Fortescue Metals Group says the future of mining mobility is being advanced at its mines, with the successful operational deployment of autonomous light vehicles (ALVs) at the company’s iron ore mining operations in the Chichester Hub of Western Australia.

Developed by Fortescue’s Technology and Autonomy team as a solution to improve the efficiency of the Christmas Creek mobile maintenance team, ALVs remove the need for fitters to make around 12,000 28-km round trips annually to collect equipment and parts, the company estimates.

With the assistance of Ford Australia, four Ford Rangers have been retrofitted with an on-board vehicle automation system to support the driverless equipment transfer service, which will improve efficiency and safety by enabling team members to spend more time on maintaining assets.

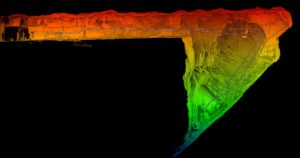

The system features an integrated LiDAR/Radar perception system that facilitates obstacle detection and dynamic obstacle avoidance, a comprehensive independent safety management, and fail safe braking system and extensive built-in system monitoring and fault response capability.

The successful deployment of ALVs at Christmas Creek will provide the opportunity to implement a similar system at other operational sites to improve safety, productivity and efficiency, Fortescue says.

Fortescue Chief Executive Officer, Elizabeth Gaines, said: “Since the outset, Fortescue has been at the forefront of innovation in the mining industry, underpinned by our value of generating ideas. It is this focus on technology and innovation that has driven our industry-leading operational performance and cost position.

“The autonomous light vehicle project is a significant advancement of our in-house automation capability, building on our leading autonomous haulage system program which has already delivered significant productivity and efficiency improvements for the business.

“With the flexibility to introduce similar systems into other mobile assets, this project is fundamental to our future mobile equipment automation projects.”

Ford Australia President and Chief Executive Officer, Andrew Birkic, said: “We’re very proud that our award-winning Ford Rangers have been used as part of the Fortescue Metals Group autonomous light vehicle project.

“Ford, globally, is at the forefront of research into autonomous vehicles, and working with companies like Fortescue is critical to gaining an insight into specific user applications.”