like the most immediate application, BluVein says the technology also has applications in open-pit mining and quarrying.

It is this technology to be trialled in a demonstration pilot in a simulated underground environment. BluVein says it plans on starting the trial install early works towards the end of this year for a mid- to late-2022 trial period.

The BluVein project will be managed by the Canada Mining Innovation Council (CMIC).